Bloomberg Professional Services

- Momentum in 2026 is supported by index methodologyenhancements, expanded asset class coverage, and continued investment in scalable fixed income index infrastructure.

- Growth in passive ETFs, evolving issuance patterns, and changing rate expectations are increasing demand for transparent, rules-based benchmarks across duration, geography, and alternative beta strategies.

With themes such as private credit and artificial intelligence dominating headlines, and factors such as tariffs and monetary policy swinging markets, global bond markets churned out positive returns across asset classes and regions last year. Emerging Markets led the way with a return over 12% in the EM Hard Currency Aggregate index. See our previous post for a deep dive on 2025 performance.

PRODUCT MENTIONS

We expect 2026 to be another ground-breaking year for Bloomberg fixed income indices. The strategic investments we’ve recently made coupled with potential regulatory tailwinds make us optimistic for the year ahead.

Enhancements and expansion

Following the full release of our Index Factory production system in 2024, Bloomberg has been focused on both enhancing capabilities and expanding coverage. In terms of methodology enhancements, the recent rollout of the month-end lockout has provided more stability in index membership and certainty as to which bonds qualify for the next rebalance. Additionally, we are making progress on the implementation of alternative pricing snaps and will then turn our attention to turnover analysis.

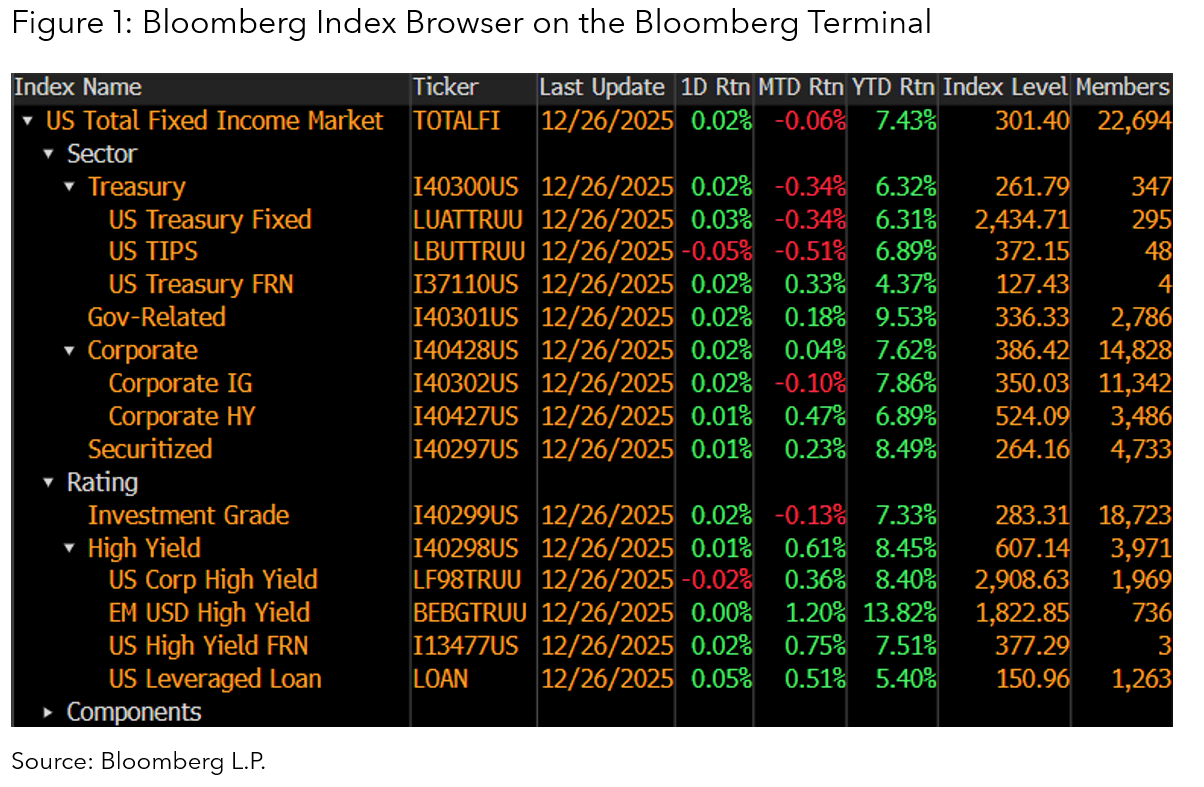

From an asset class perspective, our ongoing aim is to provide comprehensive coverage of the fixed income landscape. In July, we expanded our offering into a key asset class with the introduction of the Global Leveraged Loan indices. From there, we launched the US Total Fixed Income Market Index (ticker: TOTALFI) to capture the full breadth of taxable fixed income and reflect the evolved investment universe.

This new benchmark is an excellent example of the scalable solutions we can bring to market. Bloomberg is well positioned with both the building blocks and infrastructure to publish the broadest fixed income indices. We have invested heavily in modernizing index production over recent years, and indices such as TOTALFI are the result as we now can seamlessly combine asset classes and marry analytics.

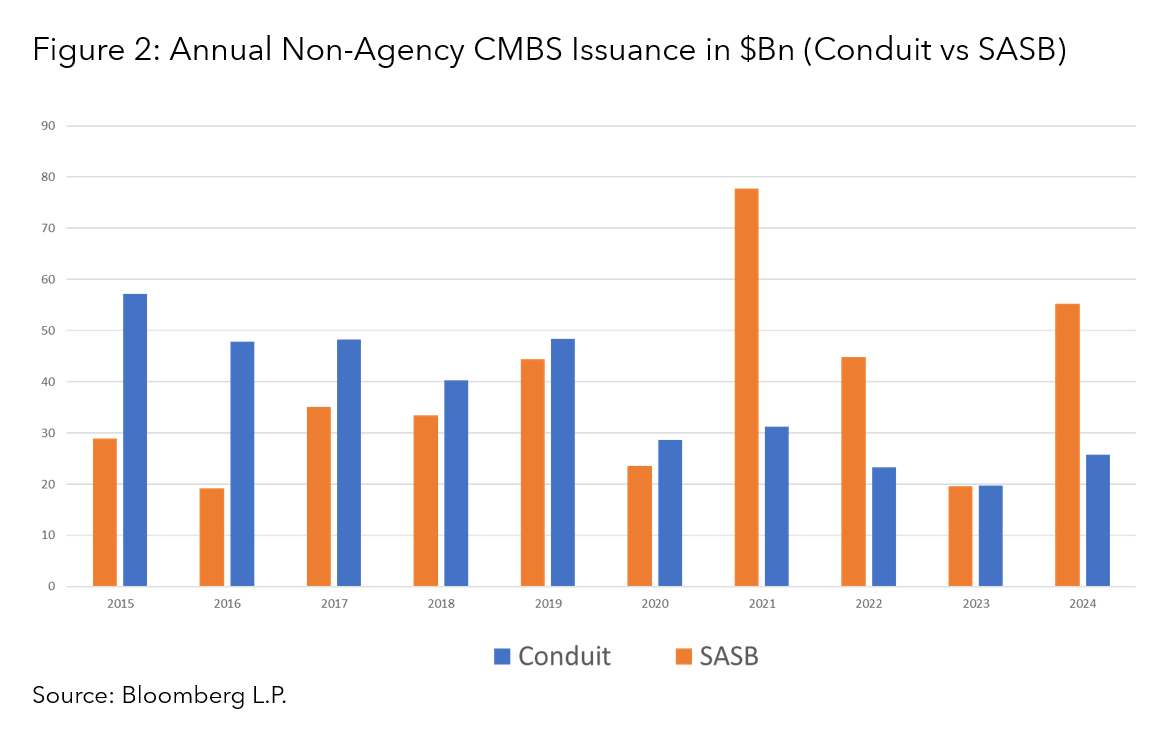

In addition to adding asset classes, we need to ensure that our indices keep up with issuance trends and reflect the current market. This is especially true for Securitized Products such as ABS and CMBS. For example, there has been a significant increase in Single Asset Single Borrower (SASB) CMBS issuance. As a result, we are planning to expand coverage with a new US CMBS SASB Index later this year that would be part of a broader CMBS Index and potentially be considered for inclusion in some broad-based indices.

Lastly, we are exploring options for benchmarks in private credit. In some ways, a private credit index seems like an oxymoron as the private market is generally more opaque whereas indices are inherently transparent. But as the public and private markets converge, there is likely to be more transparency into private credit and ultimately better price discovery.

High quality data and accurate pricing are prerequisites for any robust benchmark, and we will continue to monitor the developments in this space. In the meantime, we recently created a US BDC index that provides a view into private credit issuers as a proxy.

ETF frenzy to continue

In recent years, one could argue the success of index providers has been closely linked to the ETF market. Exchange traded funds are now a strong preference for new strategies with a record year in launches, flows and volume. Although it may seem difficult to repeat such a strong year, the recent SEC approval for issuers to add share classes may potentially result in another wave of ETFs going live. Some issuers may take a pause to focus on gathering assets instead of being in constant launch mode.

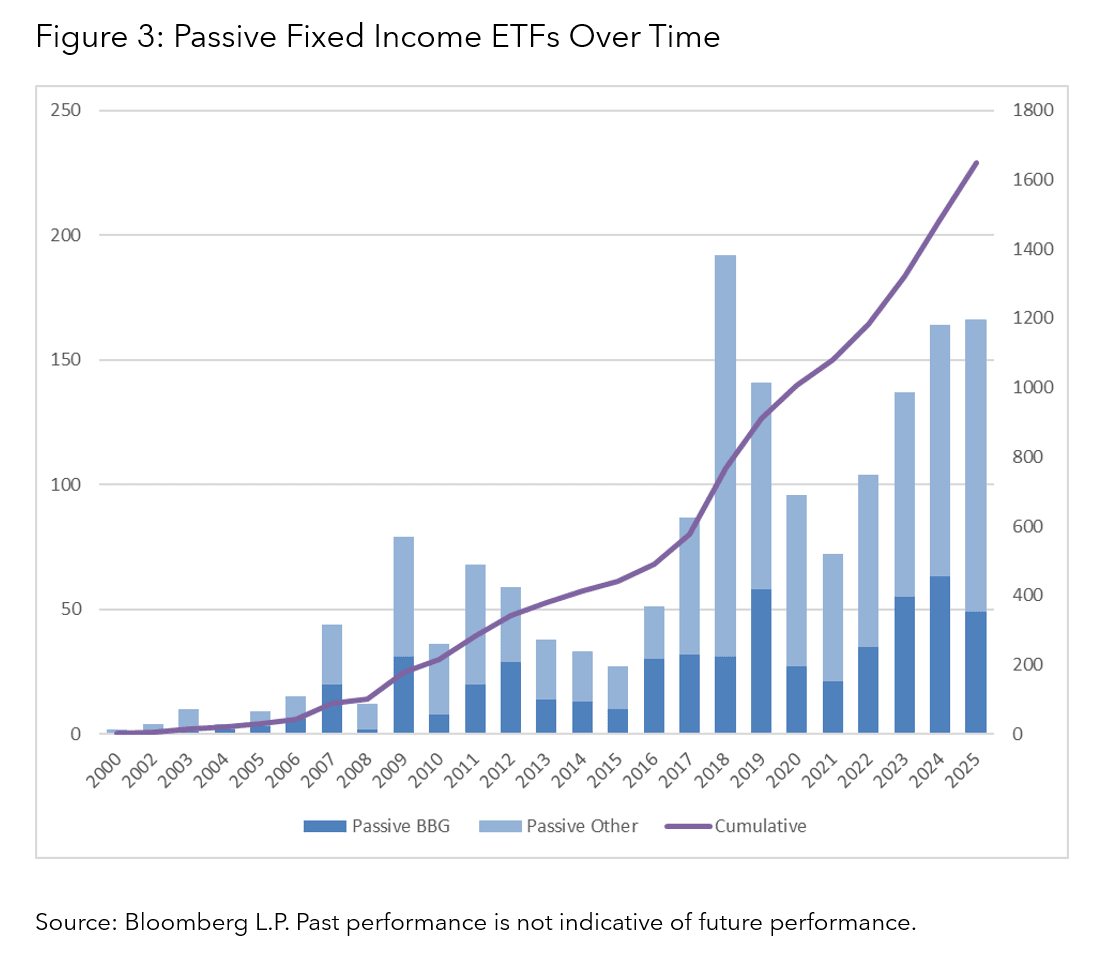

We anticipate active launches to continue to outpace passive but flows likely to continue to be dominated by cheap beta. Indeed, there are now 1650 passive fixed income ETFs with a third of them tracking a Bloomberg index (see chart below).

Active launches but passive flows

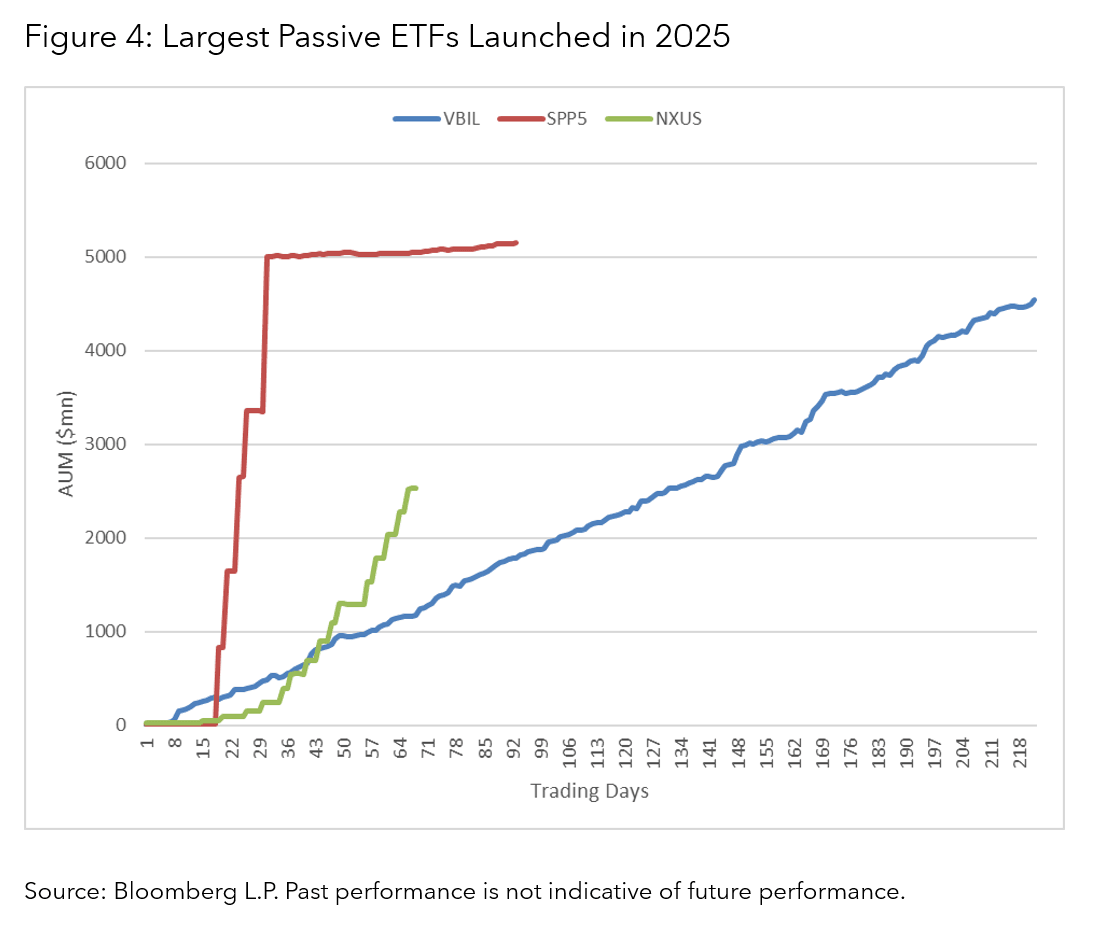

With over 50 years of history, Bloomberg is a leading index provider with 55% of total passive AUM tracking a Bloomberg fixed income index. Although active launches have picked up recently, passive makes up 83% of total fixed income ETF assets and the majority of flows in 2025 went into passive by a 2:1 ratio. In fact, the six funds with the highest flows in 2025 are all passive and four of them track a Bloomberg index. Similarly, the top two fixed income ETFs launched in 2025 (SPP5, VBIL) are passively tracking a Bloomberg index and the top three new passive fixed income ETFs are benchmarked to a Bloomberg index (see chart below).

Although bond indices appear easier for active managers to outperform, once compared to an appropriate “technical” index, our research shows that only 22% of funds have performed better than their benchmarks over the past 10 years.

Monetary policy implications

One of the biggest themes of the past couple years has been the surge in assets invested in money market funds. With risk-free rates at recent highs, investors were happy to collect their 4-5% returns as the macroeconomic landscape seemed uncertain. However, with three rate cuts in four months, the Fed funds rate now sits at 3.75% and may result in flows out of money market funds as investors extend duration into the belly of the curve or intermediate maturities.

There was an uptick in US Treasury launches this year both domestically and internationally, so ETF providers seem well positioned to offer investors solutions for moving out on the curve. On the other hand, we’ve also noticed an increase in global ETF strategies that exclude the United States suggesting a preference for different geographic exposures.

Standing out in the crowd

In an increasingly crowded ETF market with almost 40 new ETF providers in 2025, some issuers have sought to stand out by targeting specific exposures or alternative beta. The former can take many forms from narrowing the investment universe to building a basket of similar issuers with a common theme. We haven’t yet seen thematics take off in fixed income, but this could change as more and more products flood the market. A recent example is the RBIL fund that only holds ultrashort TIPS to achieve a better hedge for inflation. Another way for ETF providers to differentiate is via alternative sources of beta. This can be as simple as changing the weighting scheme or goal-based strategies or even optimization.

But choosing the right index partner is paramount. Bloomberg is well-positioned to collaborate with clients to transform their investment ideas into rules-based indices via our flexible architecture. For example, we can access thousands of data fields on the terminal and onboard for inclusion in index queries. We create dozens of new custom indices every month, and we look forward to continued partnership to bring new index strategies to life.