Bloomberg Professional Services

This article was written by Nick Gendron, Global Head of Fixed Income Index Product Management at Bloomberg.

2025 fixed income performance highlights

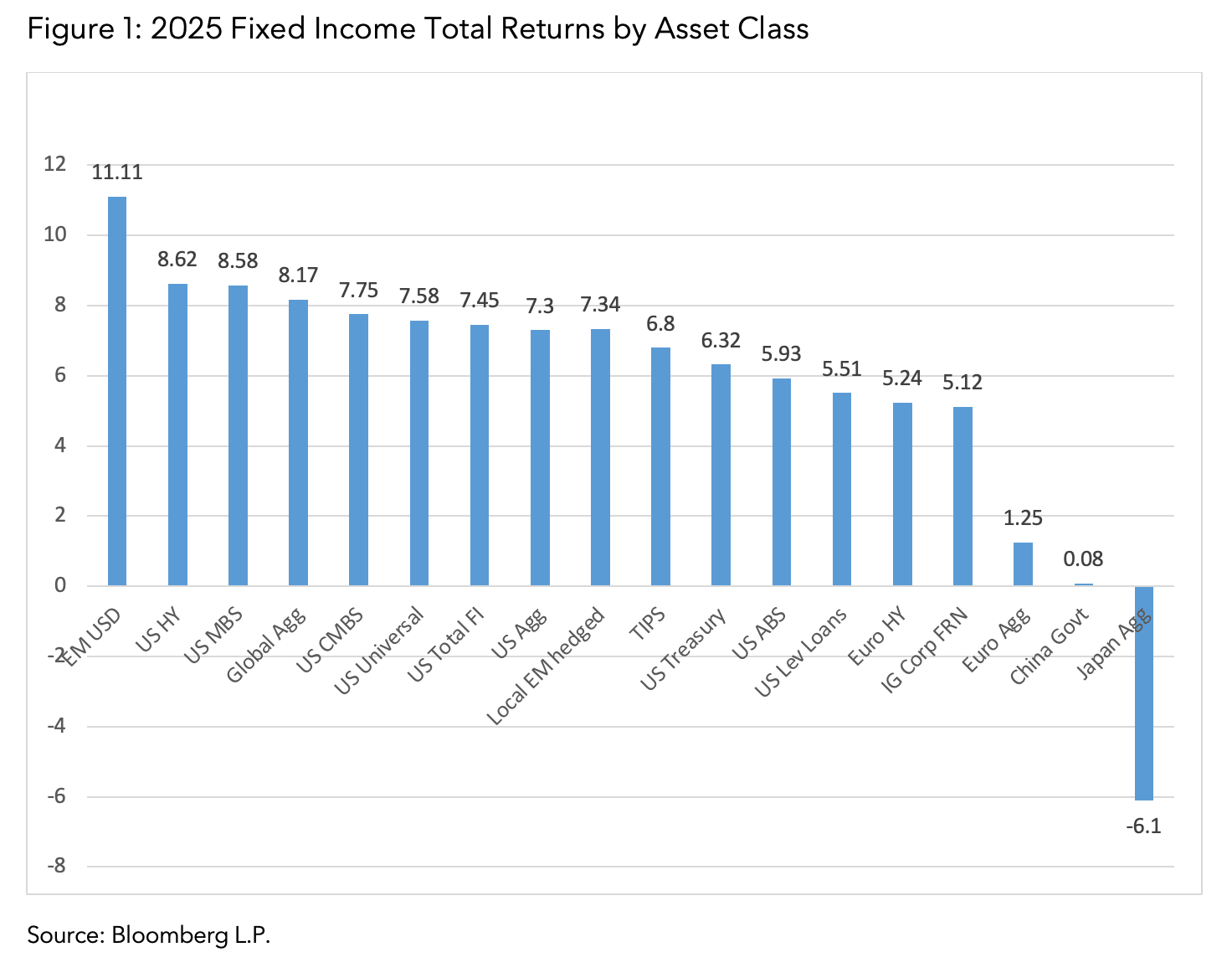

- The U.S. bond market posted its best return since 2020 as lower US Treasury yields, tighter corporate and MBS spreads pushed the U.S. Aggregate to a total return of 7.30% in 2025. In particular, MBS flourished as top performing U.S. investment grade sector for first time since 2015 while posting its best total return (8.58%) since 2002 and best excess return since 2010 (171 bp).

- 23 of 27 currencies in Global Aggregate turn in positive 2025 local returns driving the Global Agg to its best annual return (8.17% USD unhedged) since 2020. Many markets also posted very strong positive returns on a dollar unhedged basis as the dollar weakened.

- Hard currency EM debt turned in the highest performance across all fixed income asset classes with a 2025 return for the EM USD Hard Currency Aggregate Index of 12.16%, its best since 2019.

- U.S. high yield bonds posted a third consecutive year of strong performance with a total return of 8.62%, following 2023 and 2024 returns of 8.19% and 13.44% respectively.

- With global rates moving mostly lower, longer duration spread assets outperformed floating rate securities. The U.S. Leveraged Loan Index (5.51%) underperformed high yield bonds (8.62%) while investment grade corporate FRNs (5.12%) underperformed fixed rate corporate bonds (7.77%).

- Across the three different flagship measures of broad U.S. market, the top performer was the U.S. Universal (7.58%) as the addition of high yield corporate bonds, high yield EM, and 144A debt allowed it to edge out the U.S. Aggregate (7.30%). The newly introduced U.S. Total Fixed Income Market Index, the broadest measure of USD fixed income assets by adding TIPS, Leveraged Loans, and other floating rate securities to the Universal, performed slightly lower than the Universal with a 2025 return of 7.45%.

PRODUCT MENTIONS

Analysis summary

Global bond markets delivered a broadly strong year of returns, with most major markets and fixed income asset classes posting gains in the mid- to high-single digits. Performance was led by lower-quality, higher-yielding segments as declining yields and tighter spreads favored risk, with EM hard-currency debt emerging as the top performer at 12.16% and U.S. high yield returning 8.62%.

High-quality markets also benefited meaningfully from the rally in rates, as U.S. investment grade recorded its strongest performance since 2020, with the U.S. Aggregate index up 7.30%. In contrast, floating-rate sectors lagged as their limited duration exposure proved a headwind, with investment-grade corporate FRNs and leveraged loans delivering more modest returns of 5.12% and 5.51%, respectively.

Movements in the U.S. Treasury curve in 2025 were notably non-uniform, producing meaningful dispersion in returns across maturities. Short and intermediate yields declined sharply as policy expectations eased, with 3-month bills down 70 bp to 3.63%, 2-year yields falling 78 bp to 3.47%, and 5-year yields down 68 bp to 3.71%.

The rally faded further out the curve, however, as 10-year yields declined a more modest 43 bp to 4.15%, while the long end remained anchored by term-premium pressures—20-year yields fell just 8 bp to 4.78% and 30-year yields actually rose 5 bp to 4.83%. As a result, duration was rewarded in 2025, but most strongly when deployed in the belly of the curve.

The 7–10 year sector delivered the best total return at 8.40%, followed by 5–7 years at 8.18%, well ahead of the front end, where 1–3 years returned 5.17%. In contrast, exposure beyond 20 years underperformed, with the long-bond returning just 3.73% and the 20+ year segment posting a modest 4.59%, underscoring that longer-dated assets lagged despite higher starting yields.

In contrast to the strong rally in U.S. Treasuries, European government bond markets delivered far more muted results in 2025, with European Treasuries returning just 0.56% for the year. Despite modestly higher average yields—ending the year at 2.94% versus 2.72% at the close of 2024—returns were constrained by limited duration gains and continued pressure on the long end of the curve.

Performance was strongest in the front and intermediate segments, with the 1–3 year sector returning 2.29% and 3–5 years delivering 2.48%, while longer-dated bonds detracted meaningfully, as the long end (10+ year) posted a -3.80% return, echoing the underperformance of longer maturities observed in the U.S. market.

The UK stood out within the region, delivering a solid 5.02% return as gilts benefited from higher carry and more supportive curve dynamics. As in the U.S. and broader European markets, returns were strongest in the short and intermediate areas of the curve, with 1–3 year gilts returning 5.03% and the 5–7 year sector leading at 6.24%, well ahead of the long end, where 15+ year maturities returned 3.71%.

Elsewhere in Europe, country-level performance was relatively tightly clustered, generally ranging between 0% and 4%, with Italy (+3.21%) and Spain (+1.57%) leading among the larger markets, while Germany and Netherlands were the notable laggards, posting declines of -1.59% and -1.65% respectively.

Global Aggregate

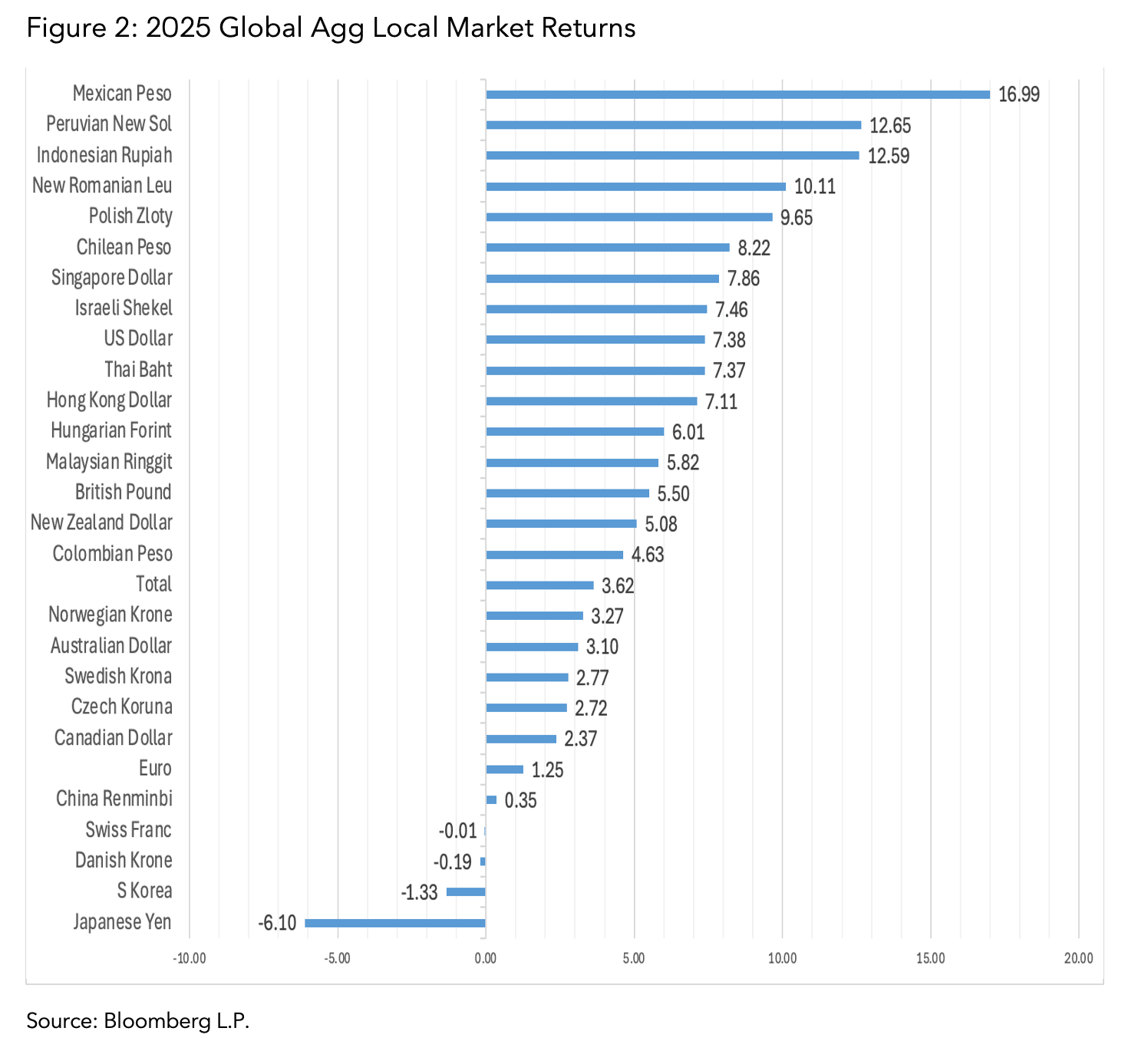

The Global Aggregate Index delivered a standout year in 2025, posting its strongest performance since 2020 with a total return of 8.17% (USD unhedged) across its 27 constituent local markets. Returns were broadly positive and geographically diverse, with only four markets ending the year in negative territory on a local basis.

Performance was led by several higher-yielding markets, most notably Mexico, which returned an exceptional local return of 16.99%, alongside strong gains from Peru (+12.65%) and Indonesia (+12.59%). This breadth of positive outcomes underscores the supportive global rates backdrop and the benefits of diversified exposure across developed and emerging bond markets.

At the same time, dispersion across major large markets remained pronounced. Several large markets delivered either muted or outright negative returns, including the Euro area (+1.25%), China (+0.35%), South Korea (-1.33%), and Japan (-6.10%).

Japan in particular continued to weigh on global results, with the Japan Aggregate posting negative returns for a second consecutive year and losses in five of the past six years, totaling -9.02% over the past two years. Despite these headwinds, the pronounced weight of the U.S. dollar market—representing 45% of the Global Aggregate—proved decisive, as U.S. exposure returned 7.38%, more than offsetting weaker performance from Japan, Europe, and China and anchoring the index’s strong overall outcome.

Across the major sectors of the Global Aggregate, on a USD unhedged basis, corporates were the top performer with a return of 10.30% followed by securitized (9.71%), Government-related (9.16%), and Treasury (6.82%). On a USD hedged basis, Securitized was the top performer at 7.86%, followed by corporates (7.08%), Government-related securities (4.43%) and Treasury (3.52%).

The Global Aggregate added $7.4 trillion of debt in 2025 and now is up to $78.1 trillion notional outstanding and $74.6 trillion market value across 31,458 securities. Based on market value moves, FX moves, and index turnover during 2025, USD-denominated securities, the largest currency in the Global Aggregate, fell by 0.83%% of the index to close at 45.25% while JPY securities fell by 1.38% to 7.95%. In contrast, Euro denominated securities rose by 1.40% to 23.24%. All others remained relatively stable.

U.S. Aggregate

The U.S. Aggregate Index delivered a powerful rebound in 2025 from 2024’s 1.25% return, posting its strongest annual return in five years at 7.30% and extending its recovery from the historic 2022 drawdown, with cumulative gains now totaling 14.65% since the -13.01% loss that year.

Performance was broad-based across major sectors, led by U.S. mortgage-backed securities, which returned 8.58%, its best since 2002. MBS were followed by government-related debt (+7.91%), corporates (+7.77%), CMBS (+7.75%), and Treasuries (+6.32%). Asset Backed securities lagged at 5.93% on a total return basis as the shorter duration of this sector (2.85 years) weighed on results.

On an excess-return basis, all sectors posted positive results, with MBS again standing out as the top contributor, delivering 171 basis points of excess return over Treasuries—easily its strongest annual excess performance since 2010 when it turned in a 225 bp print—while corporates and government-related debt also generated robust excess returns of 147 basis points and 119 basis points, respectively. Within other securitized sectors, CMBS (103bp) outperformed ABS (55 bp).

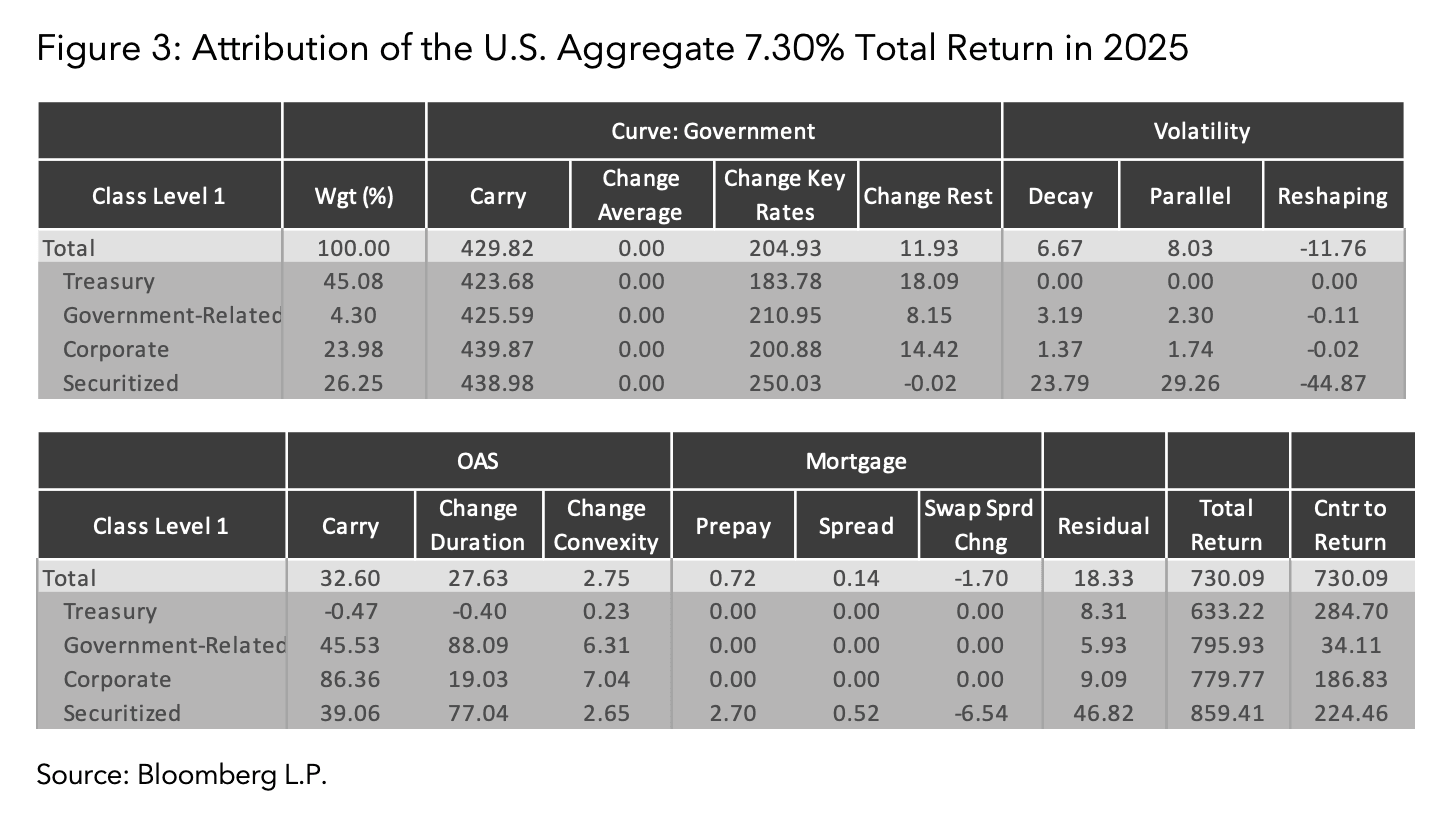

In looking at the attribution of the 7.30% annual return of the U.S. Aggregate Index, the PORT attribution model can be used to dissect the performance into curve movement, carry, and spread movement (Figure 3). The “Curve: Government” section of the figure attributes the amount of the return due to curve carry, shift, and reshaping. The curve carry can be considered as the portion of the return due to coupon and provided a total of +429.8 basis points (bps) in 2025.

With rates generally lower across the curve, the parallel shift, reshaping of the curve, and residual combined for +216.9 bps. In viewing the other components of return, volatility (convexity) contributed -2.9 bps while with spreads (OAS section) generally tighter in 2025, spread movement contributed +27.6 bp while the carry of spread assets over the Treasury curve contributed an additional +32.6 bps. The remainder of the total return in 2025 came from MBS prepayments and spreads (-0.9bp) and a residual (+18.3 bp).

Further detail at the BCLASS Level 1 can be found in the 4 rows underneath the total. Under the Contribution to Total Return (“Cntr to Return”) section, Treasuries and Securitized had the highest contribution to return in 2025 at 284.7 bp and 224.5 bp respectively.

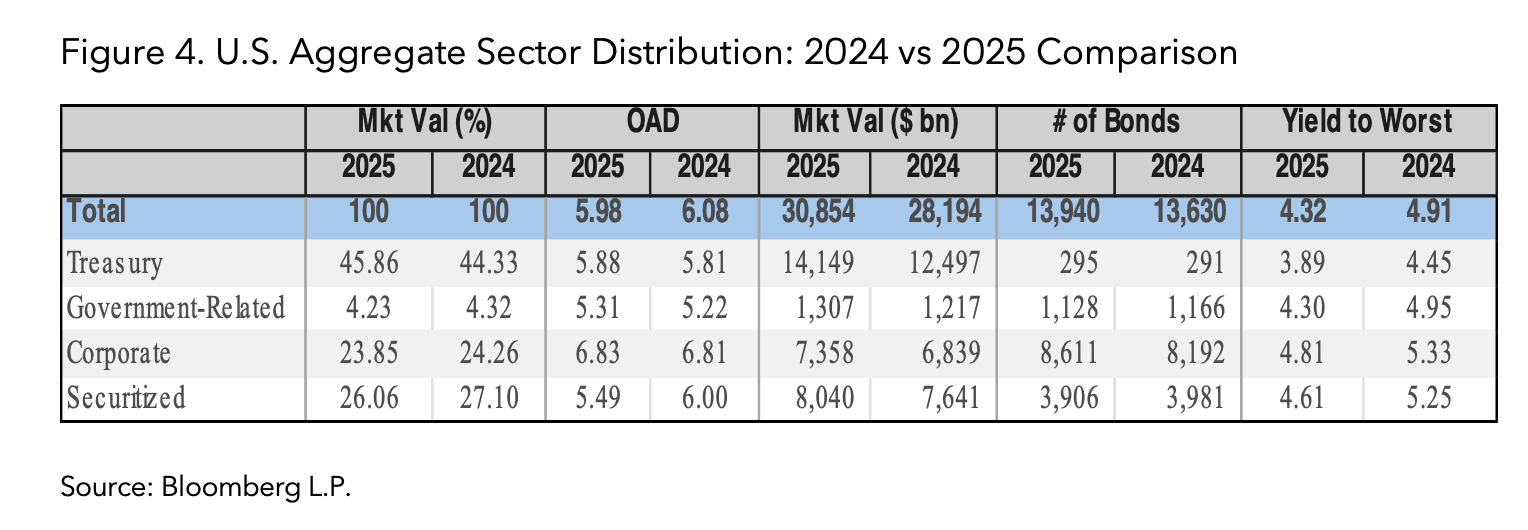

During the course of 2025, the U.S. Aggregate added a net 310 securities to reach a total of 13,940. The index grew in market value from $28.2 trillion to 30.9 trillion and increased in amount outstanding from 30.9 trillion to 32.5 trillion. The duration moved modestly lower from 6.08 to 5.98 years while the yield dipped 59 bp to 4.32%.

From a sector distribution standpoint, U.S. Treasuries grew for the fifth consecutive year from 44.3% of the U.S. Aggregate at the end of 2024 to 45.9% at the close of 2025. As a result, the Government-related, Corporate and Securitized sectors dipped in percentage market value terms to 4.23%, 23.85%, and 26.06% respectively at the close of 2025 (Figure 4).

Corporates: Investment Grade and High Yield

High yield bonds continued to stand out as one of the strongest-performing fixed income asset classes in 2025, extending an exceptional multi-year run. U.S. high yield returned 8.62% for the year, building on gains of 13.44% in 2023 and 8.19% in 2024, bringing cumulative returns to 33.32% over the past three years.

This sustained performance reflects a powerful combination of elevated carry, stable fundamentals, and resilient risk appetite, with the market continuing to benefit from modest default activity and disciplined new issuance. As valuations tightened further, average 2025 yields ended at 6.53%, the lowest year-end level since 2021, underscoring both the strength of demand and the extent of spread compression over the cycle.

Outside the U.S., high yield performance was more mixed but remained solid overall. The Euro high yield market returned 5.24% in 2025, trailing its stronger results in 2023 and 2024 but still delivering positive income-driven returns amid a less supportive rates backdrop.

In contrast, global high yield investors benefited from currency effects, as the dollar-unhedged Global High Yield market returned 12.06% for the year, aided by a weaker U.S. dollar. Taken together, high yield once again played a central role in fixed income performance in 2025, reinforcing its appeal as a return-oriented allocation during a period of declining yields and supportive credit conditions.

Investment grade corporate bonds delivered solid returns in 2025, supported primarily by duration exposure amid declining yields, while spread performance played a more stabilizing role. U.S. dollar corporates within the U.S. Aggregate Index returned 7.77% for the year, a meaningful improvement from 2.13% in 2024, as the sector’s roughly seven-year average duration allowed investors to benefit from the rates rally.

Credit spreads remained relatively stable over the course of the year, beginning at 80 basis points and ending slightly tighter at 78 basis points, despite periods of volatility. Spreads briefly widened to 119 basis points in early April before retracing and settling into a narrow 72–85 basis point range for the remainder of the year, reflecting resilient fundamentals and steady demand.

On an excess-return basis, U.S. investment grade corporates outperformed Treasuries by 119 bp in 2025—solid, though well below the outsized excess returns recorded in the prior two years. Financials led sector performance with 166 basis points of excess return, followed by Utilities at 110 basis points and Industrials at 93 basis points.

In Europe, investment grade corporates lagged the U.S. in total return terms, posting a 3.03% return amid a weaker rates backdrop, but delivered stronger relative performance versus government bonds. European corporates outperformed Euro Treasuries by 226 basis points as spreads tightened meaningfully from 102 basis points at the end of 2024 to 78 basis points by year-end 2025.

Sector leadership in Europe was led by Financials and Utilities, which generated excess returns of 247 and 255 basis points, respectively, while Industrials, though still strong, trailed at 203 basis points.

Emerging Markets

Emerging market hard-currency bonds delivered an exceptional year of performance in 2025, standing out as one of the top-performing segments across global fixed income. The EM Hard Currency Aggregate returned 12.16% on a U.S. dollar–unhedged basis, marking its strongest annual result since 2012, when the index gained 18.14%.

Performance benefited from a supportive combination of declining U.S. yields, tightening credit spreads, and resilient investor demand for higher-yielding assets, all of which contributed to strong total returns across regions and credit tiers.

Within the hard-currency universe, U.S. dollar–denominated bonds returned 11.11% for the year, with regional performance led decisively by the Americas region, which gained 13.59% as improving macro fundamentals and spread compression drove strong excess returns.

The EMEA region also delivered robust results at 12.69% (dollar unhedged), while Asia posted a still-solid return of 9.09%, reflecting a more subdued credit environment but continued income support. In contrast, performance in euro-denominated emerging market debt lagged, with the Pan-Euro EM Hard Currency Index returning just 5.11% on a euro-unhedged basis, underscoring the importance of both currency denomination and regional composition in shaping outcomes for hard-currency EM investors in 2025.

Local-currency emerging market debt delivered an exceptional year of performance in 2025, driven primarily by currency appreciation alongside supportive rates dynamics. The EM Local Currency Government 10% Capped Index returned 16.57% in unhedged U.S. dollar terms, its strongest annual result since 2009 (18.19%). In contrast, the U.S. dollar–hedged version of the index returned 7.13%, underscoring the substantial contribution of foreign exchange movements to total returns and highlighting the role of a weaker dollar in amplifying performance for unhedged investors.

Regional results further illustrate the importance of FX effects. The Americas component surged 30.98%, reflecting pronounced dollar weakness against several Latin American currencies, while the EMEA region posted strong gains of 26.95%, led by South Africa’s standout return of 40.99%.

Asia delivered more mixed outcomes: Malaysia (+16.60%) and Thailand (+16.25%) benefited from favorable currency and rates dynamics, while China (+4.54%) and India (+2.37%) lagged amid more muted FX appreciation and divergent domestic policy paths although India turned in a solid 6.67% return on a local basis. Overall, the wide dispersion across countries reinforced the importance of active regional and currency positioning in local-currency EM markets, even within a broadly supportive global environment.

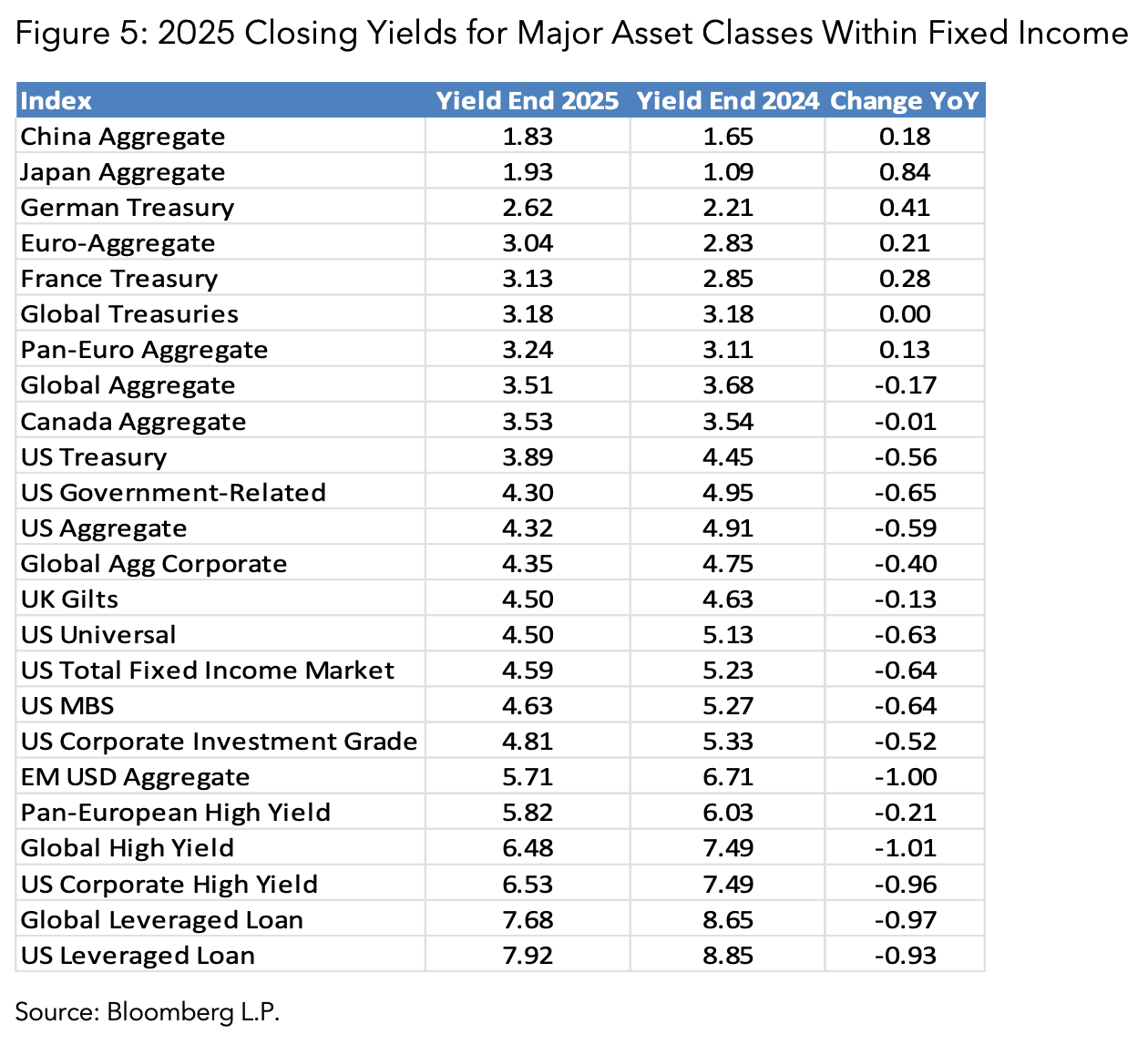

Yield levels across fixed income

Yield levels across fixed income remained elevated by recent historical standards at the end of 2025 (Figure 5), though most sectors experienced meaningful compression over the course of the year as rates declined and risk appetite improved.

Core government and aggregate markets offered yields in the low- to mid-3% range, with the Global Aggregate ending the year at 3.52% and U.S. Treasuries at 3.89%, while investment grade–oriented sectors provided a modest yield pickup, with U.S. corporates and securitized assets clustered between roughly 4.5% and 5.0%. Despite the broad-based rally, yields remained well differentiated across the spectrum, preserving clear income trade-offs between higher-quality and higher-risk segments.

At the higher-yielding end of the market, credit and floating-rate assets continued to offer materially greater income, albeit with further evidence of yield compression. U.S. and global high yield bonds closed the year with yields in the mid-6% range following declines of roughly 100 basis points during 2025, while emerging market USD debt ended at 5.71%. Leveraged loans remained the highest-yielding segment, with global and U.S. loans finishing at 7.68% and 7.92% respectively, supported by floating-rate coupons and elevated policy rates although declining almost 100 bp lower on the year.

Overall, the yield landscape at year-end 2025 reflected a market that had repriced lower yields in response to easing financial conditions, yet continued to offer a wide and investable range of income opportunities across fixed income.

Further analysis

For further detail on the 2025 performance of the markets, our Bloomberg Intelligence team has published a significant amount of detail at a sector level as well as outlooks for 2026. This information can be found at BI STRAT <GO> on the Bloomberg Terminal. In addition, please refer to our monthly publications for further detail on: US Municipals, Canadian Dollar, US Leveraged Loans, and the China Bond Market all available via INP <GO>.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. © 2026 Bloomberg. All rights reserved.