Functions for the Market

- A detailed analysis of the Magnificent 7 reveals robust earnings outlooks despite recent volatility.

- Strategic use of Bloomberg’s analytical tools helps uncover resilient EPS forecasts and forward-looking valuation trends.

- Ongoing competitive pressures from China are factored into earnings estimates, offering a nuanced view of future profitability.

Background

The Magnificent 7 — comprising leading U.S. tech companies such as Meta Platforms Inc., Alphabet Inc., Microsoft Corp., and others — have been the benchmarks of innovation and market strength. This group has consistently driven market sentiment through robust profitability and high revenue growth.

PRODUCT MENTIONS

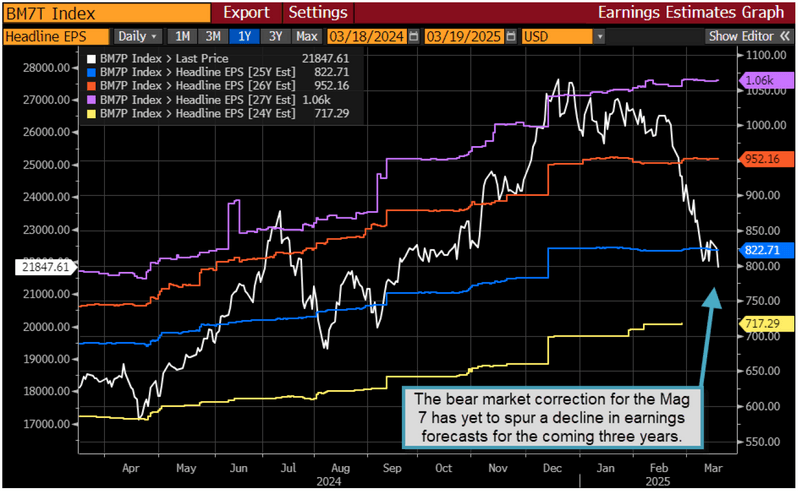

The Bloomberg Magnificent 7 Index is down more than 20% from its December high as the market shows broad concern over a loss of US dominance in the tech space and signals recession fears. There are signs the Mag 7 may see shifts to their historically high valuation metrics, even if analysts remain bullish on future earnings.

Mag 7 valuations and earnings forecasts have come under renewed scrutiny amid heightened concerns about China’s accelerating entry into the artificial intelligence (AI) space. Investors are showing worry about returns on investments, but that has yet to be realized in forecasts.

The issue

The Index reached a 16% year-to-date decline on March 18, and Meta’s fall that day meant all Mag 7 stocks had turned negative in 2025. Nvidia Corp.’s announcement of new ventures and more powerful AI chips mitigated only some of those losses the following day.

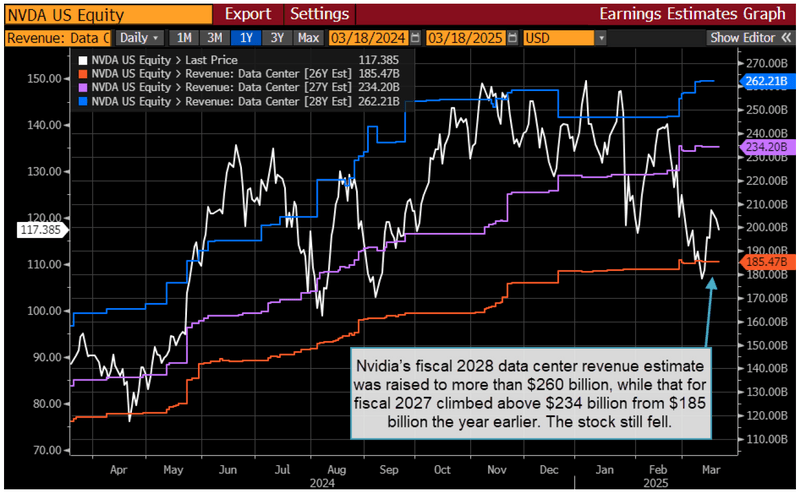

Despite this drop and a current bear market, analysts have remained largely bullish on future earnings, with forecasts for aggregate earnings per share (EPS) for 2027 rising by 2%. Future forecasts are roughly 50% higher than they were in 2024. Nvidia specifically had its fiscal 2027 data center revenue estimate increased to more than $234 billion, with 2028’s projections rising to $260 billion.

Nvidia Corp. CEO Jensen Huang said “AI is going through an inflection point” and predicted that data center spending will “very soon” reach $1 trillion annually.

Bloomberg Intelligence sees China’s recent AI gains as a pressure point for the Mag 7 as advancements will allow Chinese companies to spend less on LLM training and more on agents and applications. As Tencent Holdings Ltd. signaled it will invest $10 billion in AI infrastructure this year, the Mag 7’s 25 times forward PE closed in on the Hang Seng Tech Index’s 19.

Tracking

Run EEG <GO> to track earnings estimates for a specific index like the Bloomberg Magnificent 7 Total Return (BM7T) or to check specific estimates like Nvidia’s data center revenue forecasts.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.