Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Chief Equity Strategist Gina Martin Adams and Equity Strategist Gillian Wolff. It appeared first on the Bloomberg Terminal.

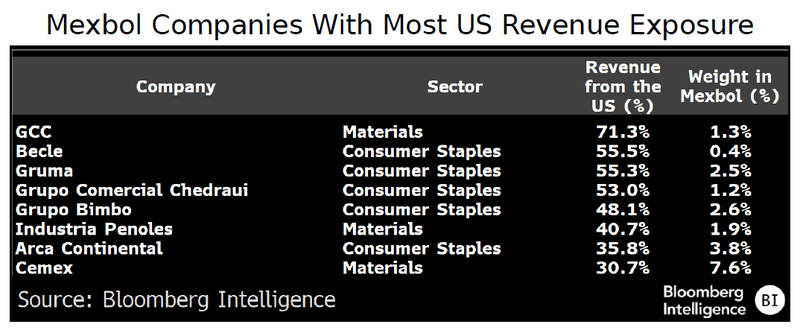

Mexico’s equity market may be less vulnerable to President Donald Trump’s tariff policy than macroeconomic data suggest. Just four of 35 companies in Mexico’s Mexbol index index derives more than 50% of their revenue from the US. The 30-day delay of US tariffs has boosted sentiment, but volatility should be expected even though valuations suggest that a significant portion of trade and political risks are priced in.

Mexbol constituents have limited tariff exposure

Mexico’s economy is highly exposed to US tariffs, but the Mexbol index is relatively insulated from the punitive measures. Of Mexico’s exports, 75% go to the US, making it the most vulnerable economy in Latin America to trade disputes. But just four of 35 companies in the Mexbol index have more than 50% of their revenue derived from the US, suggesting that tariff -related risks lie in select names rather than the broad index.

The one-month tariff delay limits risks to the economy. As in 2018-19, trade turmoil in Mexico may not be felt in equities until after it trickles through the domestic economy. And stocks are somewhat isolated, given the limited exposure of companies in the index, providing a further buffer.

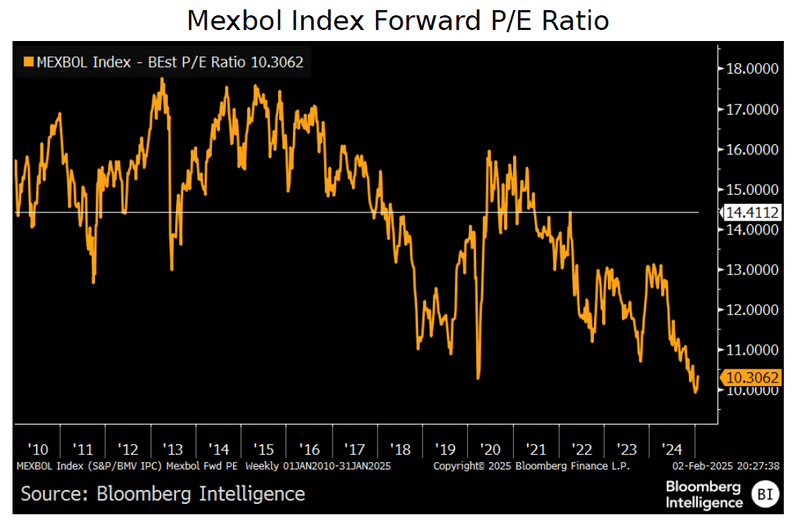

Valuations are already heavily discounted

At a P/E of just 10.3x, Mexbol still trades well below its historical average and pre-2018 tariff levels, suggesting that substantial political and economic risks are already priced in. Further downside may be limited, but uncertainties persist as trade negotiations continue. Mexican equities underwent a significant valuation de-rating in 2024, driven by Claudia Sheinbaum’s election and MORENA’s congressional supermajority, which raised concerns over constitutional reforms.

After Mexbol’s forward P/E bottomed at 9.9x toward the end of 2024, valuations recovered to 10.3x, supported by an initial softer trade stance from Trump and optimism that Sheinbaum would engage in dialogue to ease trade tensions.

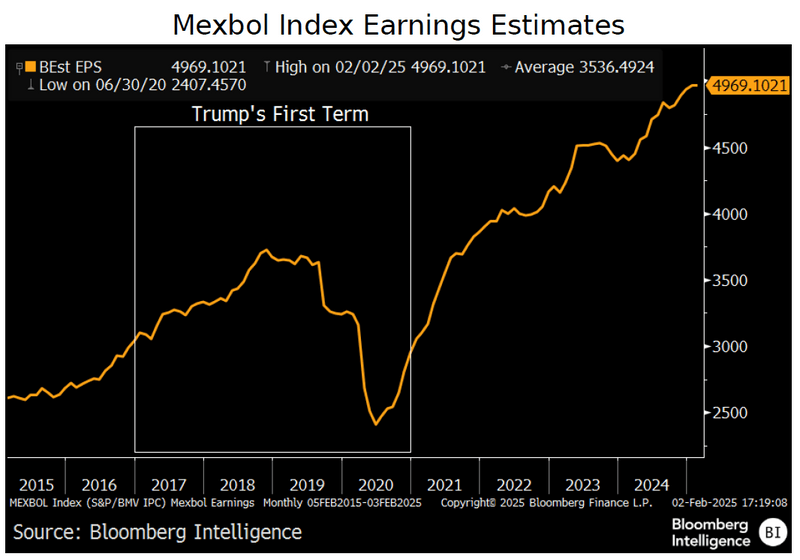

Mexbol earnings holding steady

Despite tariff threats in 2025, current EPS estimates have shown resilience, with consensus expecting double-digit growth for Mexico in 2025. The effect of tariffs on Mexico’s earnings were similar in 2018 — despite escalating US-Mexico trade tensions, Mexbol earnings estimates remained resilient through through that year, reflecting strong corporate fundamentals. It wasn’t until 2019 that estimates started to be revised downward as trade uncertainty intensified and domestic concerns emerged under AMLO’s new administration, particularly regarding economic policy shifts and slowing economic growth.

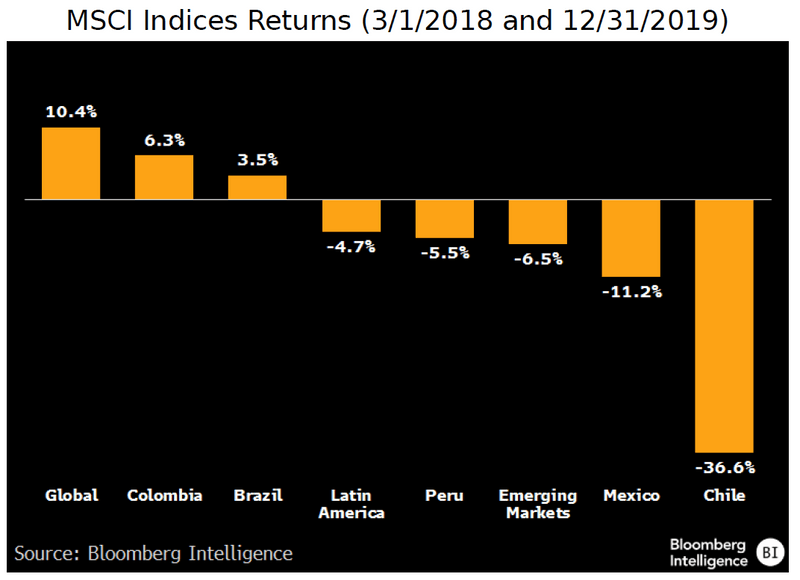

Mexico trailed LatAm under Trump 1.0

Mexican equities significantly underperformed major Latin American indexes during Trump’s first term, weighed down by trade tensions and domestic policy uncertainty, and this has potentially set a precedent for markets in 2025. Though US tariffs pressured investor sentiment across emerging markets, Mexico had one of the sharpest declines. Mexican assets were affected by a combination of tariff talks on top of uncertainties introduced by AMLO’s election in 2018. His policies on infrastructure, energy and financial regulation raised investor concerns and led to a repricing of Mexican assets during that period.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.