Bloomberg Professional Services

This article was written by Scott Atha, Fixed Income Indices Product Manager, and Vikas Jain, Quant Researcher at Bloomberg.

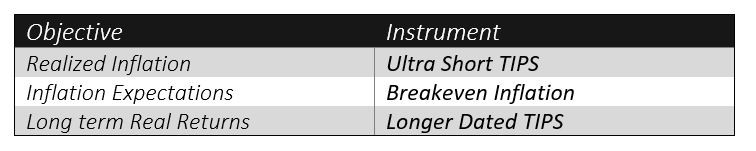

Treasury Inflation-Protected Securities (TIPS) are U.S. Treasury bonds whose principal increases with inflation. While TIPS are commonly used to hedge inflation risk, the difference between shorter-dated TIPS and longer-dated TIPS is often overlooked. The primary driver of this difference is the inherent duration exposure in TIPS, which can introduce interest rate risk that has the potential to offset the inflation hedging benefits. Investors looking to hedge inflation shocks can consider shorter dated TIPS, while those looking for inflation expectation hedge can consider the breakeven inflation swaps.

Difference in Treasury and TIPS

When held until maturity, TIPS provide a full protection against inflation, delivering the “real yield” as indicated at the time of purchase. On the other hand, a fixed-rate Treasury bond (“Nominal Treasury”) pays a fixed principal and coupon. The difference in yield between the two, the “breakeven inflation rate”, is related to the inflation expectation priced into the market. TIPS tend to outperform when inflation expectations increase, whereas nominal treasuries tend to underperform.

- TIPS Yield = Real Rate

- Nominal Treasury Yield = Real Rate + Inflation Expectation (or Breakeven Inflation Rate)

TIPS have duration, too

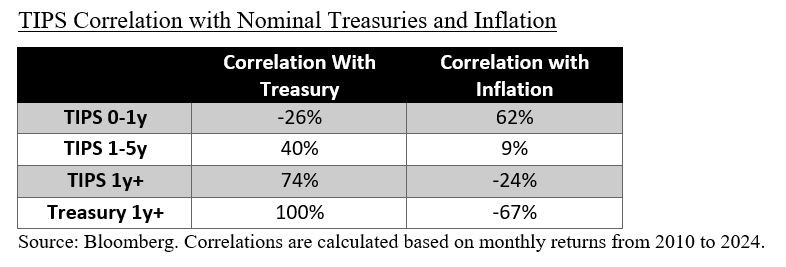

Similar to nominal bonds which are exposed to nominal interest rate risks, TIPS are exposed to real interest rate risk. In fact, TIPS typically have longer duration than similar maturity nominal bonds because coupons are lower and principal is adjusted higher for inflation. Naturally, the duration for shorter dated TIPS is lower than the longer dated TIPS.

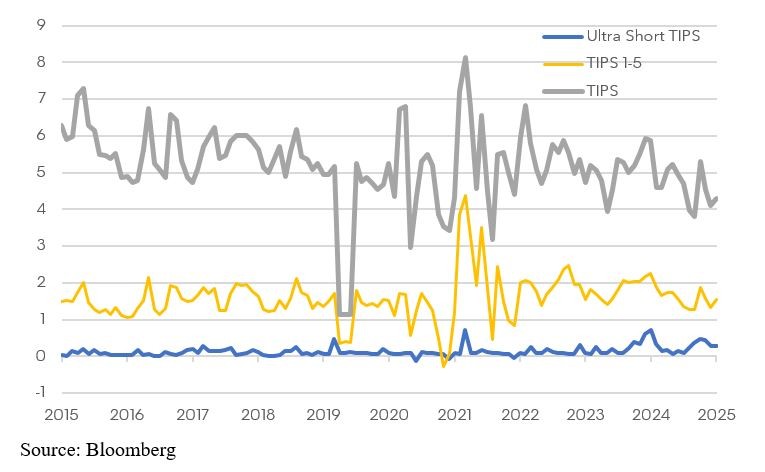

We use Bloomberg’s Ultrashort TIPS index (Ticker: TIPS13M, “Ultra Short Tips” in graphs below) to refer to shorter dated TIPS and the Bloomberg TIPS Index (Ticker: LBUTTRUU, “TIPS” in graphs below) to refer to the longer dated TIPS. The shorter dated TIPS index includes securities maturing within 1-13 months while longer dated TIPS include securities maturing in more than 1 year. The TIPS 1-5 uses the Bloomberg’s US TIPS 1-5 Year Index (Ticker: BUT5TRUU).

Impact of duration on TIPS

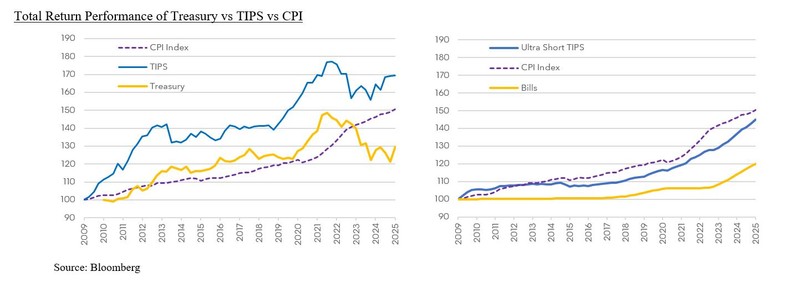

The impact of duration in longer-dated TIPS is particularly evident when inflation shocks are observed, such as in 2022. As a result of the duration exposure, the TIPS index was down 11.8% in 2022, (similar to US Treasury index, which was down 12.5%), despite US CPI hitting 6.5% YoY. During the post-pandemic inflation shock, short-dated TIPS outperformed their nominal counterparts significantly.

On the other hand, shorter-dated TIPS have a stronger correlation with inflation (62%) compared to their longer-dated counterparts and are more responsive to immediate changes in the CPI. The correlation between TIPS and nominal Treasury bonds also varies based on the maturity, with shorter-dated TIPS showing lower correlations to Treasury compared to longer ones.

Ultrashort TIPS for inflation shocks

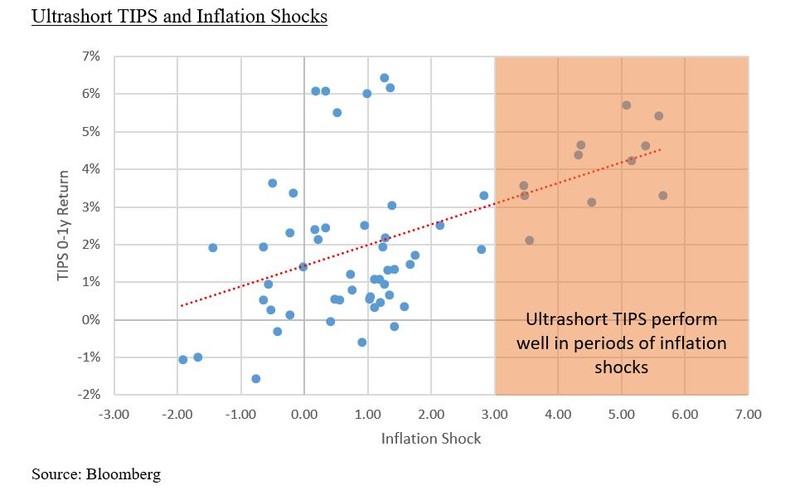

The performance of Ultrashort TIPS is closely linked to inflation shocks, which are unexpected changes in inflation. We define inflation shock as the difference between the 1-year breakeven inflation swap (USGGBE01) and the subsequent 1-year realized CPI. This measure captures the gap between expected and actual inflation, highlighting the surprise in inflation. The plot below reveals that Ultrashort TIPS tend to generate higher returns when the CPI exceeds the implied breakeven inflation.

Conclusion

For investors seeking pure inflation protection with minimal exposure to interest rate risk, shorter-dated Treasury Inflation-Protected Securities (TIPS) may be a suitable option. By minimizing duration risk, these securities can provide a more stable and predictable real return in the short term. In contrast, investors who are seeking to hedge against long-term inflation and are willing to take on the associated risks, such as interest rate risk and duration risk, may consider longer-dated TIPS.

- F/m Investments has launched the F/m Ultrashort Treasury Inflation-Protected Security (TIPS) ETF tracking the Bloomberg US Ultrashort TIPS 1-13 Months Index (TIPS13M) under the ticker RBIL.