Functions for the Market

- The big four US banks posted strong Q4 consumer loan growth, with JPMorgan reporting 7% debit and credit volume gains, but all four warned a proposed 10% credit card rate cap would restrict access to credit and hurt consumers.

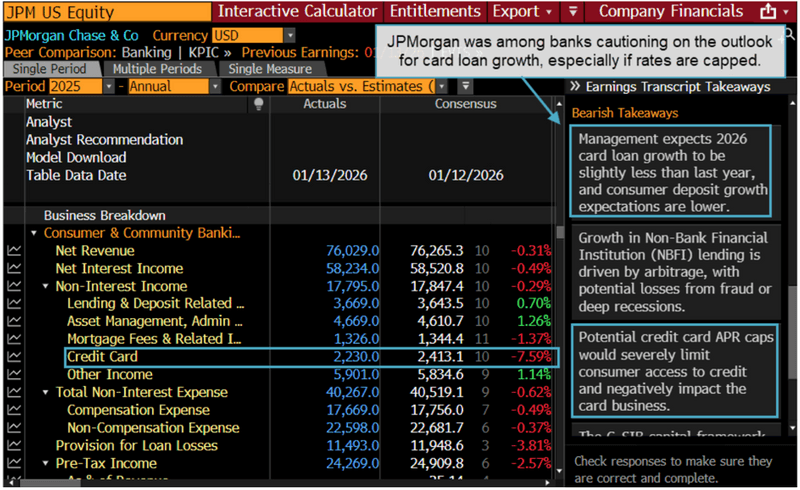

- JPMorgan’s credit card revenue missed analyst estimates by 7.6%, and the bank forecasts card loan growth will slow to 6-7% in 2026.

- Analysts project consumer loan growth to decelerate over the coming quarters, while Bloomberg Intelligence sees North American banks facing slow lending growth, tariff uncertainty and shifting credit conditions in 2026.

Background

White House trade adviser Peter Navarro ratcheted up pressure on the banking industry, calling on JPMorgan Chase & Co.’s Jamie Dimon to cut credit card interest rates in a Bloomberg Radio interview. “You are a criminal the way you charge the American people at 22, 25 and 30%, and the president wants you to lower that,” Navarro said, weeks after President Donald Trump proposed a one-year 10% cap on card rates.

PRODUCT MENTIONS

Speaking at the World Economic Forum in Davos, Dimon called the cap an “economic disaster.” In the worst case, banks would have to make “a drastic reduction of the credit-card business,” though he added that JPMorgan would “survive it.”

The issue

The push for a rate cap came as the big four US banks posted strong Q4 consumer lending results. JPMorgan said debit and credit volume growth of 7% from a year earlier showed consumers and small businesses “remain resilient.” Bank of America reported 8% average loan growth. All four banks sounded warnings about the rate cap proposal.

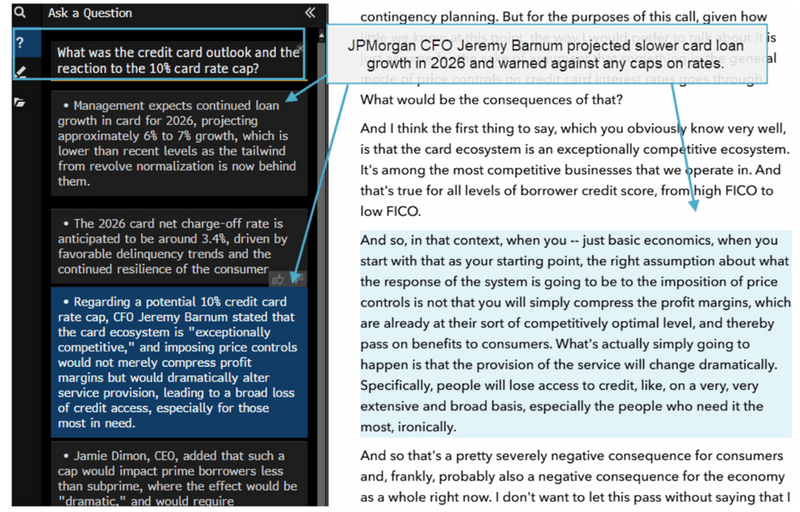

JPMorgan’s credit card revenue missed the consensus by 7.6% in Q4, and the bank forecasts card loan growth will slow to 6-7% in 2026 as the boost from consumers returning to carrying card balances fades.

JPMorgan CFO Jeremy Barnum was direct about the rate cap’s potential impact during an earnings call, saying “it would be very bad for consumers, very bad for the economy.” He added that “everything is on the table” in fighting what he described as “weakly supported directives to radically change our business.” Bloomberg’s DS transcript tool lets users ask specific questions of earnings call transcripts, surfacing Barnum’s full response alongside comments from CEO Jamie Dimon.

Bank of America CEO Brian Moynihan said a 10% cap would slow consumer spending. He also noted that the bank has been talking to the administration. “We’re working hard,” Moynihan said. “We’re trying to come up with solutions.”

Meanwhile, Wells Fargo CFO Mike Santomassimo warned the cap would “remove credit at a really important time from the people that most need it,” with “negative consequences, not just on credit availability, but also just broader economic growth.”

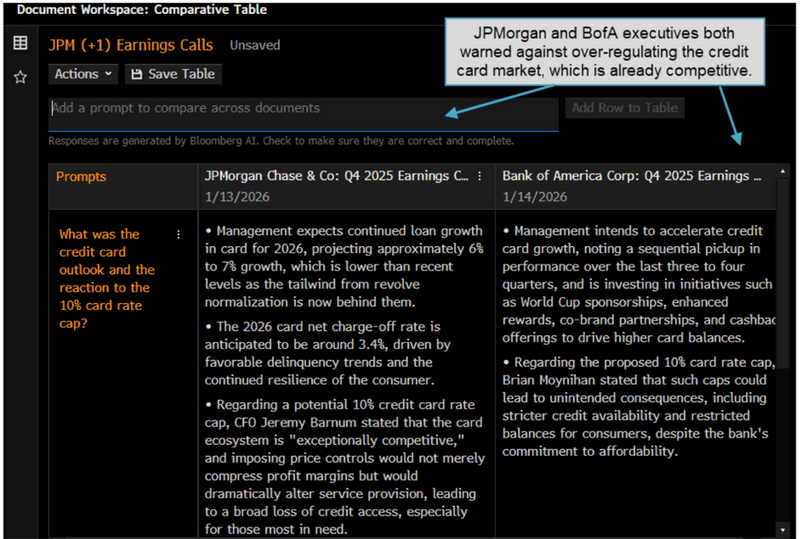

Analysts project consumer loan growth to decelerate over 2026 after acceleration in the prior year. Bloomberg Intelligence reports North American banks are heading into 2026 facing slow lending growth, tariff uncertainty and shifting credit conditions. Some banks are already adapting: Bank of America and Citigroup are weighing new credit card products with a 10% rate as a potential olive branch to the White House.

Tracking

Track and compare forecasts for JPMorgan and BofA with the DOCW (Document Workspace) function:

- Type “document workspace” and select DOCW.

- Type JPM US Equity and BAC US Equity in the Select One or More Companies box.

- Click the Select Documents dropdown and select Earnings Calls.

- Click Create New Table.

- Type “What was the credit card outlook and the reaction to the 10% card rate cap?” in the Add a prompt box.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.