Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Senior Litigation Analyst Elliott Stein and Senior Industry Analyst Paul Gulberg. It appeared first on the Bloomberg Terminal.

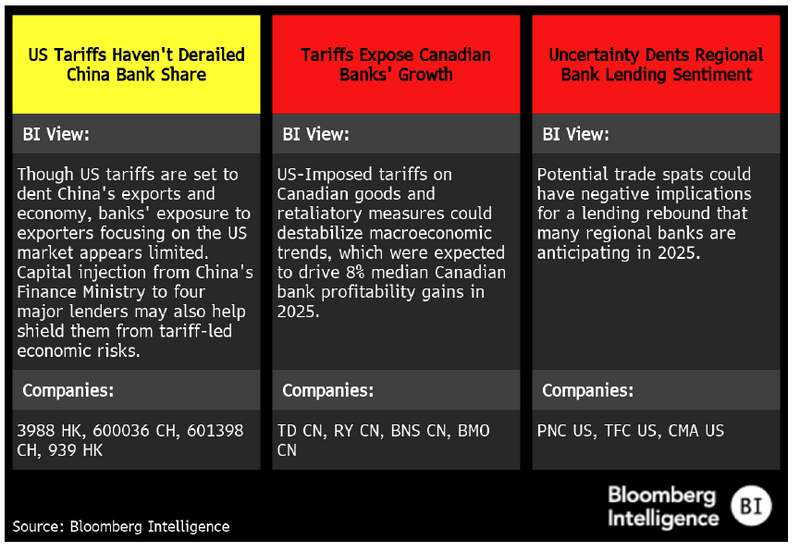

President Donald Trump’s “Liberation Day” tariffs will likely hurt US regional and Canadian banks, while Chinese banks’ exposure seems limited. Capital injection from China’s Finance Ministry to four major lenders may help shield them. US-imposed tariffs on Canadian goods and retaliatory measures could negatively impact macroeconomic trends. Trade spats could also have negative implications for a lending rebound that many US regional banks were anticipating in 2025.

Three keys for tariffs impact on financials

Key drivers

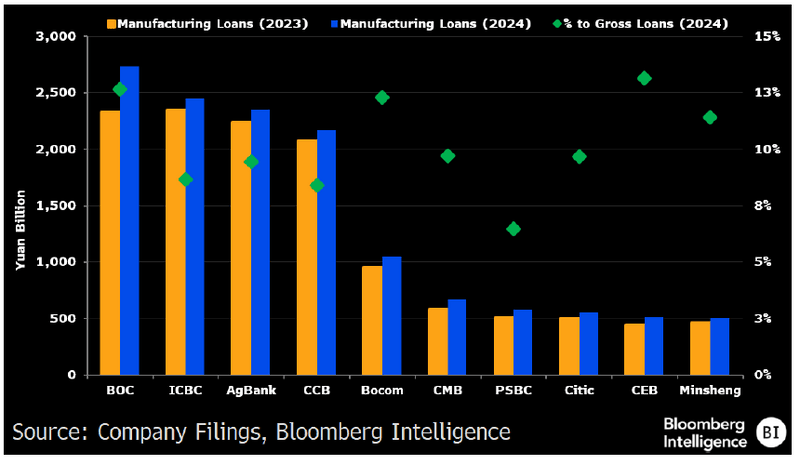

Big banks with $300 billion or more manufacturing loans

China’s Big Four banks appear to have modest exposure to the US export market, with each holding at least 2.2 trillion yuan ($300 billion) in manufacturing loans. Bank of China’s 2.73 trillion yuan topped peers in 2024, followed by ICBC’s 2.45 trillion, AgBank’s 2.36 trillion and CCB’s 2.17 trillion. The four’s exposure was equivalent to 40% of China’s medium- to long-term industrial loans (24.6 trillion yuan). Loans to manufacturers were 13% of the total at BOC, followed by 9% at AgBank and ICBC, and 8% at CCB. The other six Chinese banks we cover — two smaller state and four joint-stock lenders — jointly held 3.9 trillion yuan of such loans. Bocom’s exposure reached 1.1trillion yuan vs. 500-670 billion yuan for the rest. Among the six, Everbright Bank and Bocom were more exposed than the others.

Manufacturing loans, share of total lending

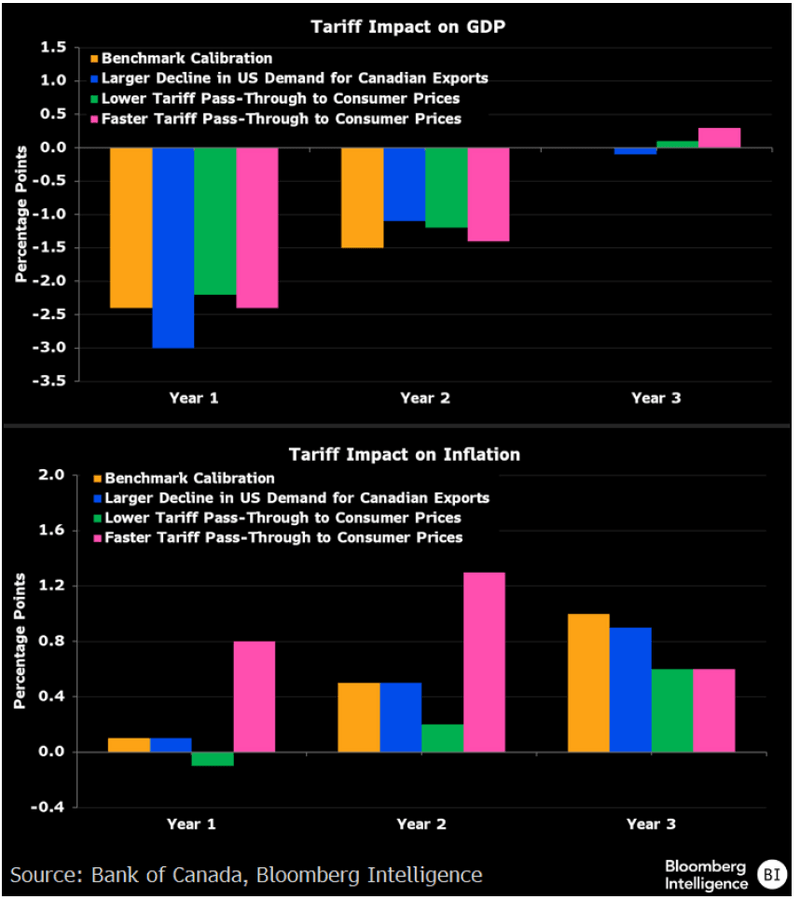

Tariff risks to GDP, inflation expose banks growth

US-imposed tariffs on Canadian goods and retaliatory measures could negatively impact macroeconomic trends, which were expected to drive 8% median Canadian bank profitability gains in 2025. The Bank of Canada noted a potential over 2% negative GDP impact in year one and risk of higher inflation. Many variables, including the length of tariffs, don’t allow us to estimate the earnings impact to Canadian banks, we note that mid-single-digit loan and overall revenue-growth expectations for the group in 2025 leave little room for additional pressures.

Lower GDP and reduced business investment could weigh on commercial loan growth and credit, accounting for 57% at BMO, 48% at National and less than 40% at peers. Higher inflation is a negative for consumers, potentially reversing a recent easing in debt service ratios.

GDP, inflation risks to banks (BoC scenarios)

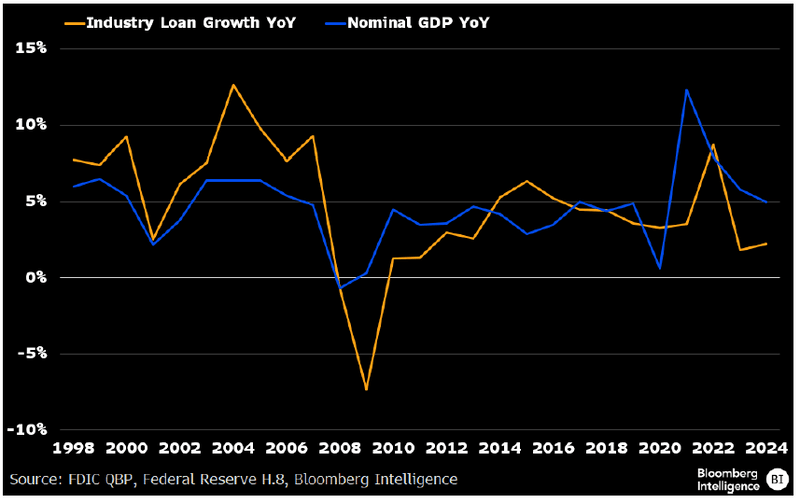

Uncertainty denting lending, business sentiment

Trade spats are hampering a lending rebound that many regional banks were anticipating in 2025. Lending has historically carried a tight relationship with nominal GDP growth, while loan gains have trailed the underlying economic output amid soft demand and elevated interest rates. In 2024,lending was only up 2% for the industry despite GDP being up 5%. Business sentiment is receding amid policy uncertainty and tariff s that can upend supply chains and reduce economic activity. The NFIB Small Business Optimism Index has fallen to 100.7 in February after reaching 105.1 in December, the highest since 3Q18.

Banks like PNC, Truist and Comerica had echoed the improved tone from commercial borrowers, but the positive sentiment hasn’t translated to strong lending. Industry commercial growth looks flat in 1Q.

Industry loan expansion vs. GDP growth

P&C Insurers well positioned among financials

US tariffs and potential retaliations pose several risks, yet P&C insurers’ defensive nature leaves them solidly positioned among financial stocks in such an environment. Consensus EPS has yet to adjust, but we think there will be some manageable bottom-line impact. Tariffs should increase building-material expenses, driving up loss costs across all personal and commercial property lines. International lines like trade credit could also be affected. The most direct effect would likely be at auto insurers such as Allstate, Progressive and Geico, though there are mitigating factors. Lower interest rates would hurt investment income.

Should tariffs spur a recession, premium growth will likely remain positive, given inelastic demand. Businesses would need to close to cancel policies and are unlikely or unable to reduce coverage.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.