Bloomberg Professional Services

This article was written by Bloomberg Intelligence Senior Analyst of Asia Consumer and Technology Catherine Lim, Bloomberg Economics Chief Asia Economist Chang Shu, and China and Hong Kong Economist Eric Zhu. It appeared first on the Bloomberg Terminal.

Downside risk to stimulus-led spending

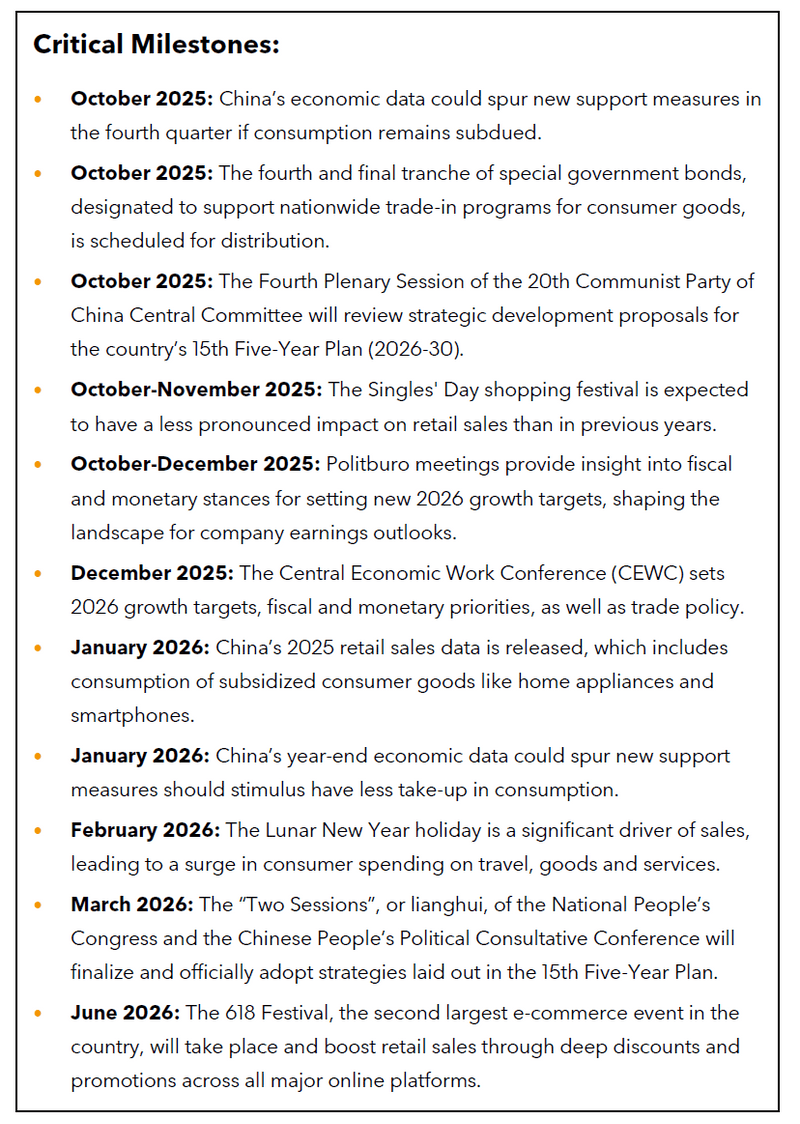

Our 2025 China retail sales outlook for modest 4.1% growth is shaped by the government’s ability to stimulate spending, with a final round of support in the second half expected to unleash over 1.2 trillion yuan (about $170 billion) in consumer spending during the period. But the effectiveness of these measures hinges on a crucial condition: Sales in subsidized categories like automobiles, home appliances and smartphones must rise by at least 4% year over year in the rest of 2025. This is a sharp deceleration from first-half growth of 12% and is compounded by subdued consumer demand coinciding with a depletion of readily available policy levers and their waning marginal impact. Our model puts the second-half rate at just 3.3%.

The current strategy of stimulating spending through subsidies for goods including automobiles, washing machines and electronics has a ceiling: there are only so many people who will buy a new one each year. The challenge is to encourage spending on unsubsidized goods and services that appeal to both the domestic population and foreign visitors. Structural shifts in consumer behavior offer a more reliable tailwind, with domestic retailers on the receiving end of a combined $42 billion windfall tied to changing travel habits. Digital platforms will continue to drive long-term retail growth, but their market-share battles must translate into sustainable profitability.

Key research topics

- Reliance on subsidized goods: Even with a big government infusion in the back half of the year, achieving the full-year retail sales growth target is too reliant on subsidized goods growing by at least 4% year over year from July to December.

- Change in preferences: The growing fitness trend is a movement expected to last into 2026, and a preference for affordable premium goods is set to benefit local leaders.

- Digital platforms sustain growth: E-commerce platforms like Alibaba, JD.com and Meituan will continue to be primary engines of retail growth, yet their intense competition will limit margin growth until regulators intervene.

- Domestic spending lift: Chinese travelers are cutting back on overseas purchases and could redirect an estimated $27 billion back into the domestic market.

- Rising tourism inflows: Relaxed visa policies, attracting a surge of foreign visitors, are poised to channel an additional $15 billion into the local economy.

Performance and valuation

Price-to-earnings ratios diverged across China’s eight major consumer goods and services groups this year through Aug. 22. Multiples for clothing and footwear makers, jewelry retailers, e-commerce, and cosmetics brands expanded 21-80%, but only the first pair saw a rise in earnings estimates of up to 127%. For e-commerce and cosmetics, cuts in earnings forecasts of 25-43% drove valuation gains. In contrast, P/E ratios for food and beverage service chains and home appliance makers compressed, as hikes in profit expectations of up to 51% offset price multiples.

Sustainable retail growth needs more than stimulus

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.