Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Equity Strategist Laurent Douillet and Equity Strategist Kaidi Meng. It appeared first on the Bloomberg Terminal.

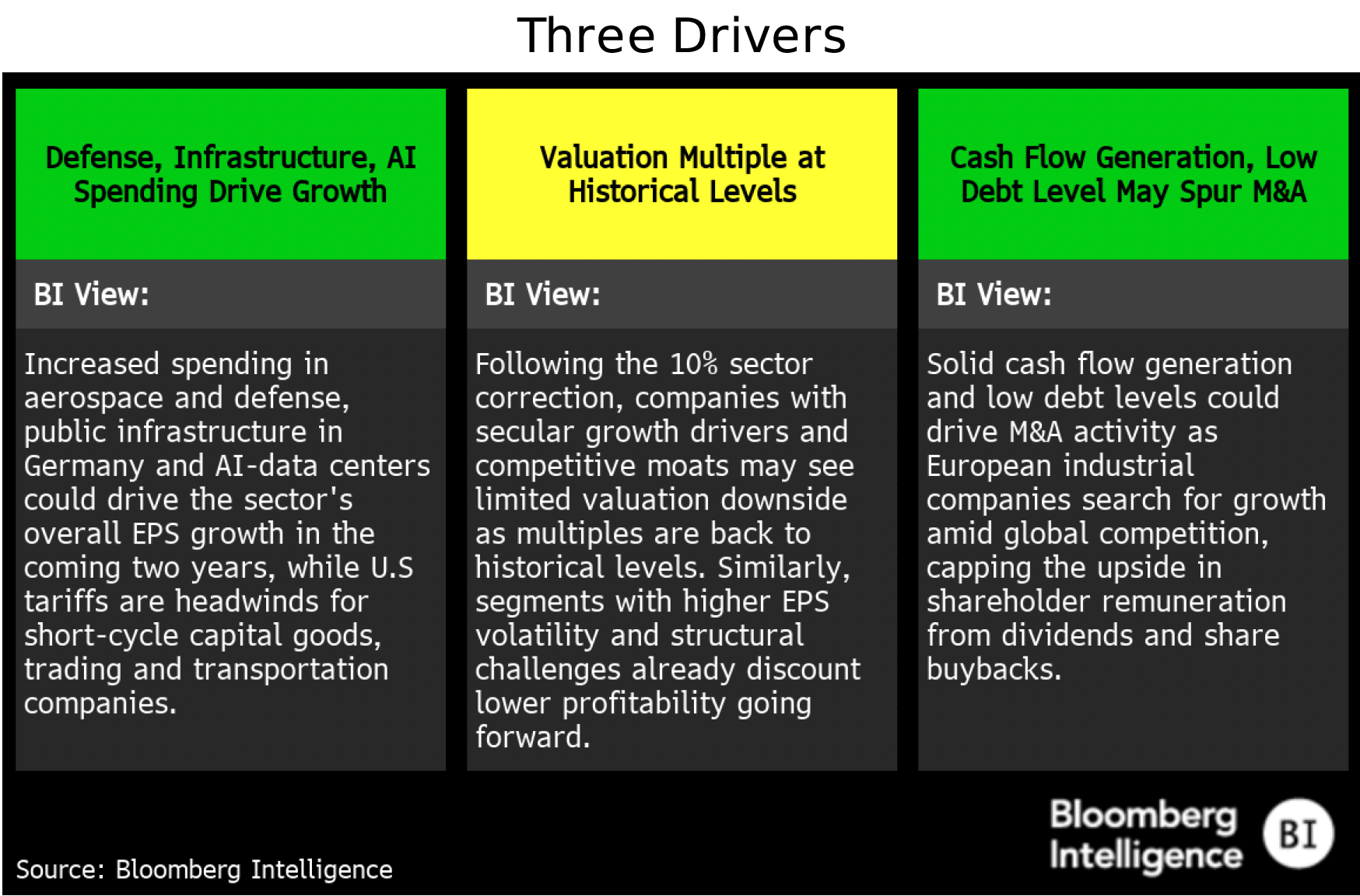

European industrials are poised for one of the highest EPS expansions among peers, with 2024-26 consensus growth of 12.5% propped up by government defense spending, AI data-center rollouts and Germany’s investment inpublic infrastructure. Though US tariffs have lifted earnings volatility in the trading and transportation segments, solid cash generation and low debt leverage could spur M&A activity in aerospace and defense, construction and electrical-equipment. Valuation multiples are back to more normalized levels and structural growth drivers could shield the sector from sharper drawdowns.

Fiscal stimulus pushes aerospace and defense, and machinery, to the top of our industry scorecard, while trading and distributors, and transportation companies ,sit at the bottom as US tariffs weigh on the outlook.

Three keys for European industrials sector

Fiscal Boost Helps EPS Growth

EU industrials EPS to get defense, infrastructure-spending boost

The European industrials sector is set to deliver 12.5% EPS compound annual growth over the next two years with the game-changing rise in defense spending and Germany’s public investments, despite US tariff threats and AI data-center build-out concerns. Solid cash flow and low balance-sheet leverage give bolt-on M&A flexibility and growth scope.

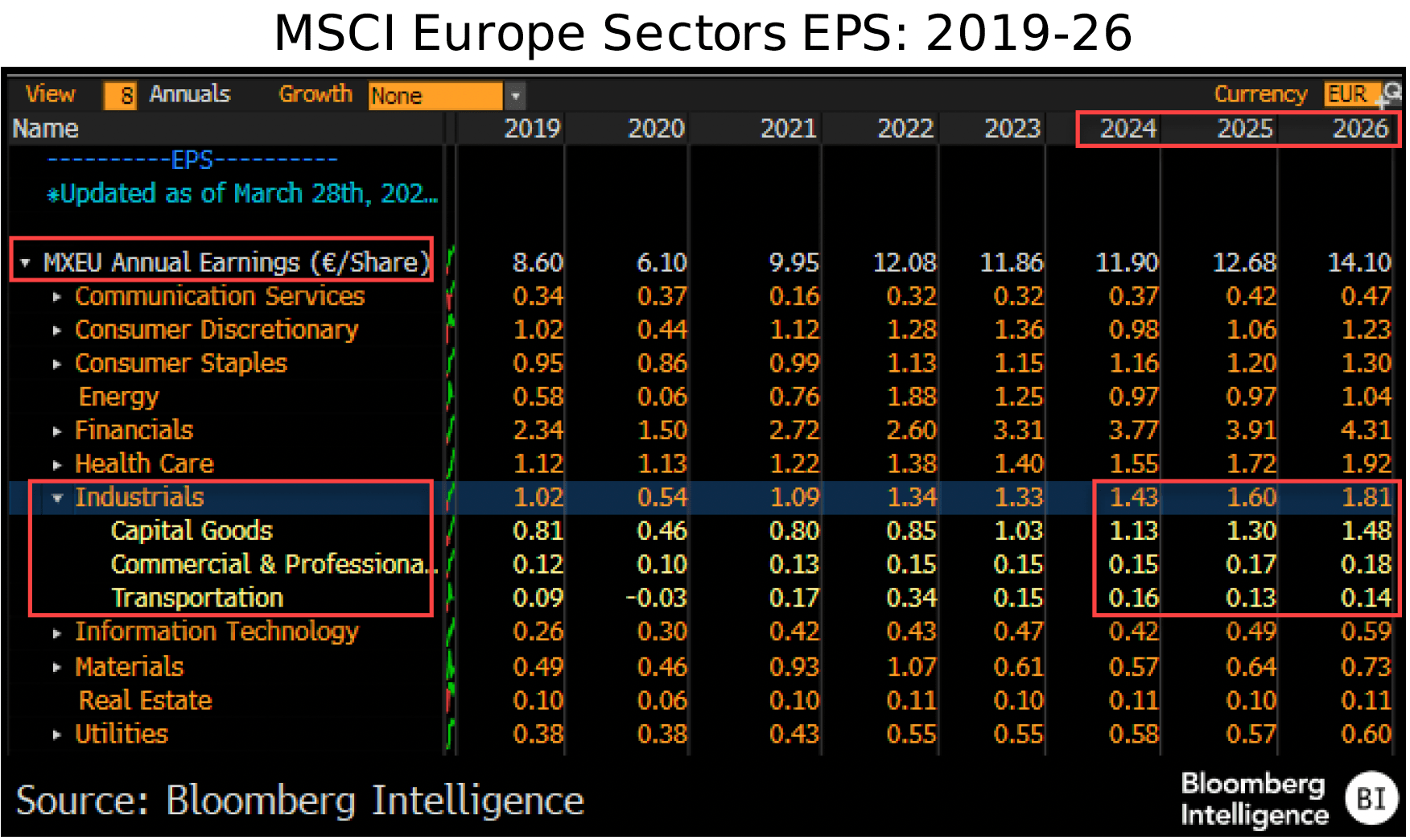

Broad-based EPS growth driven by top-line, margin expansion

Industrials’ EPS growth (12.5%) is expected to be the MSCI Europe Index’s third highest over the next two years, thanks to solid sales growth (6.8% vs. 4% for the benchmark) and 90-bp margin expansion. Greater spending across many segments — including aerospace and defense, AI infrastructure, renewable energy and German public investment — point to double-digit EPS gains for five out of eight of the industries (63% of the companies). In contrast, the transportation industry (EPS CAGR of minus 6%) is set to exert a drag, driven mainly by Maersk.

The sector’s estimated 2025 EPS has fallen slightly (to minus 0.4%) over the past three months mainly on Airbus, Safran, Vestas and ABB, but with more upgrades than downgrades (revision ratio of 6%) while the MSCI Europe’s forecast was cut 1.4% with a revision ratio of minus 6%.

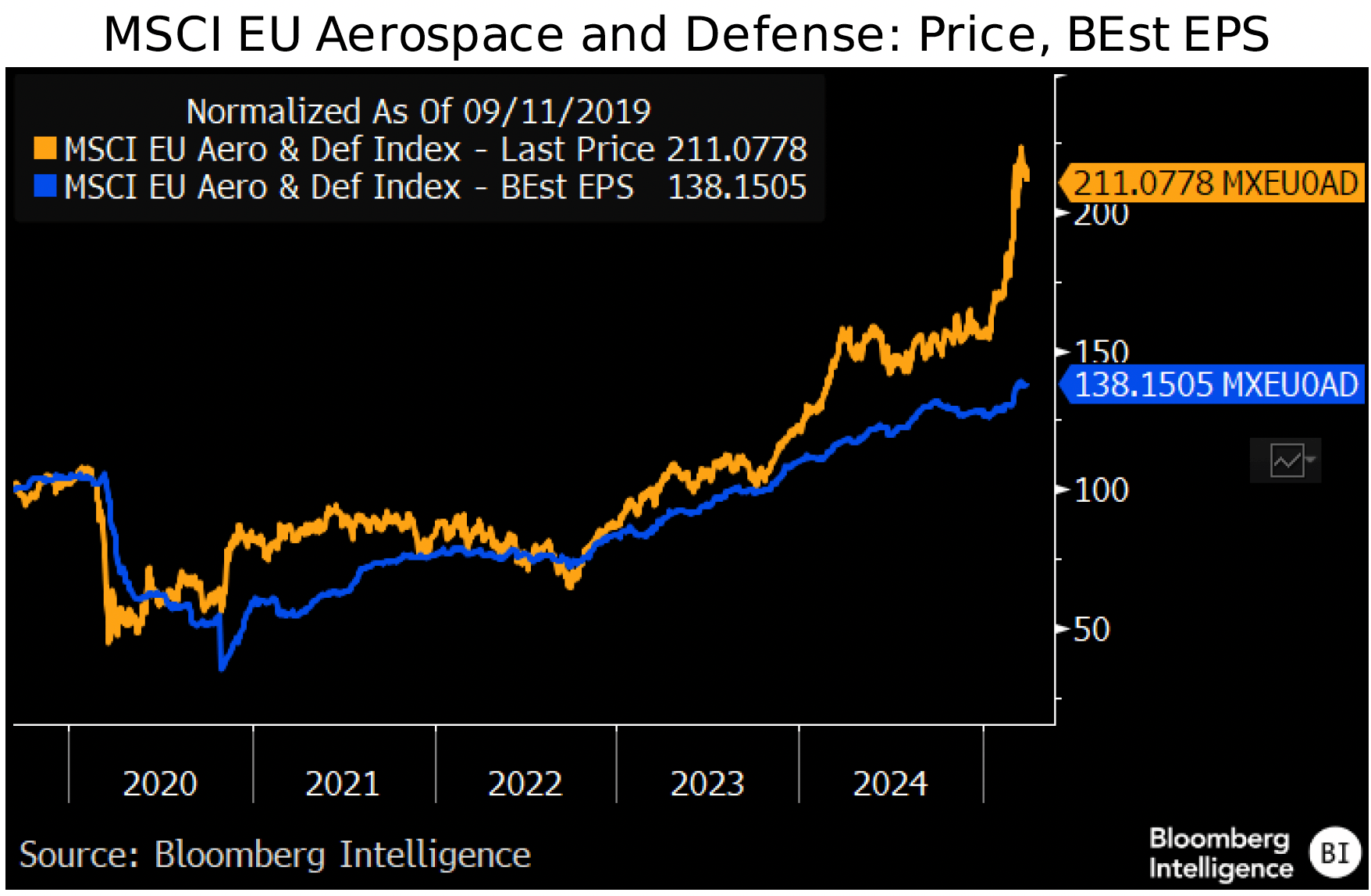

Higher defense spending, air-travel expansion positive

Aerospace and defense remains the primary contributor to industrials’ EPS growth, with all peers — except Thales and Leonardo — expected to deliver double-digit gains over the next two years.Despite budget constraints in countries like France, Italy and Spain, European defense spending could rise to 2.6% of GDP by 2034 vs. 1.8% in 2024, with more spending on European equipment stimulating economic activity and limiting the debt burden as a percentage of GDP, according toBI economists. Assuming 50% of defense spending is on equipment (vs. 37% currently) and half is supplied by European companies (22% today), the boost to the industry group would be significant, with a roughly sixfold increase in the addressable market.

Aerospace and defense have a 25% Industrial index weighting, but make up only 17% of earnings.

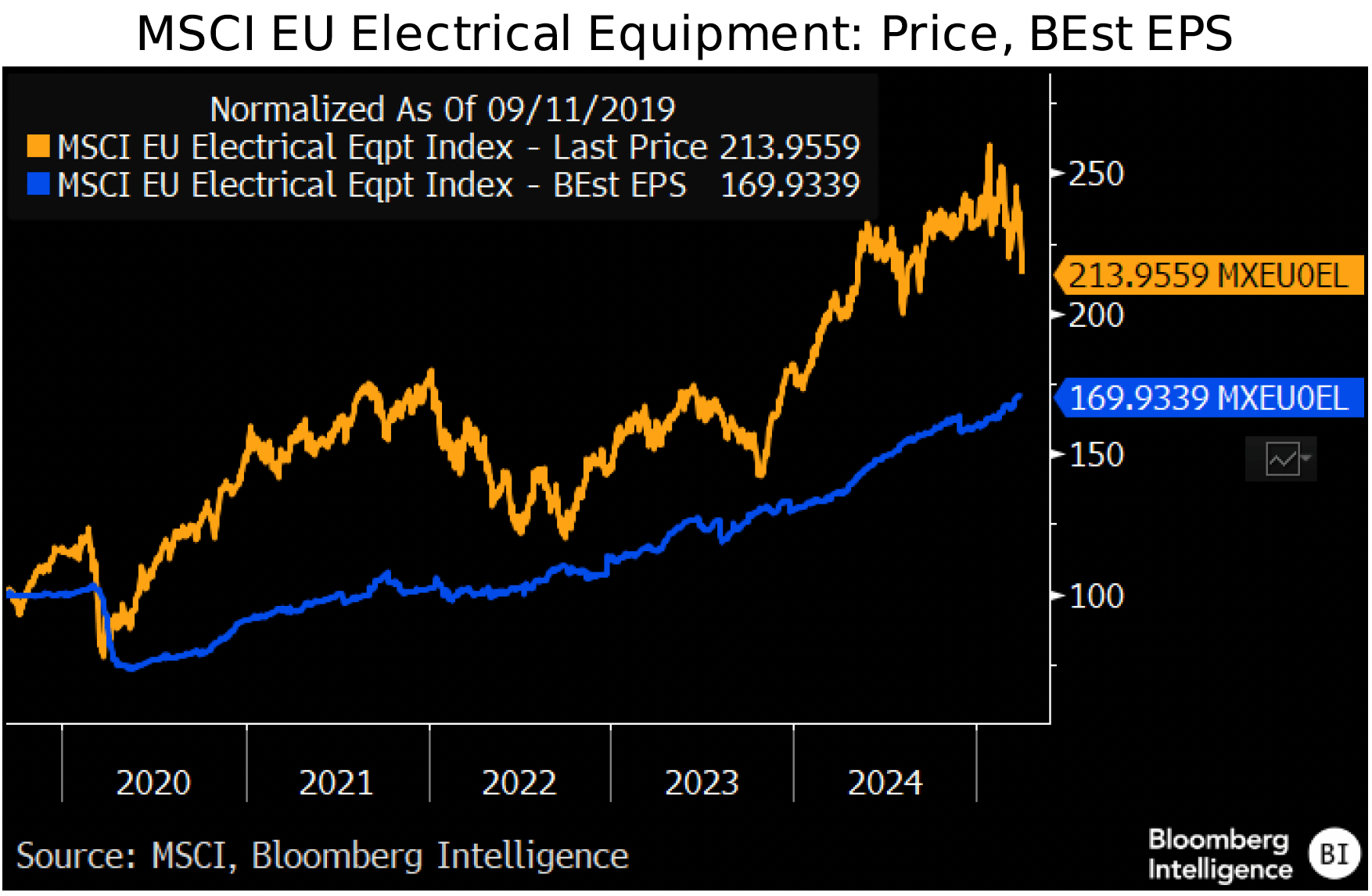

AI, energy security drive electrical-equipment segment

Earnings within Europe’s electrical-equipment segment benefit from two strong growth drivers — the rollout of AI data centers and new energy systems — with consensus calling for compound annual 19% EPS growth over the next two years. Schneider, ABB and Legrand are positioned fora profit boost, with demand for data-center infrastructure set to increase in the double digits over the next five years, based on US technology analysts. Consensus also expects solid sales growth and a major operating-margin improvement at Siemens Energy, Vestas and Prysmian on sustained renewable-energy project investment.

The segment has entered a correction phase, down 18% from the highs in January, after which DeepSeek announced its AI model had obtained a similar performance to Open AI’s at a fraction of the cost.

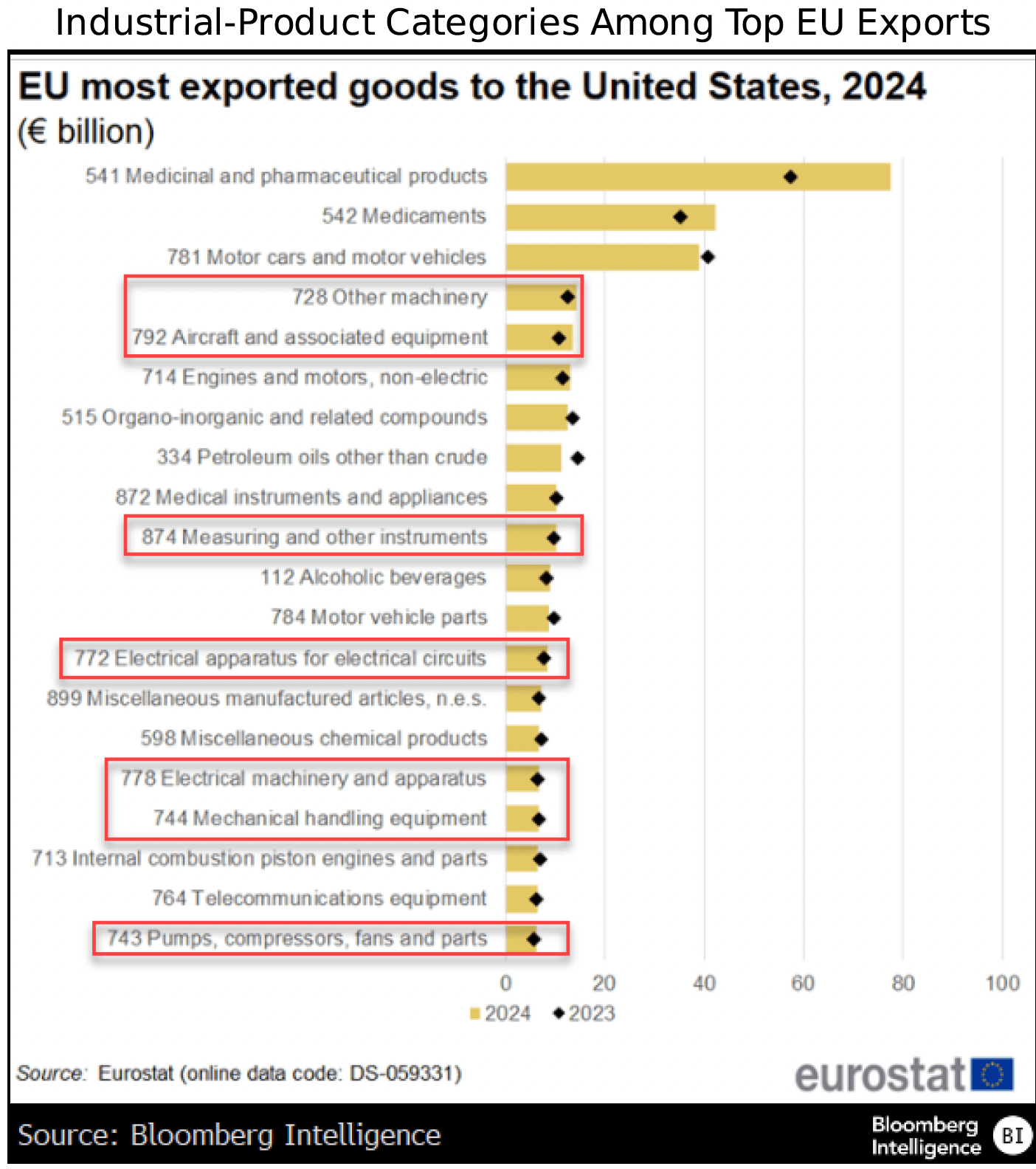

Tariffs appear a manageable threat

The European industrials sector is the second most exposed to the US following health care, and slightly ahead of the automobile segment, but it’s partly insulated due to many companies’ production plants there (Airbus, Siemens, Schneider, Saint Gobain) after numerous acquisitions over the past decade. Schneider, Legrand and Airbus management teams recently commented that their P&Ls could be temporarily affected in the short term, but they don’t view tariffs as strategic threats. That’s because they plan to respond to them via a combination of pricing, supply-chain changes and cost cuts.

Services sales make up an estimated 40% of the sector (with services companies comprising about 25%), while manufacturers’ higher-margin after-sales services account for the rest, mitigating the dent from tariffs imposed on final products.

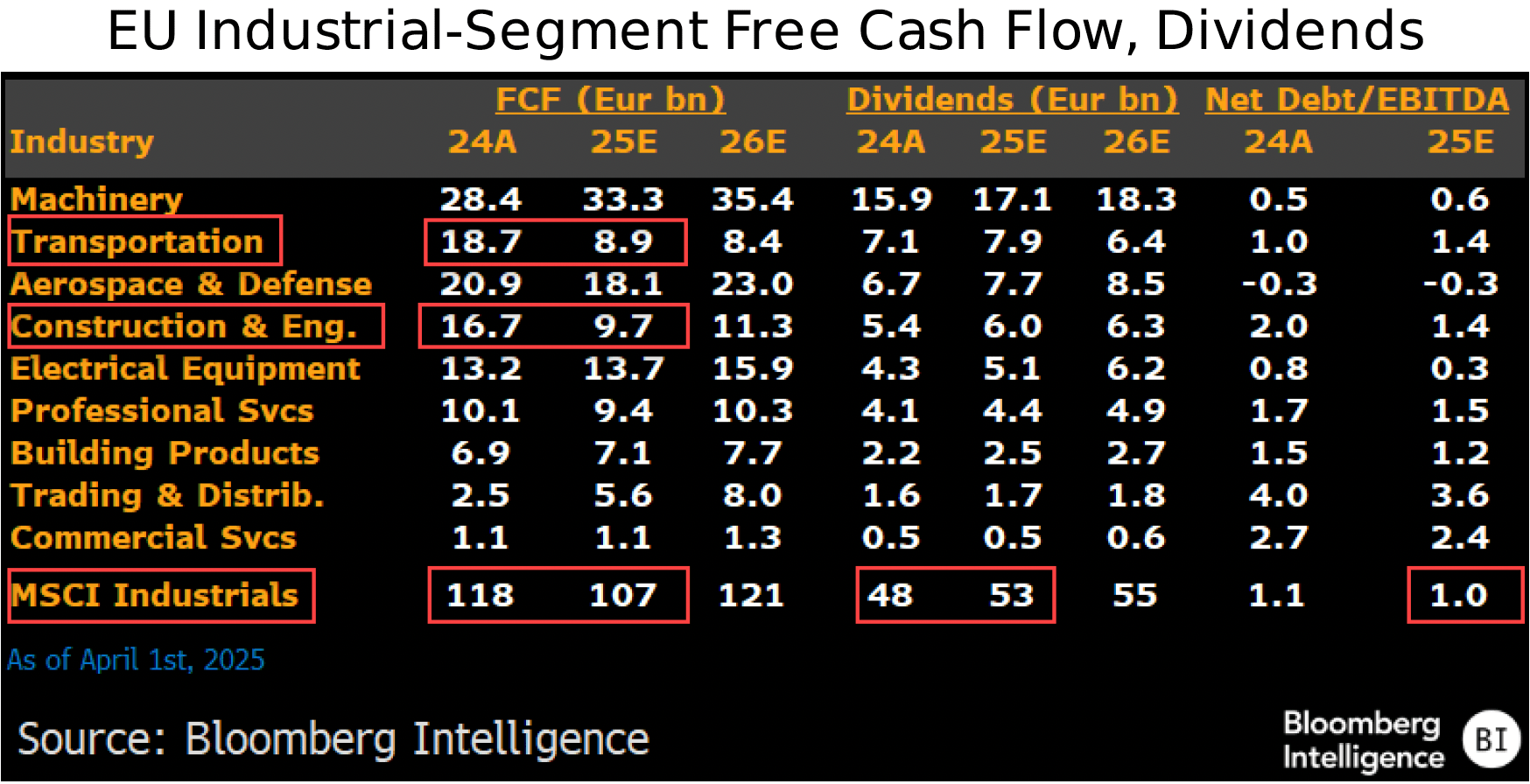

Means to facilitate corporate action

The industrials’ sector net debt-to-Ebitda ratio is expected to fall to 1x this year, its lowest since 2017, allowing for companies to engage in M&A. Given European companies need to reach a critical mass to compete against US and Asian rivals — and be able to capitalize on growth opportunities created by the AI and energy transitions — acquisitions are likely to be the preferred capital-allocation option vs. greater dividend payouts or buybacks.

Dividends are expected to rise 11% this year despite lower free cash flow, driven mainly by transportation and construction, and engineering segments. As a result, the dividend-to-free-cash-flow payout ratio is set to reach 50% vs. 40% last year, but remain below the 2015-19 average of 53%. Buybacks are seen as falling toward €15 billion (down 28% vs. 2024) driven by all segments.

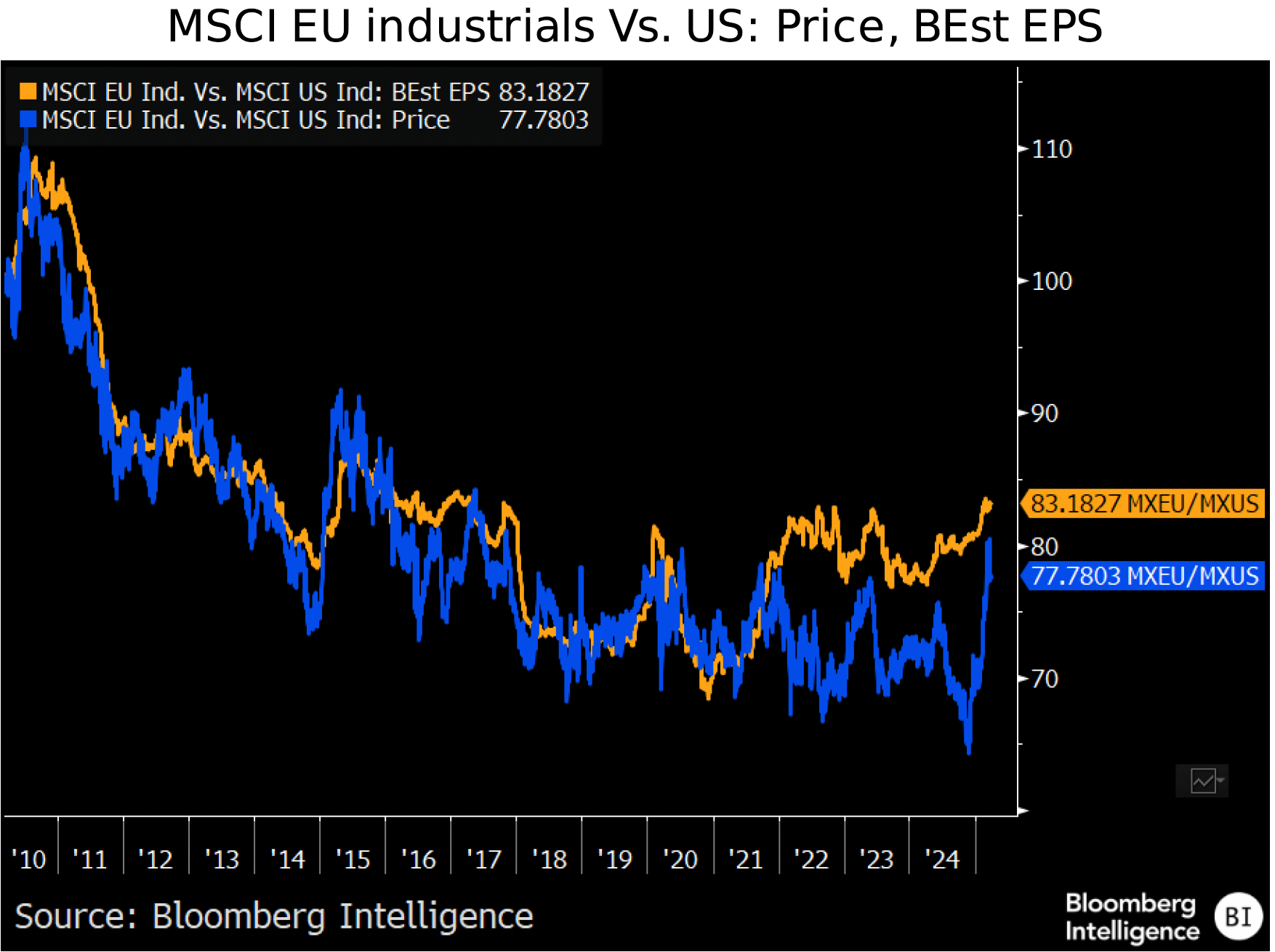

Rally in EU industrials is closing post-covid EPS gap to US

Valuation: Growth vs. tariffs

European industrials’ 12% EPS growth upholds premium valuation

US tariffs have brought European industrials’ valuation back toward the historical average, yet the stronger sector growth and profitability prospects still justify a premium to the broader market. Both growth and value companies in the sector trade at moderate valuation vs. other industries while lower growth, ROE and higher earnings volatility justify lower valuation vs. US peers.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.