Bloomberg Professional Services

Regulatory momentum across the Gulf is moving from rapid framework-building to consolidation and execution, as reforms introduced in recent years are embedded into supervisory practice, enforcement activity and market infrastructure. Regulators are increasingly using rulemaking and supervisory focus to shape market behavior, support institutional investment, and strengthen the resilience of cross-border financial activity.

This shift is evident in the evolution of digital-asset regulation towards fully institutionalized market infrastructure, the growing emphasis on data governance, cyber resilience and open-banking frameworks, and a parallel push to align market standards in support of deeper liquidity, stronger investor confidence and more resilient financial markets.

PRODUCT MENTIONS

Against that backdrop, the key regulatory initiatives and signals cluster around four themes:

- Trading and markets

- Risk, capital, and financial stability

- Digital finance and technology

- Sustainable finance

Markets and trading

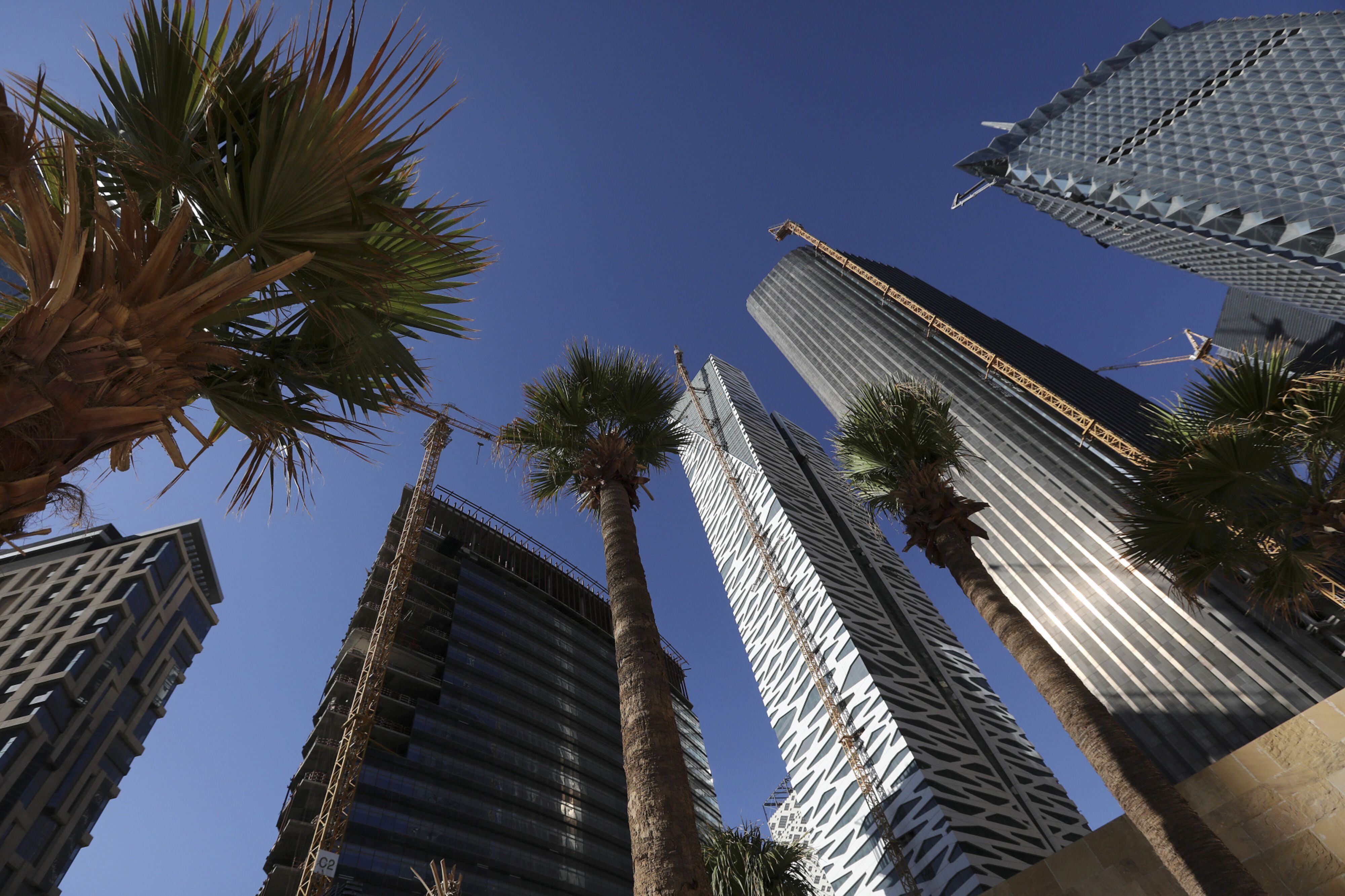

Gulf capital markets have been evolving to reduce execution and access frictions – simplifying rules, improving market infrastructure, and widening participation for both issuers and investors. At the same time, the United Arab Emirates (UAE) and Saudi Arabia are increasingly positioning themselves not just as exporters of capital via sovereign and outbound investment, but as capital importers, using policy and regulatory reforms to attract foreign direct investment and portfolio inflows and to anchor more financial activity onshore.

This shift in mindset is reflected in regulatory frameworks designed by policymakers to reduce ownership restrictions, streamline market access, and attract foreign capital into domestic markets.

Listing regime reform

In Saudi Arabia, reforms to foreign ownership and investor access have been pursued against a backdrop of comparatively lagging exchange performance, with regulators seeking to address liquidity, valuation depth, and international participation. The Saudi Exchange (Tadawul) published guidelines for the offering and listing of foreign companies, clarifying the criteria for cross-border, dual and incorporation-based listings.

The Saudi Capital Markets Authority (CMA) also published a consultation on broadening the investor base by removing the Qualified Investor Regime (QFI) in the Main Market, therefore allowing foreign investors to access the markets without special qualifications.

These reforms aim to broaden the capital pool and boost overall capital market participation. In 2026, attention is likely to shift from access reform to ownership reform, specifically whether Saudi Arabia moves to loosen the 49% aggregate foreign ownership cap that still applies to most listed companies.

International investor reform

In the UAE, capital markets are already accessible by foreigners and ownership frameworks are highly streamlined within freezones, namely the Abu Dhabi Global Market’s Financial Services Regulatory Authority (ADGM FSRA) and the Dubai International Financial Centre (DIFC). Nevertheless, government and regulators are still focused on inward investment.

Recently, the ADGM reaffirmed and enhanced alignment with International Organization of Securities Commissions (IOSCO) principles on securities regulations, reinforcing investor confidence and demonstrating commitment to international best practices, as part of broader reforms to strengthen transparency, governance, and market integrity.

Looking ahead to 2026, regulatory and market initiatives across the Gulf are focused on improving liquidity and market access by reducing structural barriers to intra-regional trading. Efforts to enhance financial market integration within the GCC are aimed at supporting more interconnected markets and facilitating cross-border investment, though progress remains incremental and uneven across markets.

Risk, capital, and financial stability

Basel III and prudential resilience

Gulf regulators continue to advance a more resilient and outcomes-focused prudential agenda, aligned with global regulatory priorities. A central theme remains continued alignment with Basel III, with supervisors maintaining close attention on capital adequacy, buffer calibration, and the quality of risk management frameworks across banking and insurance sectors.

Prudential policy across the region is tightening around firm resilience, with increasing emphasis on capital strength, governance credibility, and robust financial crime controls, that can be expected to continue into 2026.

Governance and transparency

Regulators are sharpening expectations around governance and transparency in ownership structures. In Saudi Arabia, updated corporate rules now require the identification and reporting of ultimate beneficial owners (UBOs) for shareholders owning 25% or more of shares or voting rights.

This enhances regulators’ ability to assess control, reduce the risk of hidden influence or financial crime, and strengthen accountability. In 2026, beneficial ownership information is likely to be used more actively in supervisory reviews, licensing decisions, and enforcement activity, rather than serving solely as a disclosure requirement.

Financial crime and enforcement

Across the region, supervisors are increasing enforcement activity, signalling that expectations are shifting from framework design to outcomes and accountability. Firms are increasingly expected to evidence how controls operate in practice to supervisors.

In the UAE, the introduction of the Unified Financial Sector Law (Federal Decree-Law No. 6 of 2025) signals a further step toward integrated financial oversight of the sector. In parallel, the new Anti-Money Laundering, Counter-Terrorist Financing and Counter-Proliferation Financing Law (Federal Decree-Law No. 10 of 2025) reflects the continued hardening of the region’s financial crime perimeter.

Over the year ahead, firms should expect closer supervisory engagement, continued tightening of AML and counter-terrorist financing requirements, and a greater emphasis on macro-prudential oversight and more sophisticated stress-testing. Preparation for 2026 will increasingly centre on evidencing operational effectiveness and supervisory readiness, rather than further rule interpretation.

Digital finance and technology

With technology reshaping business models and financial services, the Gulf is taking an open yet controlled approach to foster innovation. Gulf regulators and governments have been ambitious adopters of emerging technologies, developing frameworks that accommodate digital assets, AI, and stablecoins, while promoting innovation through initiatives such as sandboxes.

Artificial Intelligence

The UAE remains at the forefront of AI development and digital finance. In December 2025, the ADGM granted Binance a broad set of licenses covering regulated activities within ADGM. This marks a major step in formalizing digital asset markets in the UAE.

AI adoption in the DIFC has surged. According to DFSA research, AI use nearly tripled over the previous year, and the majority of firms are planning greater AI adoption over the next 12 months. However, governance practices are still maturing.

A Dubai Financial Services Authority (DFSA) report on the integration in the DIFC highlighted that regulatory uncertainty remains the main concern for firms, and firms are calling for clearer regulatory guidance on AI oversight, ethical use and accountability – highlighting a key area for regulatory focus in the year ahead.

Forthcoming guidance and clarity from regulators will be helpful in supporting safe and responsible AI adoption for firms.

Cyber resilience

Kuwait has recently enacted a landmark reform of its cyber resilience framework, with the Central Bank of Kuwait (CBK) publishing its new Cyber and Operational Resilience Framework (CORF), replacing the 2020 Cybersecurity Framework.

The CORF unifies the regime for all CBK regulated entities, introducing cyber and operational resilience baselines and a new Cyber and Operational Resilience Working Group (CORWG) with mandatory participation for all CBK regulated entities.

Kuwait’s CORF marks a regional pivot from basic cybersecurity to holistic operational resilience, with mandatory collaboration and sector-wide baselines across the financial sector. Similar operational resilience themes are expected to gain prominence across the region in 2026, with regulators increasingly assessing sector-wide dependencies, third-party risk and incident response capabilities, rather than standalone cybersecurity controls.

Sustainable finance

Sustainability regulation across the Gulf is becoming more formalised and operational, moving beyond policy ambition to tangible requirements including listing standards, disclosure rules, and prudential supervision.

ESG disclosures

Regulators across the GCC are placing greater emphasis on the consistency and credibility of ESG information provided to investors. While adoption remains uneven across the region, several jurisdictions, including the UAE, Qatar and Oman, have moved more quickly to formalise ESG disclosure frameworks.

In Qatar, the Qatar Financial Centre Regulatory Authority (QFCRA) issued the GENE (Governance, Environment, Nature and Economy) Corporate Sustainability Reporting Rules 2025, strengthening sustainability reporting requirements for in-scope entities. Firms operating within the Qatar Financial Centre are expected to provide more consistent and comparable ESG information to support investor decision-making.

Oman has also transitioned to mandatory ESG disclosure, with requirements issued jointly by the Financial Services Authority and the Muscat Stock Exchange in June 2025, marking a shift from voluntary guidance to enforceable obligations.

ESG disclosures are becoming mandatory across several Gulf jurisdictions, with Saudi Arabia remaining an exception where reporting is largely voluntary. Expectations around ESG disclosure and governance are also being reinforced through listing standards, including the introduction of unified investor relations guidelines in 2025, which place greater emphasis on ESG communication by listed companies.

These developments reflect a broader regional effort to improve the decision-usefulness of sustainability information and align disclosures with international standards.

Climate risk

Across the Gulf, climate considerations are increasingly being integrated into mainstream supervision. In line with global regulatory trends, authorities are placing greater emphasis on climate risk governance, the quality and reliability of ESG data, and the role of transition finance.

For firms and investors, this signals a shift towards closer supervisory scrutiny of how climate and ESG considerations are embedded into governance, risk management and operational practices.

In the UAE, green finance regulation extends beyond disclosure into risk management and economy-wide obligations. The UAE Central Bank’s Climate-related Financial Risk Management Regulation places climate risk squarely within supervisory expectations for financial institutions.

In parallel, the UAE Climate Law, issued in August 2024 and effective from May 2025, requires all UAE entities, including those operating in free zones, to measure, report and progressively reduce greenhouse gas emissions, with full compliance required by 30 May 2026.