Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Andrew John Stevenson. It appeared first on the Bloomberg Terminal.

US stocks focused on meeting the challenges of the more-than $500 billion climate economy have grown 19.7% in 2024, topping the S&P 500 (up 17.7%), and this may continue following a record 1H for catastrophe-related losses. Companies like Waste Management and Tetra Tech, part of BI’s Prepare and Repair theme group, have also beaten the S&P 500 by 7.5 percentage points annually over the past five years.

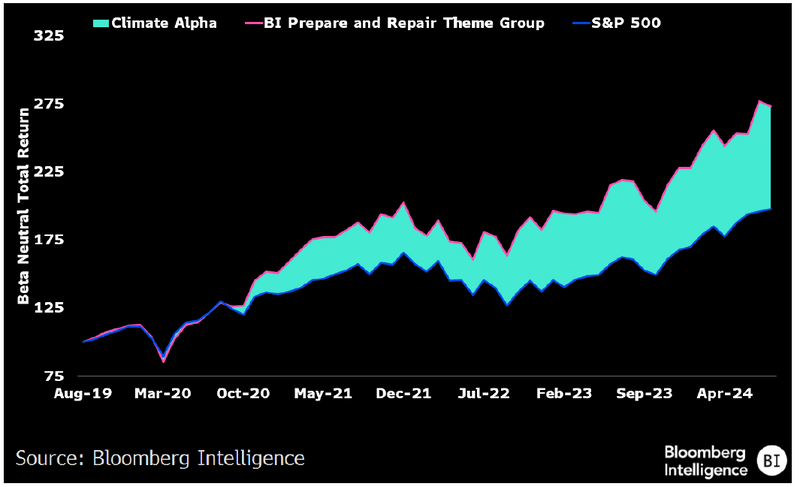

Prepare and Repair returns top S&P’s this year

Companies in BI’s Prepare and Repair theme group, such as Republic Services, U-Haul and W.W. Grainger — focused on meeting different needs of the $500 billion-plus US climate economy — have on an equal-weight, beta-neutral basis continued to best the market-cap-weighted S&P 500 this year through Aug. 19. The 82 US-focused large- and medium-cap stocks have also exceeded the performance of the S&P by an average of 7.5 percentage points annually over the past five years (22.25% vs. 14.75%), as spending on insurance premiums, climate infrastructure and disaster recovery has remained elevated.

Return of BI Prepare and Repair Theme vs. S&P 500

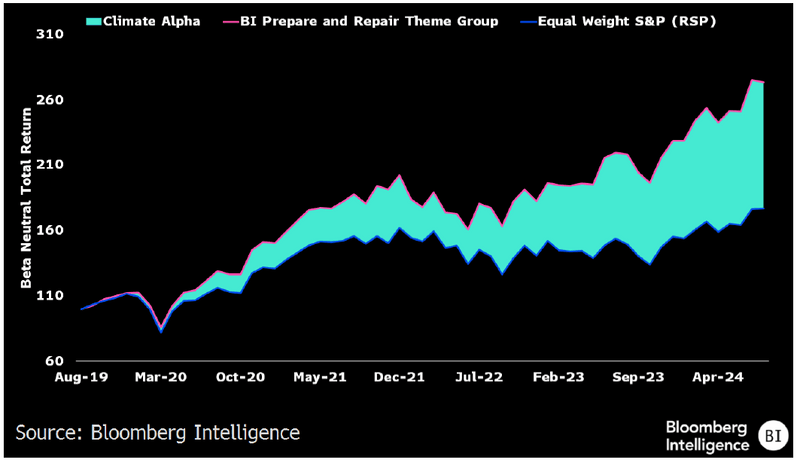

Prepare and Repair bests equal-weight S&P by 10% annually

The equal-weight BI Prepare and Repair theme group has also performed well against the equal-weight version of the S&P 500 (RSP), outperforming the benchmark by 10 percentage points annually (22.25% vs. 12.25%) over the past five years on a beta-adjusted basis. For investors, the equal-weight comparison may be more relevant, given the heavy market-cap-weight bias of the S&P 500 in recent years.

BI Prepare and Repair vs. S&P 500 Equal Weight

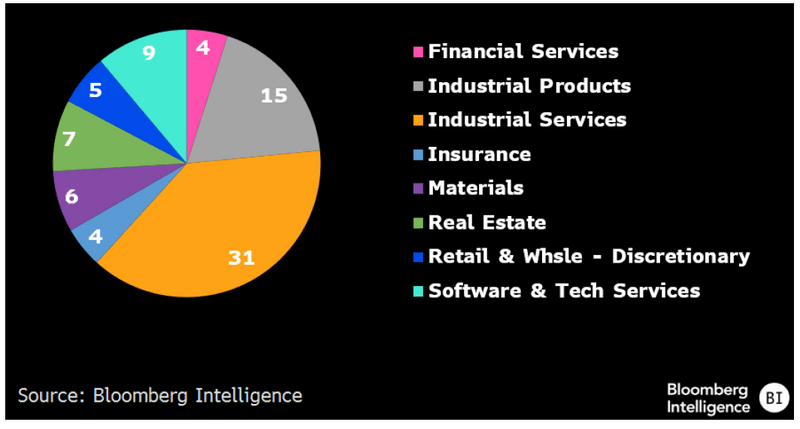

What sectors comprise Prepare and Repair theme?

Our Prepare and Repair theme group is made up of companies from eight different sectors providing goods and services to numerous aspects of the climate economy. They vary from industrial service companies like Primoris, which provides maintenance and engineering to utilities and municipalities, to building-materials companies like James Hardie Industrials and Advanced Drainage Systems, to insurance brokers like Brown & Brown and Arthur J. Gallagher. The group is fairly diversified and tends to have an average beta below 1.

BI Repair and Prepare Group by Sector

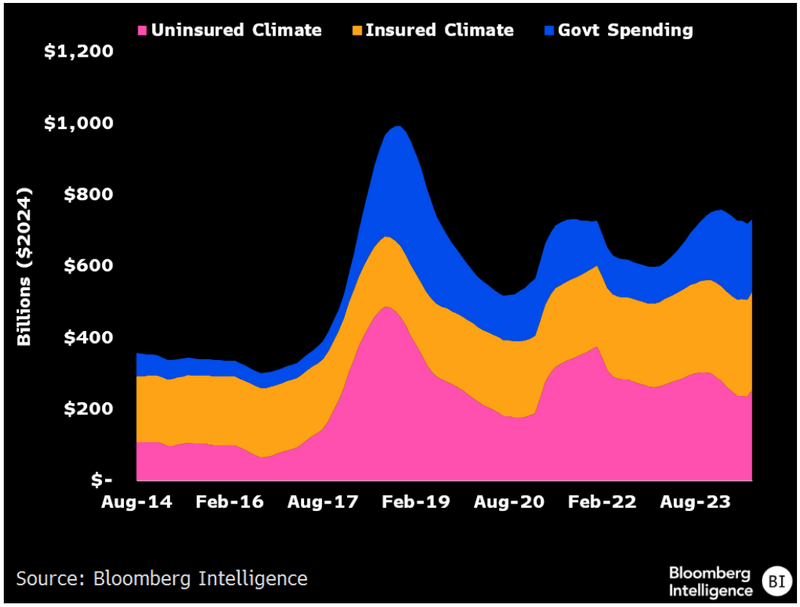

US impacts top $700 billion on record 1H losses

According to the BI Climate Tracker, US climate-related impacts reached $730 billion on a one-month rolling basis in July. These impacts include uninsured losses (construction inflation, damages and power outages), insured losses (net insurance premiums paid plus insured damages) and government spending (local and federal climate-related spending). Though these economic headwinds nearly reached $1 trillion after a very active 2018 hurricane season, they remain a significant wealth transfer within the economy today, accounting for around 3% of US GDP.

These costs include a record $60 billion in damages related to severe storms in 1H of this year as well spending on insurance premiums ($205 billion), government outlays including the IRA and Infrastructure bills ($188 billion) and other climate-related costs.

US Climate Impact Costs by Type

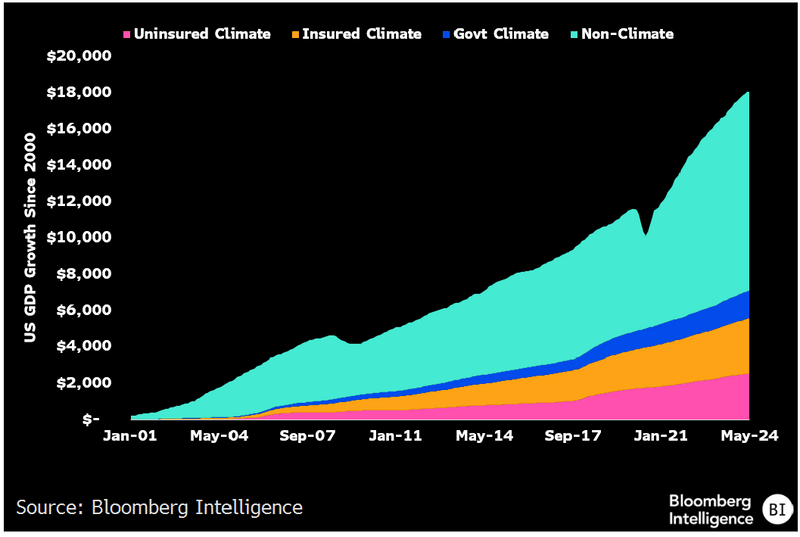

Climate economy a growing portion of US GDP

US spending on climate-related insurance premiums, infrastructure and disaster recovery has grown by $7.2 trillion this century, according to BI’s Climate Tracker, with half of that in the past seven years. The total since 2000 represents 40% of US GDP growth and makes climate one of the fastest-growing sectors in the economy. For example, utility PG&E has spent as much as $30 billion to bury its power lines.

Sources of climate spending include insured climate (insurance losses and premiums), uninsured climate (uninsured losses and climate-driven construction inflation) and government climate (state and local climate aid, annual federal climate related spending and IRA climate spending).

US GDP Growth by Type Since 2000

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.