ARTICLE

Power shift: Should investors pay attention to renewable energy adoption?

Bloomberg Professional Services

This article was written by Edo Schets, Head of Climate & Nature Solutions, Rohit Seksaria, Head of Climate Transition Solutions, and Michael Zhang, Senior Quantitative Researcher at Bloomberg

Renewable energy usage and investment has been steadily growing, with financing hitting a record $2.1 trillion in 2024, up from $1.88 trillion in 2023, according to BNEF’s Energy Transition Investment Trends 2025. Data compiled by Bloomberg suggests this is a structural long-term shift, underpinned by the need for energy security, efficiency, and affordability.

As renewables become a strategic consideration for businesses, we analyzed how companies transitioning to renewable energy perform compared to others, and uncovered signs that renewable adoption translates into performance gains for those making the switch.

A structural long-term shift

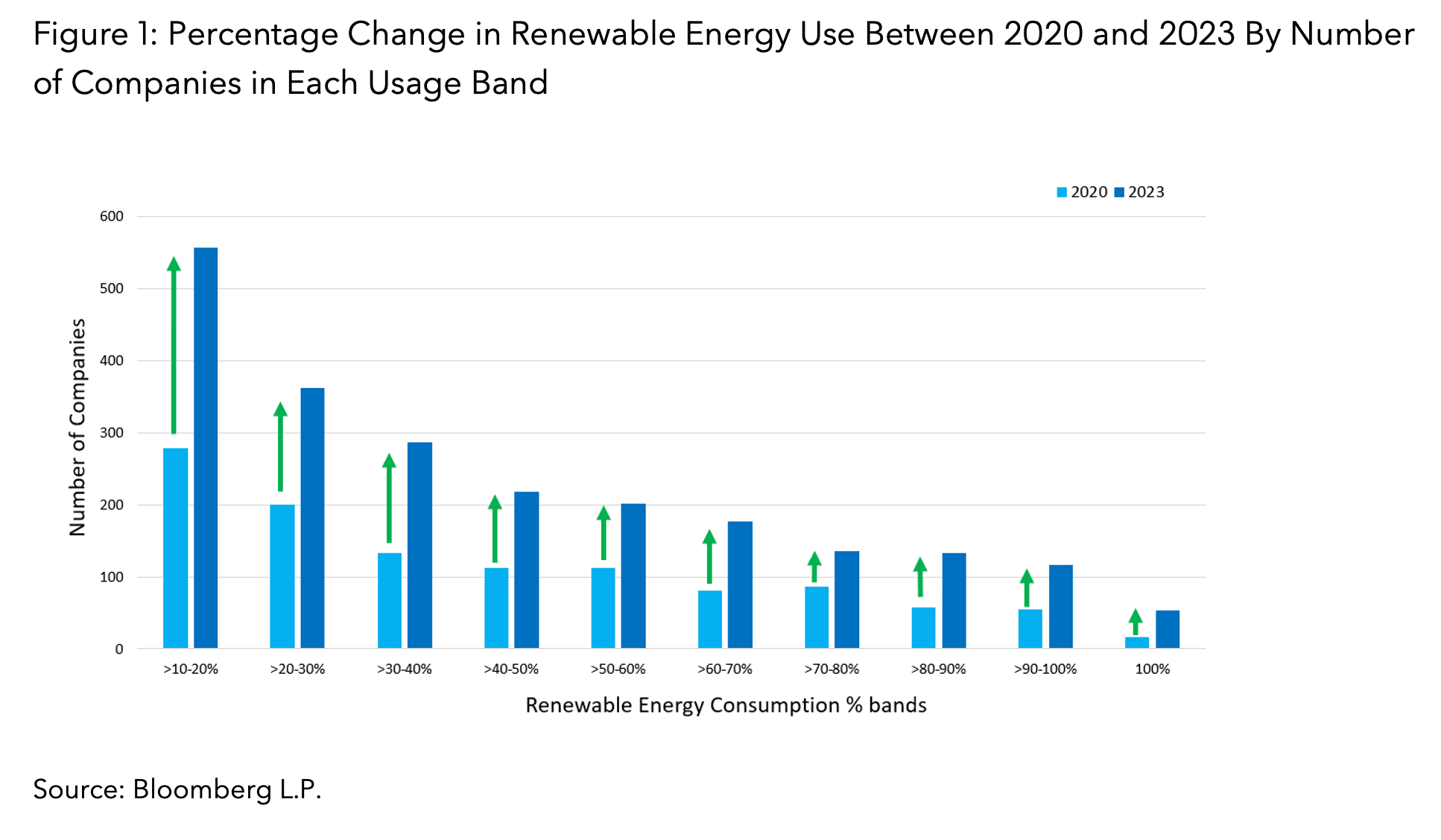

In 2023, 4,166 listed large and mid-cap companies reported using renewable energy, a 72% increase in just 3 years. With a combined market cap of $73 trillion, these companies account for about half the global total of $151 trillion as of June 6, 2025. Over 2,300 companies also increased their renewable energy use from 2022 to 2023 alone. This dramatic rise in adoption spans nearly all sectors, including industrials, materials, healthcare, consumer staples, technology, financials, and real estate.

Companies are also increasingly investing in building their own renewable energy infrastructure. This move from operating expenditure to capital expenditure suggests a deeper pivot from short-term procurement to long-term energy resilience.

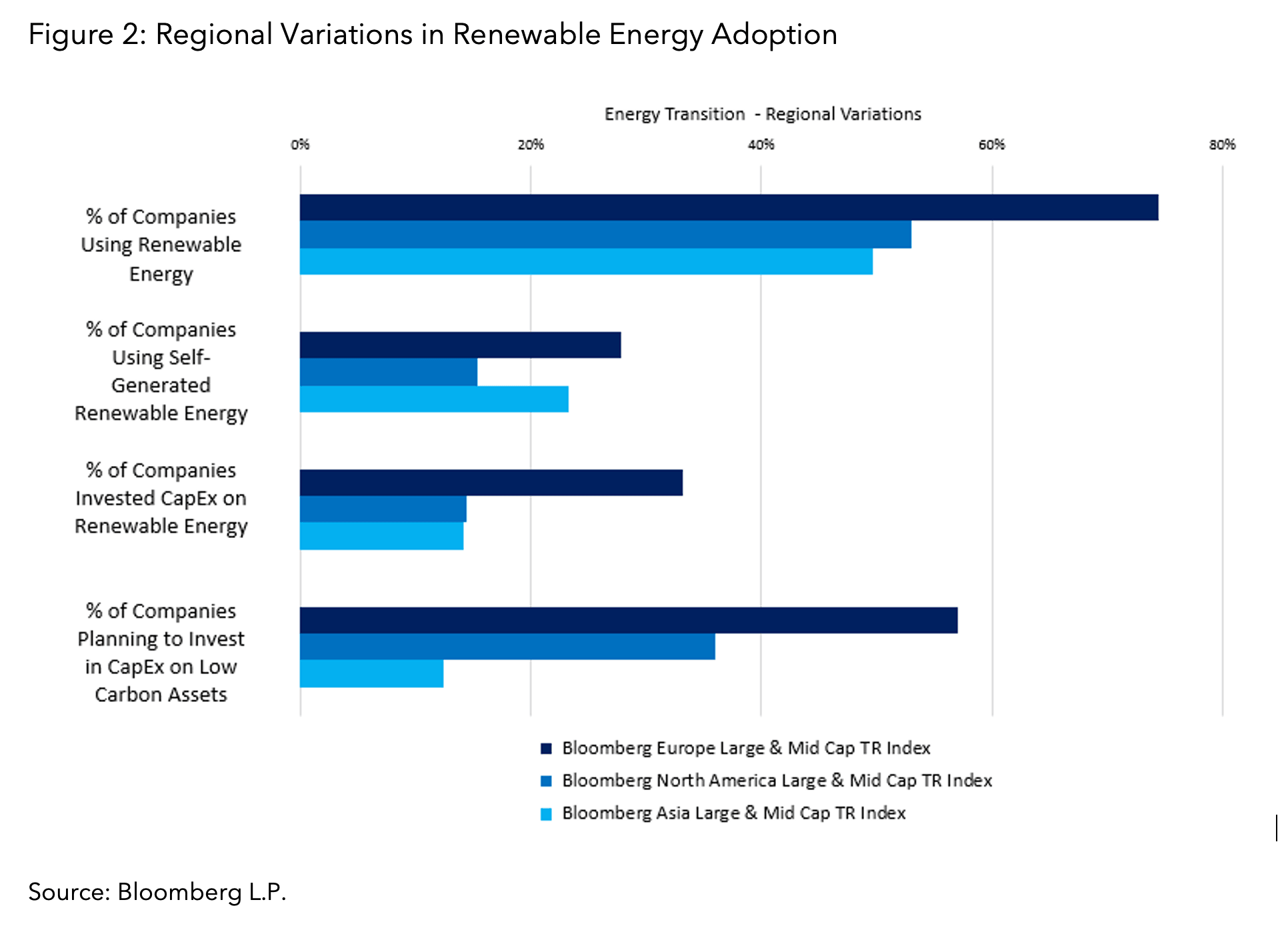

It’s a geographic shift too, as companies rethink their footprints to align with cleaner energy access. A recent global survey of over 1,500 business leaders showed that over half of respondents are planning to relocate operations to access renewable energy within the next five years.

While the growth of renewable energy is happening globally, its progress is uneven. As of 2023, European companies are leading in renewable usage, self-generation and capital investment, followed by North America and Asia.

Financial performance and renewable energy adoption

When renewable energy costs become competitive with or lower than traditional fossil fuel alternatives, transitioning to renewables can directly lead to cost savings and therefore enhance corporate profitability. However, a critical consideration for investors is whether companies adopting renewable energy realize measurable improvements in financial performance, and whether these improvements are reflected in stock valuations.

To investigate this, we analyzed companies within the Bloomberg World Large & Mid Cap Index (Bloomberg ticker: “WORLD Index”), a broadly diversified, float market-cap-weighted global equity benchmark index representing approximately 85% of global market capitalization of the measured markets. In aggregate, Bloomberg’s sustainable finance data covers about 97% of the index’s constituents and 99% of its market value as of December 2024. In particular, the analysis employs the Bloomberg field “Percentage of Renewable Energy Consumed” (Field Id: SA011) as the primary determining factor. Companies lacking data on renewable energy consumption were excluded to maintain analysis integrity.

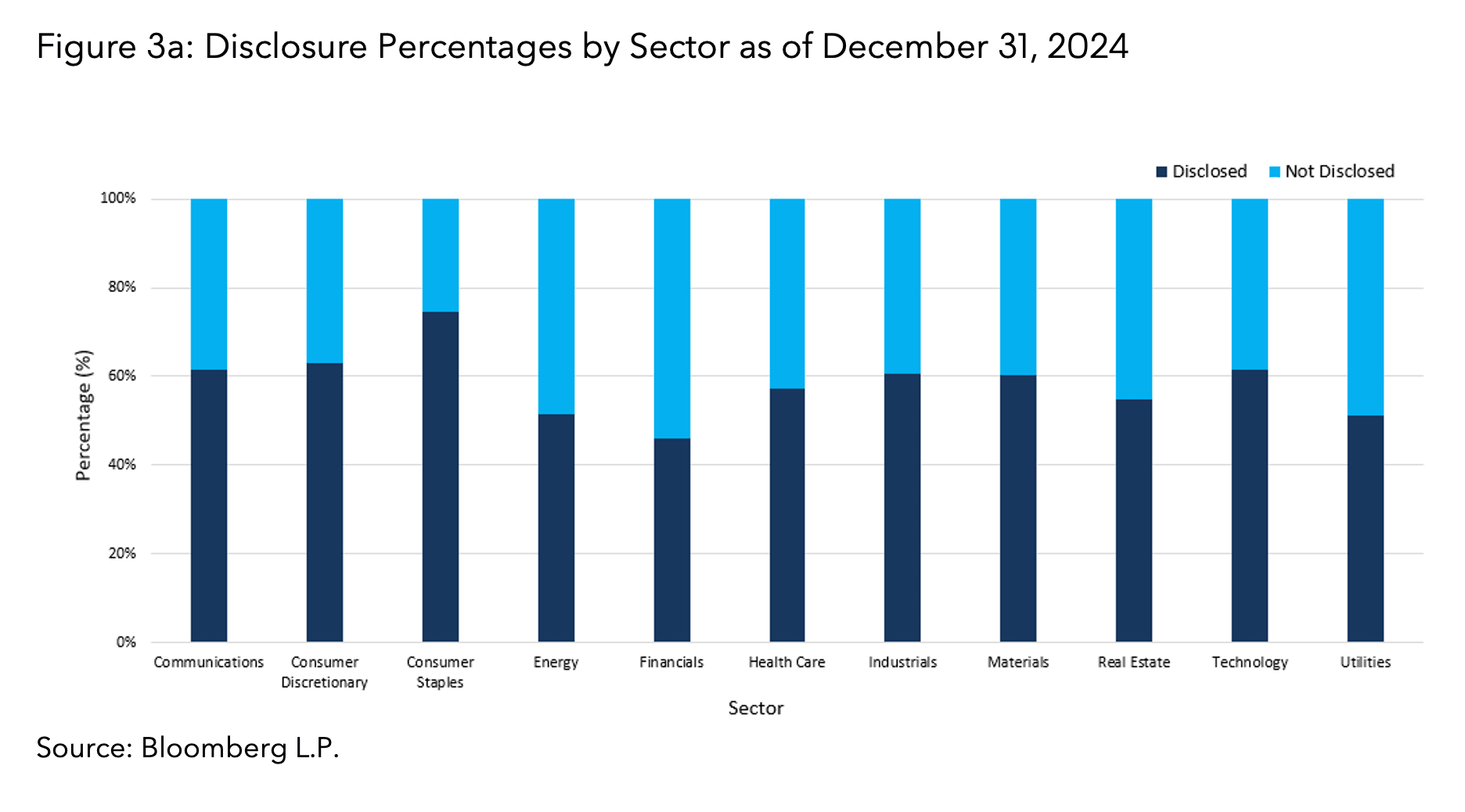

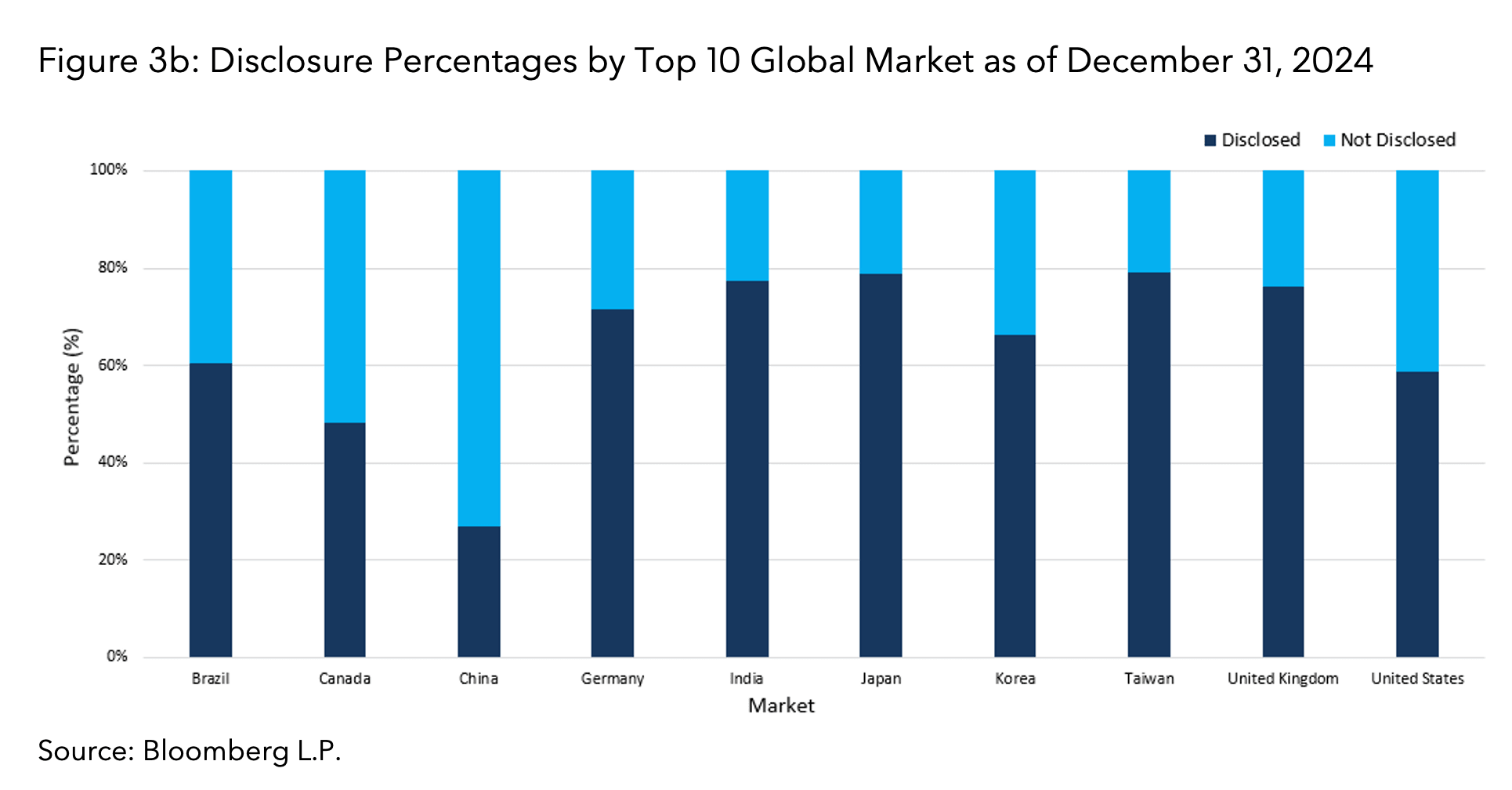

Disclosure rates for renewable energy use vary moderately across sectors and geographic markets. Figures 3a and 3b illustrate that most sectors disclose at rates between 50% and 80%, with Consumer Staples (74.5%), Consumer Discretionary (63.0%), and Communications (62.1%) leading. Geographically, developed markets generally exhibit strong disclosure rates, whereas certain emerging markets show significantly lower levels. While these variations introduce variability in data availability, the disclosure patterns do not indicate extreme biases toward specific sectors or regions, thereby providing a reasonably balanced dataset for subsequent analysis.

We conducted a sector-neutral analysis by sorting companies with available data on a quarterly basis into quintile portfolios based on renewable energy consumption, employing the following methodology:

- Sector-specific stock selection: Within each sector, companies were ranked and assigned to quintiles based on their percentage of renewable energy usage.

- Sector weight matching: Portfolios were rebalanced quarterly to match benchmark sector weights, eliminating sector-driven biases.

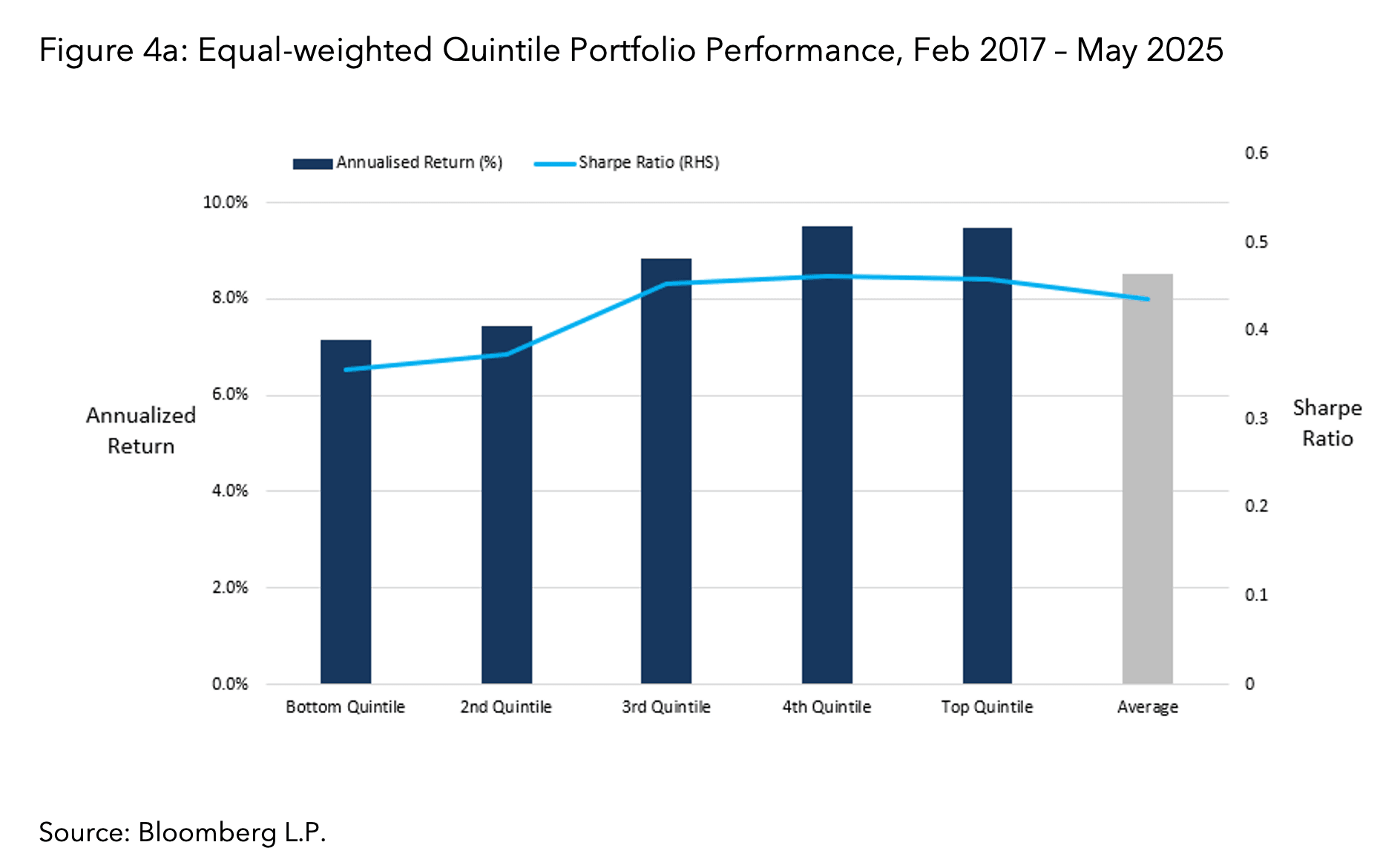

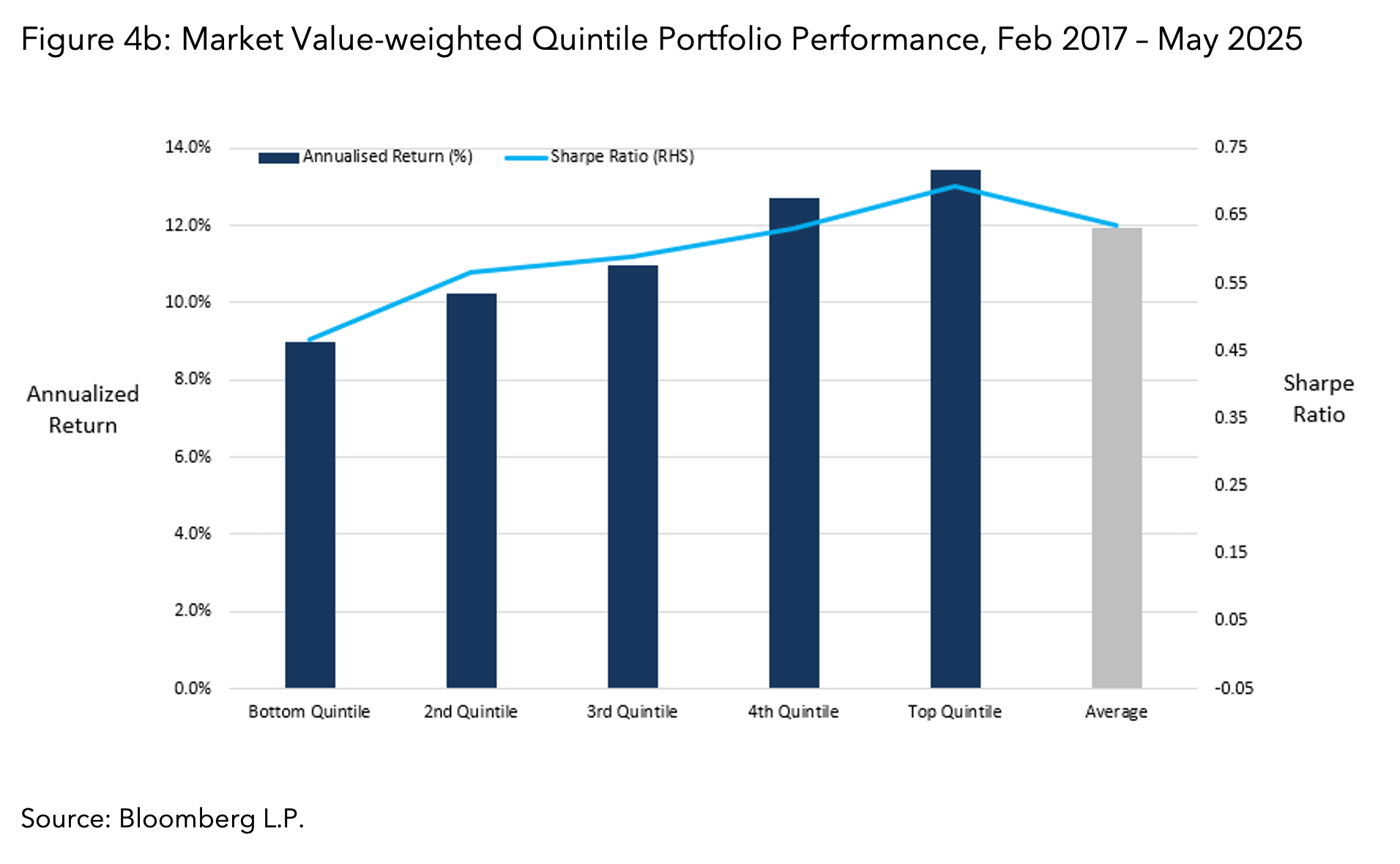

Figures 4a and 4b summarize performance outcomes for equal-weighted and market value-weighted quintile portfolios from February 2017 to May 2025.

Key findings

The analysis reveals a distinct pattern: companies in the highest quintile for renewable energy consumption achieved higher returns and superior Sharpe ratios (which measures risk-adjusted returns) compared to companies in the lowest quintile. Notably, this outcome persists across both equal-weighted and market value-weighted methodologies, indicating that performance differences are not driven purely by company size.

However, the observed outperformance did not reach conventional levels of statistical significance. This may be due to the limited historical period and moderate magnitude of the observed differences. Additionally, uneven disclosure rates and resulting data gaps could also have influenced these results.

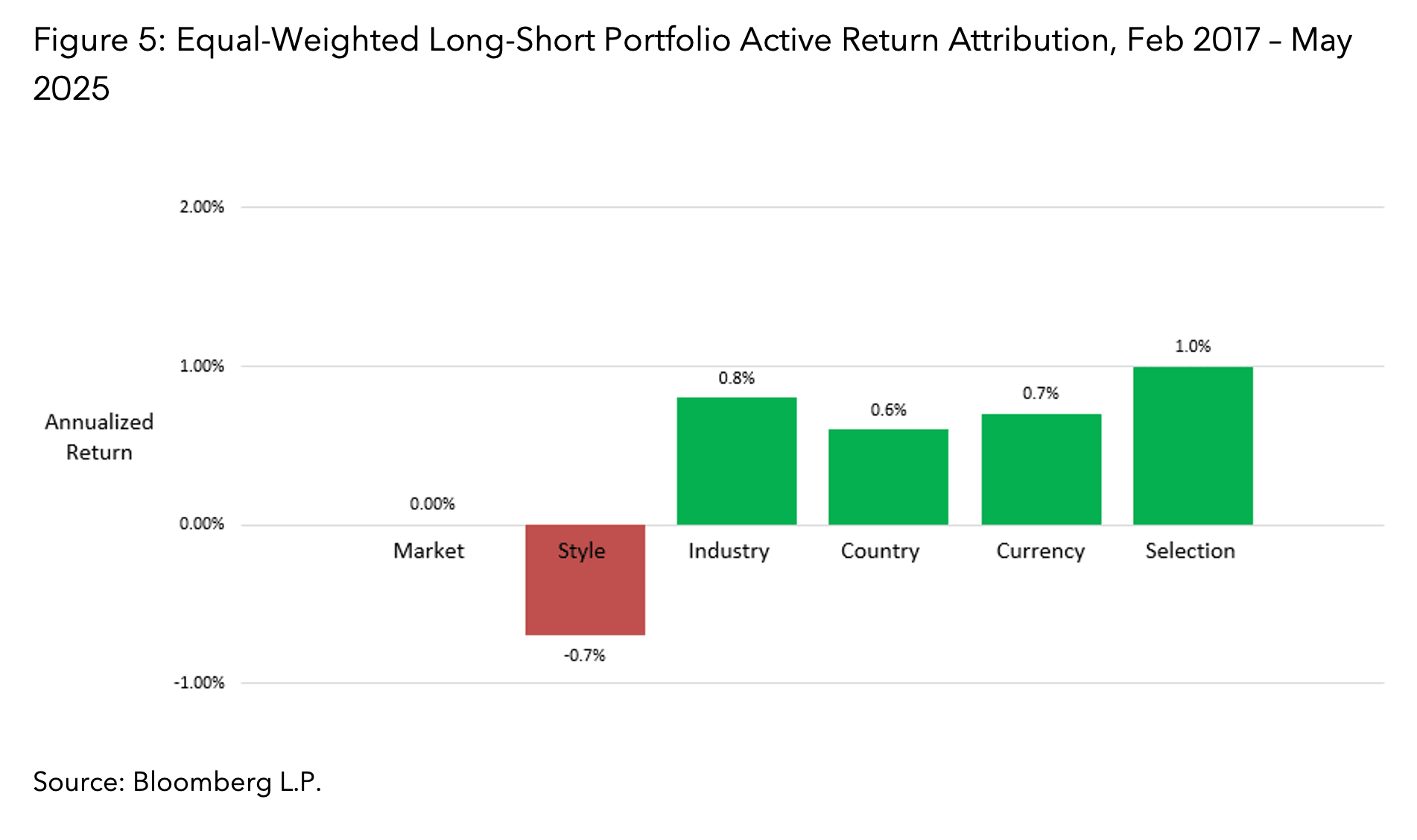

To further investigate whether this observed outperformance can be specifically attributed to renewable energy consumption rather than incidental exposure to other factors, we conducted a return attribution analysis using Bloomberg’s Multi-Asset Class Fundamental risk model (MAC3) for equities. We formed equal-weighted long-short portfolios within the WORLD Index universe, going long the companies in the highest quintile and short those in the lowest quintile based on sector-specific levels of renewable energy consumption.

Note that this return attribution is based on monthly down-sampled risk exposures from MAC3, which are produced at a daily frequency. As a result, the attribution results shown here are approximations and may not precisely match analyses performed in PORT tool available via the Bloomberg Terminal.

A significant portion of the returns from these long-short portfolios could not be explained by conventional factors such as Industry, Country, Currency, or Equity Style (e.g., value, quality), termed the “selection effect”. In our analysis, this effect accounted for 1.0% out of the 2.4% annualized returns of the long-short portfolio, suggesting meaningful financial materiality linked explicitly to the level of renewable energy usage.

In conclusion, our findings suggest financial benefits linked to greater renewable energy adoption, warranting further examination using extended timeframes and broader datasets for definitive validation. Investors, whether explicitly focused on energy transition or not, may therefore benefit from studying and incorporating this signal into their investment processes.