Bloomberg Professional Services

This article was written by Jigna Gibb, Head of Commodities and Digital Assets Indices at Bloomberg.

As digital assets and cryptocurrencies gain mainstream traction, more investors are entering the space, balancing long-term potential with near-term volatility.

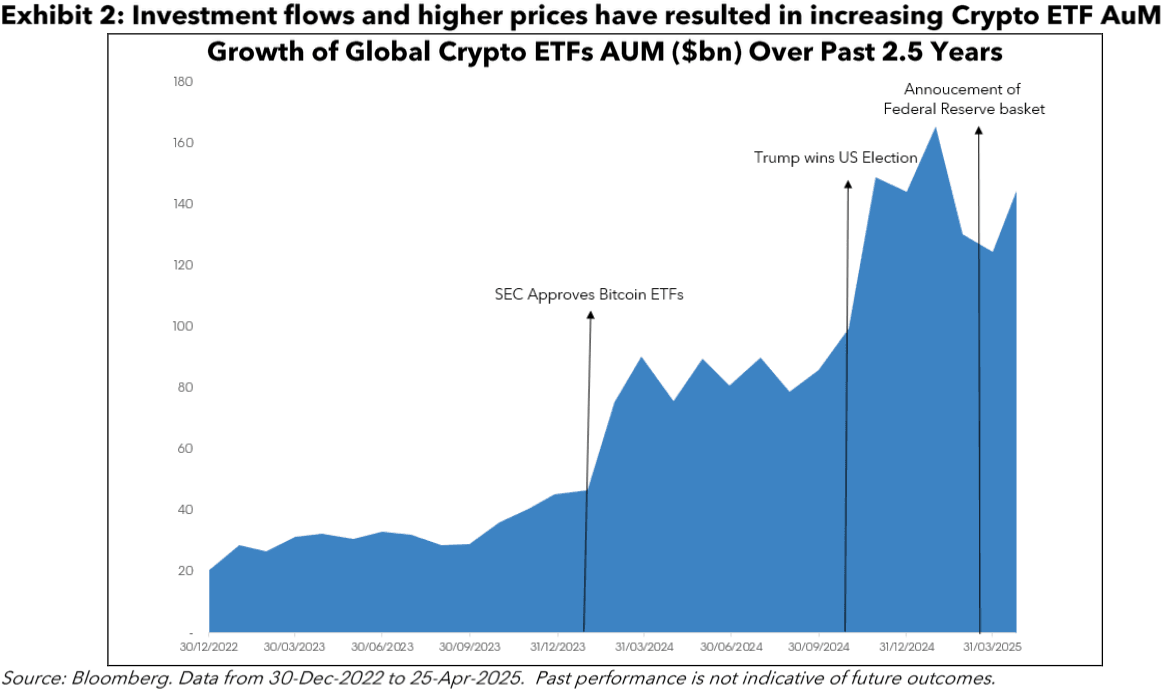

Overall, while crypto asset flows have been steadily growing, currently at $145bn, recent outflows of $500mn in a single day highlight the fickle nature of some of these allocations. Like a new language or a new piece of technology, there is a lot of information to learn in this still evolving space of digital assets. In this article, we aim to demystify the acronyms, cover the basics, explore the use of indices for digital assets and assess recent flows to this emerging asset class.

Demistyfying fundamentals of digital assets

Digital assets refer to a range of items that have value that can be created and stored digitally – these include cryptocurrencies and tokenized assets. There are many reasons behind the growing attention on digital assets and how to size allocations in a multi-asset portfolio; both these topics are discussed in “The Power of A Crypto Allocation“ article. Typical rationales include diversification, USD alternatives, store of value and momentum investing.

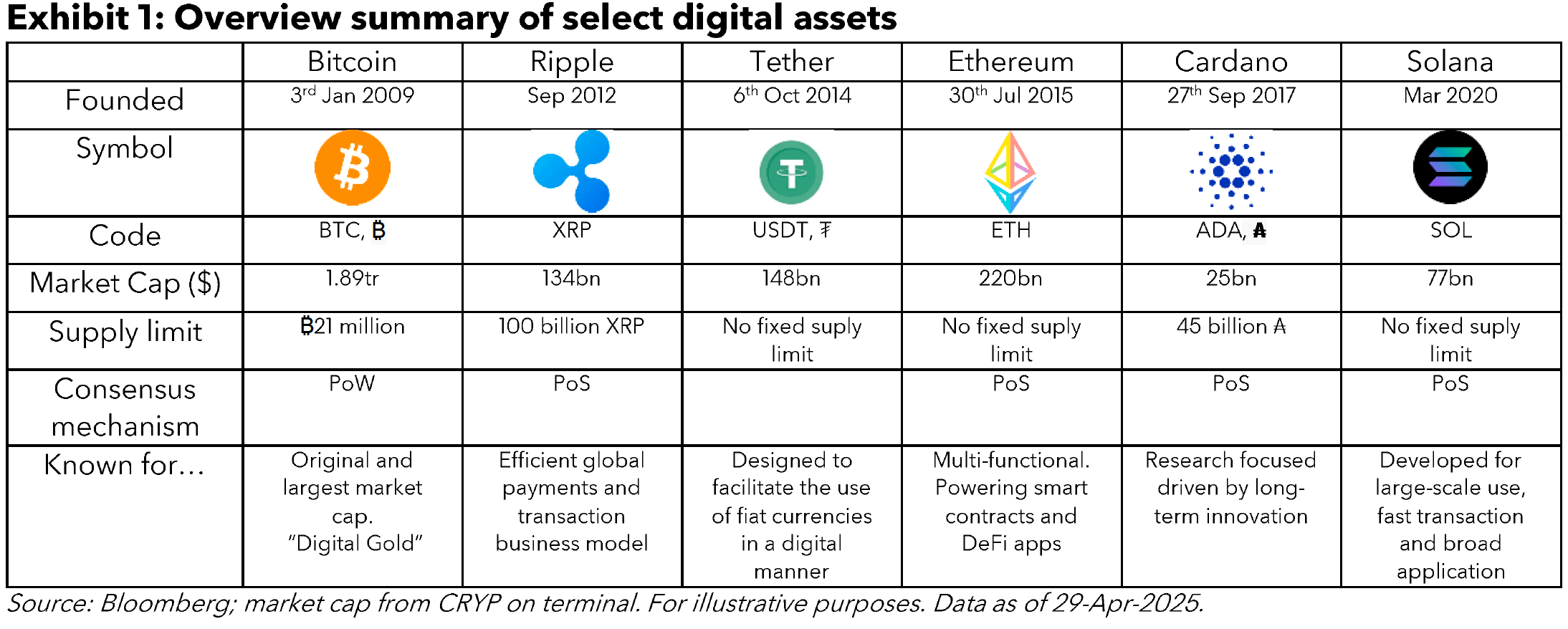

Crypto assets are decentralized digital currencies meaning that individuals could make payments across the globe without the involvement of a trusted intermediary such as a bank or government entity. Transactions are recorded on the blockchain, which is an unregulated, open-source, software system or ledger. The security of the coins is encrypted versus backed by a government or agency. Another way to conceptualize each digital asset is that they operate like a small company with different profiles and backgrounds – which are summarized in the table of Exhibit l. A distinguishing feature is the consensus mechanism – this is the process in the crypto network to validate transactions. Early adapters, like Bitcoin, use “proof of work” (PoW) whilst newly founded tokens use “proof of stake” (PoS). The key differences are energy required to mine the token, speed of certification and scalability.

Here are some common terms: Forks occur when a blockchain protocol splits into two paths. There are hard forks which are split in the blockchain slicing out new from old path and soft forks such as a system upgrade which ensure compatibility between old and new paths. Staking is a method to enhance the returns by earning rewards while participating in the blockchain’s security. Stablecoins, like Tether, are cryptocurrencies that have their value pegged to fiat currencies or gold.

Policy tailwinds for digital assets

With the opening of the global regulatory environment led by the US, the SEC approved Bitcoin and Ethereum ETFs in 2024, asset flows in cryptocurrencies have risen quickly, as seen in Exhibit 2. This was further accelerated by a pro-crypto US administration. At the start of March this year, the US government announced plans to hold a reserve of digital assets including Bitcoin, Ethereum, Ripple, Solana and Cardano, which further spiked prices. We have seen regulatory shifts across the globe with the SEC launching its crypto task force, the UK initiating the digital pound lab to design its Central Bank Digital Currency (CBDC), and the Markets in Crypto-Assets (MiCA) regulations in Europe. These regulations are further legitimizing the use of digital assets.

Investors can directly hold crypto assets in a digital wallet; however, indices offer flexibility and allow access via established investment formats such as ETFs. Currently, Bloomberg offers single component indices on Bitcoin {BITCOIN Index}, Ethereum {ETHEREUM Index}, and Solana {BSOLANA Index}.

How digital asset indices and baskets can change crypto-asset exposure?

For many investors the biggest hurdle for taking the leap into a crypto allocation is the asset class volatility – the long-term volatility of Bitcoin has been ~ 100%. More recently the 1-year volatility has been steadily moving lower to about half as adoption picks up. There are a couple of ways to reduce this volatility such as employing a target volatility scheme, blending with stable assets such as Gold and the USD or combining a basket of crypto assets, hence, baskets offer an alternative format to access digital assets for many investors.

Often, Bitcoin is referred to as digital gold, and so it is natural to think of combining Bitcoin and Gold together. The Bloomberg Bitcoin and Gold Equal-Weighted Index {BBIG Index} is an equal-weighted basket. The Bloomberg USD, Bitcoin and Gold Equal-Weighted Index {BBUG Index} combines Bitcoin, Gold and US Dollar indices equally. With exposure to Bitcoin’s potential upside returns, gold’s historic stability and the US Dollar’s defensive characteristics, Bitcoin and Gold indices could alter the risk/return profile of these assets on their own.

Bloomberg has launched crypto asset baskets on Bitcoin and Ethereum: equal-weight{XBTXETEW Index} and market cap-weighted {XBTXETMC Index}. Overall, Bitcoin and Ethereum complement each other well, in the same way that Gold and Silver do in the precious metals sector. Both cryptos are fundamentally designed to have different objectives; Bitcoin is seen as a store of value and Ethereum has broader use-cases and appeals for greater trading activity. Overall, Bitcoin and Ethereum account for more than ~60-70% of the crypto market cap and are the most mature and widely adopted blockchains. The equal-weighted basket would have balanced 50:50 exposure to both components, whereas the market cap-weighted would be tilted 90:10 to Bitcoin:Ethereum, with monthly rebalancing of weights. Therefore the market cap-weighted index would be much more heavily geared towards Bitcoins risk and return profile over Ethereum.

In 2018, Bloomberg partnered with Galaxy to offer broad-basket indices. The Bloomberg Galaxy Crypto Index {BGCI Index} based on the largest market-cap weighted cryptocurrencies, rebalanced monthly. Other Alternatives the components in the index are Bitcoin, Ethereum, Solana, Avalanche, Polkadot, Chainlink, Litecoin, Stellar and Sui Network; where the top three represent 88% weight ofthe basket. The Bloomberg Galaxy DeFi Index {DEFI Index} is a modified market cap-weighted of decentralized financial services on blockchain benchmark. The index aims to be diversified and representative of the broader DeFi market and as of May-25, index components include Uniswap, Aave, lnjectivev Protocol, Maker and Curve DAO Token.

From HODLIing to ETF holding

The crypto community’s practice of HODLing signals strong belief in long-term value despite market swings. It remains to be seen if ETF investors are embracing the same approach. When considering ETF assets, as shown in Exhibit 4, there is no surprise that traditional assets like Equities and Fixed Income have a majority share at ~95%, whereas Alternatives including Digital Assets, Commodities and Real Estate make up the rest. Within the Alternatives segment, the Digital Assets ETFs have grown quickly but they still only represent 1% of total AuMs. Hence, there is still potential for flows into this developing asset class. Historically when nascent technology is launched, there has been a gestation period which can be volatile. With more institutional adoption and governments on board, there is potential for Digital Assets to experience greater stability with more investment flows into this space.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloom berg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates. BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Oueen Victoria Street, London, England, EC4N 4TO. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.