This analysis is by Bloomberg Intelligence analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

Bitcoin faces deflationary forces after 2021 excesses, but the crypto shows divergent strength. With year-to-date losses less than half those for the Nasdaq 100, Bitcoin may be maturing toward global digital collateral. Initial pivot levels are where Bitcoin and the stock index closed the week before Russia invaded Ukraine: $40,000 and 14,000.

Bitcoin showing divergent strength vs. Nasdaq

The Nasdaq 100 Stock Index is down about 13% in 2022 through March 2, and if it keeps sinking, most risk assets (notably cryptos) will be poised to ride out the falling tide. Despite higher volatility, Bitcoin has dropped only about 5%. A long stretch of struggle for the stock market (part of the inflation and wealth effect) may be needed to help central banks check runaway prices. Historically extended and a big portion of most portfolios, equity prices appear poised to keep trailing cryptos. Our graphic depicts Bitcoin potentially building a base of around $40,000 vs. the declining Nasdaq 100.

If the index recovers, past patterns portend that Bitcoin will rise at a greater velocity. What’s significant is the crypto may be holding the line at key support vs. the stock market pressing lower.

Bitcoin may revisit $30,000, but what of stocks?

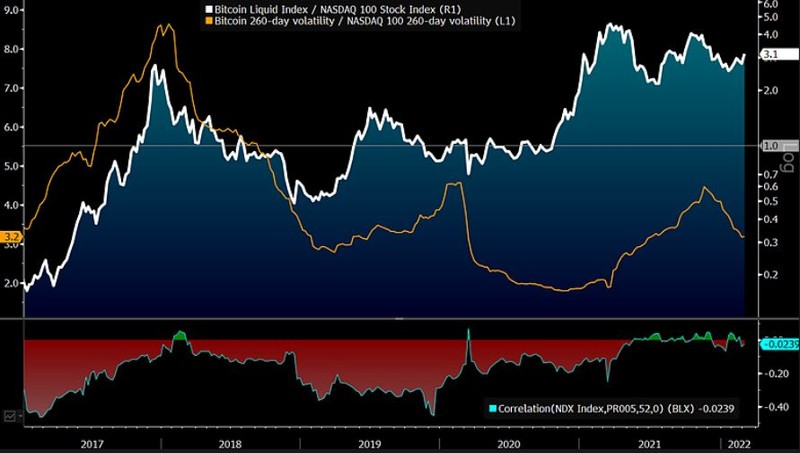

Bitcoin outperforming with declining volatility

The advantage of low or negative correlations and superior performance may distinguish Bitcoin vs. the stock market in 2022. The crypto has had brief periods when it lagged behind equities, but rarely from such low relative volatility as now. Our graphic depicts two key Bitcoin trends that appear enduring: beating the Nasdaq 100 stock index and declining relative volatility. At about 3x the 260-day volatility of the Nasdaq 100, this Bitcoin risk metric compares with almost 9x in December 2017, when futures on the crypto were launched.

Not partially allocating to Bitcoin as it progresses into the mainstream may remain the greater risk for most asset managers. We expect 2022 to be a good test, and if the stock market enters an elusive bear market, Bitcoin appears poised to gain an upper hand.

Bitcoin divergent strength vs. The stock market

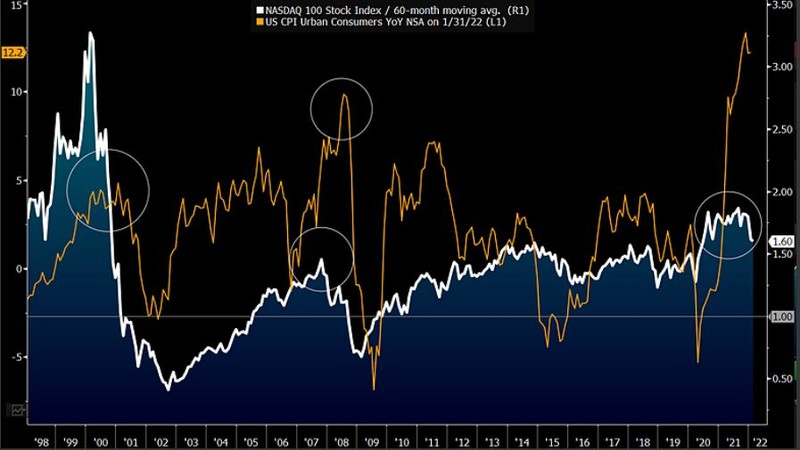

All assets subject to reverting inflation

Most assets are subject to the ebbing tide in 2022, on the inevitable reversion of the highest inflation in four decades, but this year may mark another milestone for Bitcoin. Our key takeaway from the graphic is elevated mean-reversion risks from the Producer Price Index year-over-year spiking above 2008 levels and the Nasdaq 100 behaving similarly vs. its 60-month moving average. If risk assets don’t decline and reduce some of the price pressure, inflation measures are more likely to remain buoyant, leaving few options for central banks but to raise rates more aggressively.

Not since the recovery in 2009 from the financial crisis has the stock index traded below its five-year mean. Some additional reversion may seem like a crash.

Inflation unlikely to drop unless risk assets do