Functions for the Market

- This analysis explores such tools using Tesla’s stock movement in 2025 as an example.

- During the selloff, Tesla approached key technical support levels, while options market sentiment appeared to turn more bearish.

- There are a variety of pre-trade and sentiment analysis tools that help investors construct directional options strategies, these include GN for news activity chart, BTM to monitor block trade, and OVME to structure options trade betting.

Kenny Chong, APAC Market Specialist at Bloomberg contributed to this article. The original version appeared first on the Bloomberg Terminal.

With headlines and technical signals often moving in opposite directions, how can investors build options strategies that seek to capture market sentiment and price risk — especially for volatile single-name stocks?

By analyzing options open interest distribution on different expiration dates, block trade activity, news sentiment and key technical levels, investors can use pre-trade analytics to construct directional options strategies tailored to their market outlook. This article explores such an approach using Tesla’s recent stock movements as an example.

PRODUCT MENTIONS

For instance, analyzing open interest distribution across expiry dates can reveal the market’s directional bias. A concentration of put open interest — particularly in near-dated expiries — may indicate hedging behavior or outright bearish positioning. Similarly, large block trades on options struck below the bid or above the ask offer clues about institutional sentiment.

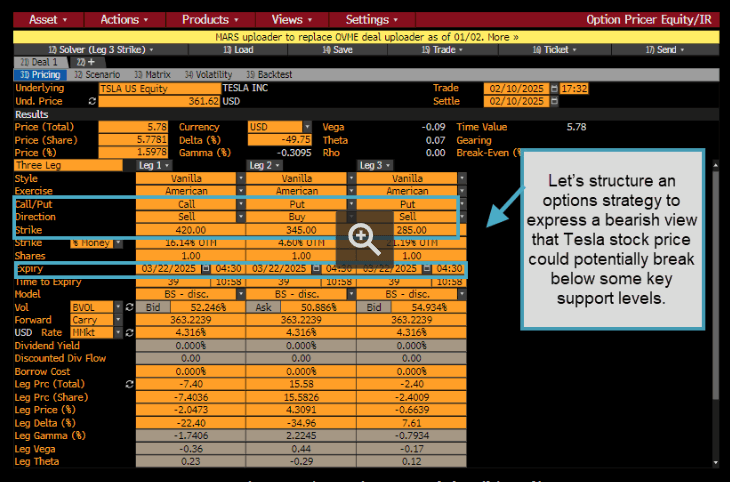

To construct a full view of the opportunity, traders can also run pre-trade pricing and scenario analyses using tools that enable them to price and model strategies such as vertical spreads, risk reversals, or collars — with control over key variables like strike, expiry, and implied volatility.

Background

Tesla’s reputation for sharp price swings has long presented opportunities and risks for options traders. In late 2024, the company’s stock rallied to a record high, driven by investor enthusiasm around its next-generation initiatives in artificial intelligence, robotics, and autonomous vehicles.

But by early 2025, that momentum had reversed. Tesla reported its first annual sales decline in more than a decade, missing fourth-quarter earnings estimates and posting its weakest January delivery numbers in years across key markets. Sales in Germany and France hit their lowest levels since 2021 and 2022, respectively. In China — Tesla’s largest non-U.S. market — deliveries fell 11.5% year over year.

While Tesla CEO Elon Musk highlighted a strategic pivot toward robotaxis and AI, analysts questioned whether these long-term narratives could offset near-term headwinds, including growing competition from rivals like BYD Co., which saw its shares climb more than 20% on strong smart-driving announcements.

The issue

Tesla shares declined more than 25% in the first quarter of 2025, erasing much of the late-2024 rally. The drop coincided with persistent negative headlines, underwhelming sales data, and broader concerns about the company’s stretched valuation.

Options market activity reflects this skepticism. An analysis of March 21 expiries shows a distinct bearish skew, with put open interest dominating across strikes. Shorter-dated expiries — including February 14 — reveal a similar tilt. Meanwhile, block trades on large Tesla put positions, many executed above the ask price, suggest institutional investors are actively hedging downside risk.

Technical indicators have also added to the bearish outlook. A Fibonacci retracement from Tesla’s December high to a recent low places key support near $270 — a level that has repeatedly acted as resistance over the past year. With the stock hovering near this threshold, options traders are positioning for further downside.

Together, these signals highlight the case for building a structured strategy that captures a bearish view without incurring unlimited risk.

Tracking

Use GN for news activity chart and BTM to monitor block trade. Run TSLA OVME to structure options trade betting on Tesla’s stock price movements.

This so-called risk reversal put spread involves selling a call option with an embedded put spread — buying a put option at a higher strike price close to current trading price and selling another put option at a lower strike price.

For context, in a risk reversal put, a trader sells a call option to help finance the purchase of a put spread, creating a bearish setup with limited risk. This strategy allows the investor to benefit from a potential decline in the underlying asset while managing the cost of the position. It offers a structured approach to constructing options strategies by providing a cost-efficient way to express a bearish view with clearly defined risk parameters.

Want to learn more? Visit our more Bloomberg derivatives trading solutions and pre-trade solutions.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.