ARTICLE

How automation, TCA and broker wheels work together in modern equity EMS

Bloomberg Professional Services

- Desks using automated workflows and wheels often see better consistency and, in some cases, stronger performance than manual processes.

- Wheels help manage growing execution complexity by promoting more consistent and reviewable decision-making.

- Linking pre-trade TCA, rule-based routing, wheels, and post-trade analysis can help desks refine allocations and parameters over time.

- Wheels can reduce operational effort and parameter inconsistency while still allowing trader input for higher-touch or higher-ADV orders.

Trading automation is now native to the Execution Management System (EMS).

Orders routed to algos, dark pools, RFQs, and high-touch desks are increasingly automated; the nuisance work is disappearing, and productivity on the desk is rising

PRODUCT MENTIONS

This steady march has pushed broker wheels from a “nice-to-have” to central infrastructure. Bloomberg’s 2024 study found that firms using equity automation for any part of their workflows see, on average, a 3 bps improvement in overall desk alpha vs. peers that do not. Within firms that do automate, automated workflows outperform comparable manual ones by 5 bps— suggesting that trading desks not adopting automation features such as wheels and rule-based trading may not be operating optimally. ¹

The expansion of algorithmic trading brings choice and complexity. There are many sophisticated broker algos; picking the right one for a given order can’t rely on memory or heuristics. Desks that implement a structured, auditable framework for selection and review take back control of execution, manage costs deliberately, and improve steadily over time.

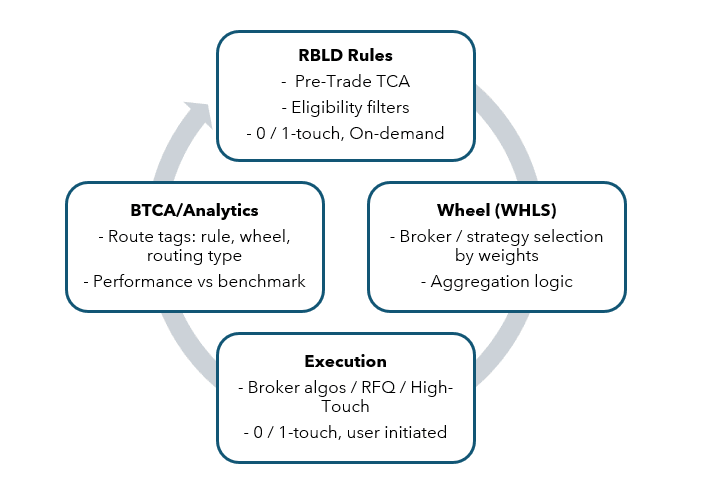

The operating model: a closed loop that learns

Inside Bloomberg’s EMS, each order runs through a defined decision framework—codified in RBLD, the rule‑based engine—so “when, how, and where” routing happens by design, not by habit. Pre‑trade Transaction Cost Analysis (TCA) informs those rules by scoring expected difficulty using %ADV, liquidity, volatility, and spread. Similar orders are treated consistently, without slowing the desk.

From there, WHLS (the wheel) allocates flow across brokers/algos using target weights and parameter templates (aggression, participation, algo type) to keep intent consistent. Wheels run zero‑touch, On‑Demand (trader‑initiated), or hybrid—and support A/B testing by duplicating entries with single‑parameter tweaks to learn quickly and objectively.

Executions feed Bloomberg Transaction Cost Analysis (BTCA), which tags each order by rule, wheel, and routing type so desks can compare like‑for‑like (implementation shortfall, fill rate, dispersion), then push insights back into RBLD/WHLS for reweights and template refinement. It’s a governed feedback loop that compounds.

Among listed‑equities RBLD users, ~90% of orders and ~85% of USD notional route via automated wheels. An illustrative setup: 4 regional wheels, ~7 strategies from ~6 brokers, and quarterly reconfiguration. Update mix: ~65% weight changes, ~15% adds, ~10% removals. On‑Demand workflows account for ~10% of wheel flow. (Outcomes vary by desk and configuration.)

What actually changes on the desk and why it matters

1) Allocation discipline you can audit—without spreadsheets

Keeping five brokers near 20% each is busy work if you do it manually. With pre-trade TCA grouping comparable orders, RBLD setting eligibility, WHLS enforcing target weights/templates, and BTCA validating outcomes, allocation stays on target and defensible. For example, an illustrative wheel might cover ~7 strategies across ~6 brokers, and be reviewed roughly every three months. This type of set up now drives ~90% of listed equity orders among RBLD users.

2) Like-for-like broker reviews with credible sample sizes

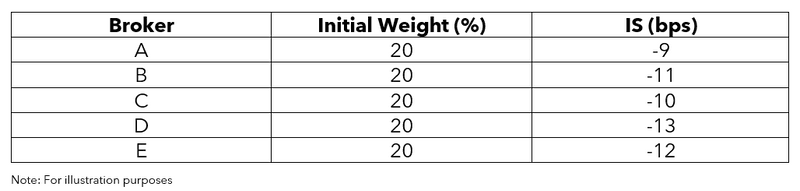

Wheels normalize inputs so broker comparisons are like-for-like. A desk might, for a VWAP neutral bucket of U.S. large-cap orders (0.2–0.5% ADV) split evenly across five brokers, see initial BTCA results like:

After analyzing performance, assume the trader rebalances the wheel to 25/25/20/15/15.

In the following quarter, dispersion narrows (IS stdev. −18%) and average implementation shortfall improves by about 2 bps. All adjustments and outcomes are documented through governance for transparency and oversight.

3) Continuous algo selection without parameter fatigue

Remembering parameters order by order creates inconsistency. Wheels map profiled flow (e.g., VWAP neutral) to standardized templates, so aggression/participation stay coherent across brokers.

Need to experiment? Duplicate a broker entry, flip one parameter, and let BTCA judge. Among listed‑equities RBLD users, most desks prioritize finetuning over churn—~65% of updates are weight/parameter adjustments; ~15% add new strategies.

4) High ADV and time-staged execution (with trader control)

High‑ADV orders demand careful slicing to curb impact and leakage while still honoring allocation targets. EMSX On‑Demand Wheel lets traders send full, partial, or grouped orders on their schedule; WHLS quietly keeps allocations aligned over time. BTCA tags zero‑touch vs. trader‑initiated to compare styles. In practice, ~10% of wheel flow uses On‑Demand, with ~5% devoted specifically to high‑ADV management.

Why leading desks standardize wheels

Wheels institutionalize good trading: they codify intent, enforce consistency, create audit trails, and build a learning loop that improves results over time. They reduce operational drag, make broker governance credible, and free traders to focus on the exceptions that actually need human judgment. The framework—not any single feature—is what scales.

Conclusion

Automation isn’t just speeding up routing; it’s redefining how execution is managed. Wheels connect pre‑trade insight, rule‑based eligibility, and post‑trade measurement into a single, auditable operating model. The outcome is repeatable: consistent decisions, transparent governance, and measurable performance gains—from rules to results—and a desk that gets better every quarter it runs the loop.