Bloomberg Professional Services

This article was written by Niall Smith, Quantitative Researcher at Bloomberg and Lydia Hamill, Fixed Income Index Product Specialist at Bloomberg.

Globally, we are well behind the necessary rates of emissions reduction necessary to limit warming to 1.5°C. In fact, recent climatological research suggests we are likely to exceed this threshold of temperature rise as soon as 2027. Achieving net-zero emissions by 2050 will require $7 trillion a year in clean energy investment, much of which will be sourced via government debt channels. Investors need analytical solutions to help direct capital towards the governments that have climate mitigation high on their agenda and that will play a critical role in achieving this transition.

We explore some of the common hurdles for sovereign debt investors looking to integrate climate-related risk and opportunity, both in terms of the data used to assess countries, as well as the complex task of portfolio construction in this space.

Challenges with measuring sovereign climate performance

Many of the challenges faced by investors seeking to integrate climate risk in sovereign debt relate to data. Unlike corporate ESG or climate data, sovereign investors are faced with a high concentration of information sources, meaning that data may fail to provide new or uncorrelated information. Secondly, indicators chosen often contain a strong wealth bias, leading to the potential for signals that inadvertently direct capital flows to developed markets in the name of ‘sustainability’.

To add further challenges, there is no regulatory or internationally agreed consensus on measuring climate risk in sovereigns. Often such assessments incorporate wider sustainability metrics with weak rationale, potentially diluting the strength of the climate signal. Even when focusing on climate specifically – there are the two dimensions to consider: physical and transition risk. While both elements clearly have the potential to impact government creditworthiness, they are quite distinct in terms of their drivers, and their potential economic impacts. There is value in assessing each dimension of climate risk independently, not least because transition risks are expected to materialize over shorter timescales.

Leveraging the Bloomberg Government Climate Scores

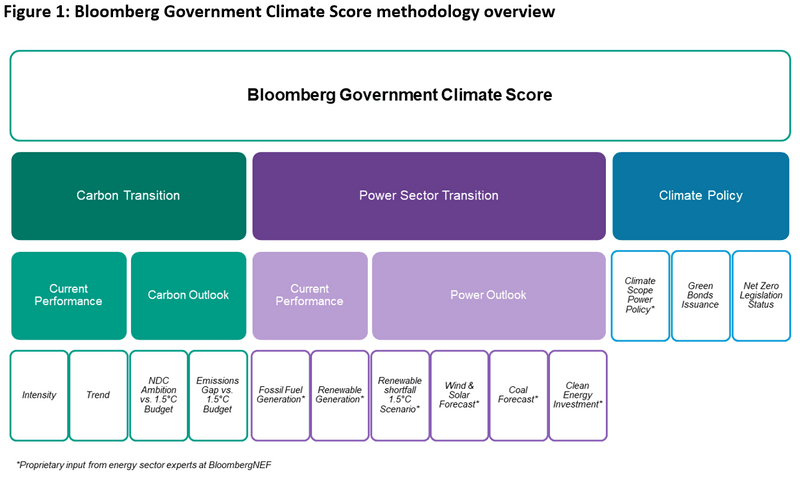

The Government Climate Scores (GOVS) were developed to systematically measure the preparedness in the transition to a low–carbon world of over 140 countries globally. The scoring methodology accounts for the extent to which a country may transition in a manner that can ensure economic growth and avoid inflationary environments. The approach to scoring, depicted in Figure 1, assesses overall decarbonization progress, climate policy and regulatory conditions and includes a detailed view of the power sector — given its crucial role in climate mitigation.

Each pillar of the analysis includes forward-looking measures to gauge how the low-carbon transition will impact a country’s economy in the future. Crucially, the scores assess countries’ stated intent to reduce emissions, rather than focusing purely on past trends. Carbon intensity metrics are incorporated using both per capita and per unit GDP methods to ensure a fair assessment across jurisdictions with different levels of development.

The majority of the input data (greater than 80% by weight) behind the scores are internally developed proprietary metrics. The Power Sector Transition pillar integrates detailed forecasts of the energy mix produced by sector experts at BNEF, while the Climate Policy pillar includes an assessment of clean energy policies in the power sector derived from BNEF’s Climatescope.

In summary, GOVS provides a lens through which a country’s performance on the low carbon transition can be well understood and examined. Figure 2 visualizes the distribution of headline scores for countries grouped into their respective region and market classification (DM or EM), while Figure 3 shows the differentiation between countries, looking at the largest 20 issuing countries in the Bloomberg Global Treasury Index.

Immediately evident is the lack of wealth bias in the scores, unlike what is seen with other sovereign datasets. The divide between DM and EM countries varies by region, but there are overlapping distributions in each case. In APAC for example, major economies like Australia and Japan lag relative to other DMs and behind some EMs like Korea and Thailand. Similarly in the Americas, several LATAM countries like Brazil and Colombia outrank the US.

With the granular country-level data behind the scores, it’s possible to pinpoint the reasons why some countries are leading in their preparedness for meeting the goals of the Paris Agreement. Further analysis is made possible via the Bloomberg terminal (GOVS <GO>), allowing users to determine why France, for example, is a leading country with consistent performance across the board.

Constructing climate-aware government bond portfolios

One of the key challenges in incorporating climate considerations into sovereign debt portfolio construction is the delicate balance of improving portfolio-level climate-specific metrics with various other traditional investment objectives (e.g., maintaining similar duration and yield exposures). Some investors may wish to achieve higher levels of impact by allocating capital towards leading countries, while others may have less tolerance for tracking error and active country weights, accepting a moderate uplift in climate performance as a result. The analysis shown in Figure 4 demonstrates how the scores can be used to tilt asset allocation towards leading countries in a tailored manner.

The chart displays two pillars of the scores and the performance of each country in blue. The red cross signifies the weighted score of the Bloomberg Global Treasury index, while the several green crosses illustrate a range of implementation options for a climate-aware sovereign debt portfolio. By increasing the tilt strength, we can control the degree to which we overweight the leading countries (those in the upper right quadrant) like France, Canada and the UK.

This flexible tilting approach is also utilized by the recently launched Bloomberg Government Climate Tilted Bond index family. These indices focus on a single, clear objective: tilting country weights based on preparedness to achieve Paris Agreement goals. The resulting index not only achieves a reduction in emissions intensity versus the parent, but also supports the real-world transition by directing flows towards governments with tangible plans to decarbonize their economy.

In addition to adjusting tilt strength, investors can target specific outcomes through optimization, such as a specific CO2 intensity reduction, or a desired uplift in power generation from renewables. Moreover, country inclusion can be altered using thematic exclusions and weights can be capped for diversification. In each case, the resulting portfolios are backed with a robust, transparent, and proprietary climate score through GOVS.

Stay on pace with the race to Net Zero

The Bloomberg Government Climate Scores (or ‘GOVS’) and the Bloomberg Government Climate Tilted Bond Indices provide investors with tools to drive investments towards countries best prepared to meet global climate goals. We will expand further on this topic in a forthcoming white paper, investigating approaches to portfolio construction using the scores in more detail. Terminal users can access the Bloomberg Government Climate Scores through GOVS <GO> and the Bloomberg Government Climate Titled Bond Indices through IN ESG <GO>.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.