Functions for the Market

-

Traders who code have an edge – Python skills are helping traders automate tasks and improve accuracy.

-

Automation is solving workflow pain points – Leading firms are cutting manual steps and boosting speed with trading APIs.

- Bloomberg’s DOR API makes trading easier – It helps automate trades in bonds, swaps, FX options, and more.

Bloomberg API Product Manager Joan Puig contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Leading investment firms are finding value in employing traders with programming skills. The traders– particularly those with Python coding in their skillset – are helping to enhance efficiency and accuracy through workflow automation.

PRODUCT MENTIONS

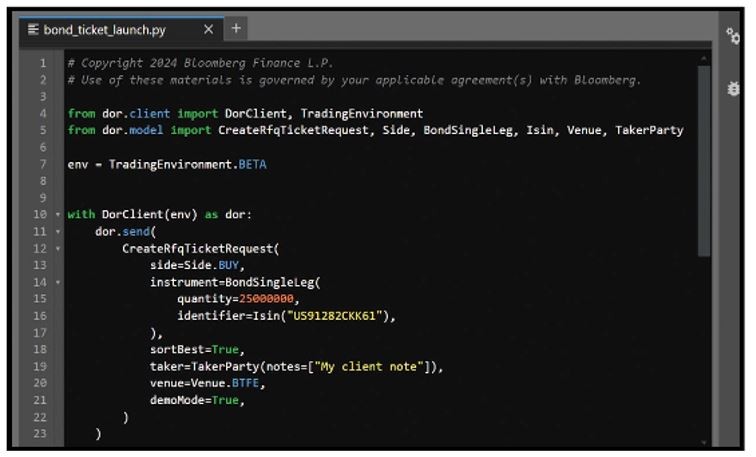

Bloomberg offers a Python-based trading application programming interface (API): Direct Order Routing (DOR) for Python. It enables coding-proficient traders to streamline a wide range of financial instruments. Among them: bonds, including single securities, curves and butterflies; generic to-be-announced mortgage-backed securities, or TBAs (singles and rolls); interest-rate swap baskets; and foreign exchange option strategies.

The issue

Hedge funds, private banks and other large asset managers are under pressure to become more efficient. Drivers include geopolitical risk and evolving market dynamics, the AI boom and the possibility of recession in the US.

Regulatory environments are also becoming more stringent. Alongside these pressures are growing regulatory consequences for operational errors.

Teams at asset managers and banks usually perform their own analyses to determine which trades need to be executed. Often, a team member is then required to manually type in the trade parameters in tickets on the Terminal before negotiating with counterparties.

Many leading institutions have identified this manual handling as a pain point and the automation of trading workflows.

Bloomberg’s DOR for Python is one viable and cost-effective solution. The API enables developers and traders to integrate sophisticated trading capabilities into existing systems for fixed income, derivatives or FX portfolio management.

Tracking

To get started, download the DOR for Python software development kit (SDK) from the Bloomberg Developer portal.

Type “Bloomberg developer” in the command line of a Bloomberg screen and click on the BDEV match in autocomplete. The shortcut is {BDEV}.

To download the DOR Python SDK, run {BDEV } to go to the Bloomberg Developer portal. Click on Downloads and then type “DOR” in the Search Downloads field.

Click on Downloads. Then type “DOR” in the Search Downloads field and hit . Click the icon to download a zip file. In it, you will find the Python package dor-1.1.0.tar.gz, an examples directory and a README.pdf file to help you with the installation.

Once you’ve installed the package in your Python environment, you can start to write code. The examples directory in the zip file contains a variety of samples of code to trade asset classes such as bonds, FX options, interest-rate swaps and TBAs.

For more information on the capabilities of DOR for Python, contact your Bloomberg electronic trading representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.