Bloomberg Professional Services

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

The global economy is fueled by commodities. Ever since the industrial revolution, the production and consumption of fossil fuel-based commodities has been the dominant source of energy; but the winds seem to be shifting. A new revolution has taken hold in terms of the energy transition where the key ingredients of the future global economy will look a lot different than the current energy mix. The world is moving from a fossil-fueled economy to one powered by technologies consisting of metals. We have seen increased allocations to metals reflected in the liquidity & production-weighted broad commodity benchmarks, such as the Bloomberg Commodity Index (BCOM). Transition metals, made up of industrial, precious, and battery metals, continue to gain significance as one of the most important global themes we see for the future.

As sustainability gains traction, renewable energy technologies are gaining in popularity and participating in the energy transition. These technologies are made up of metals and major metals futures markets have been around for decades but there are newer battery metals futures contracts like cobalt and lithium. The CME contracts on cobalt and lithium have less than 5 years of history but lately have seen an uptick in trading liquidity as they have grown more in relevance to the world economy.

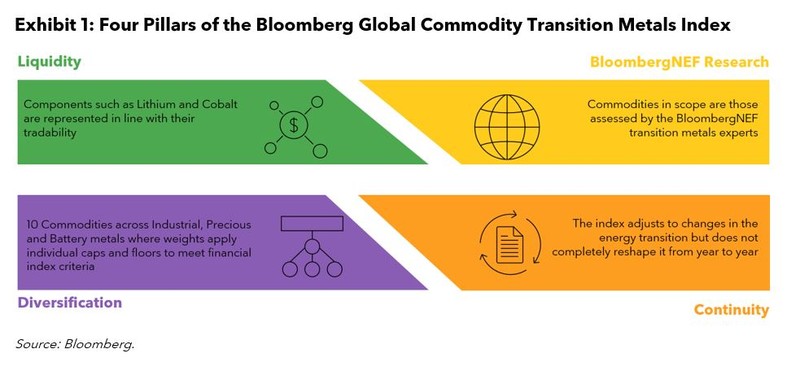

Now may be the right time for the launch of an index of these metals. The Bloomberg Global Commodity Transition Metals Index (GCOMTM Index <GO>) is designed to track the performance of holding a long position of liquid metal commodities futures contracts key to the energy transition with the universe defined by our metals analysts at BloombergNEF (BNEF). From here, the index is initially weighted according to the underlying liquidity of each metal futures market and then diversification through caps and floors is implemented to get to the final index weights. The index is reconstituted on a yearly cadence to ensure continuity over time (Exhibit 1). New metals may enter if BNEF analysts observe a change in the materials powering the energy transition. This makes the index adaptable as the energy transition develops but done in a way that does not completely reshape it rapidly.

In 2025, tariffs are top of mind for market participants and the focus of the US administration has shifted to metals like aluminum and copper. This index is diversified across 10 liquidly traded metals and diversified by containing copper and aluminum contracts from different exchanges hence 12 contracts in total (Exhibit 2). Not only does this help with diversification of the index, but it also contributes to replicability. When creating thematic indices with commodities, a concern often arises around the ability to trade the underlying components, especially new markets or not as established as a typical equity market. By using different metal sector constituents as well as different exchanges for the same metals, the index becomes more representative of the theme while also potentially becoming insulated to tariff news that might affect aluminum from New York versus aluminum from London. We’ve already seen the effects of tariff headlines on the copper markets. In the first quarter of 2025, the threat of copper tariffs caused a record spike in the premium of copper futures on New York’s Comex exchange over copper futures on the London Metal Exchange.

Despite changes in some government administrations to some less interested in prioritizing the energy transtion, the changing of the global economy continues to occur. The key metals needed in the future are already seeing bigger percentages of their traditional demand shift to a focus on the energy transiton. BloombergNEF analysts forecast significant changes to the demand picture for these metals. Copper, in particular, will likely have more than half its total demand coming from the energy transition by 2030. This is a very significant shift from 2023 when energy transition demand for copper was only 26% (Exhibit 3).

Geopolitical risk is ever present in the metals space. Already this year, the price of cobalt is soaring despite a supply glut. This is due to the majority (80% of world supply) of cobalt produced in the Democratic Republic of Congo (DRC) and a surpise four month export ban in February in order to rein in supply. The DRC isn’t the only country exporting metals with a high supply concentration risk. Exhibit 4 shows places like South Africa (73% of world supply of platinum) and Indonesia (47% of world supply of nickel) where the threat of supply concentrated in one area could lead to price spikes if similar export bans surprise markets. BloombergNEF considers at least 30% concentration of supply to be a threat threshold but another transition metal, silver, has 25% of supply concentrated in Mexico which has been one of the first targets of tariffs by the new US administration.

With concern about recent volatility in equity markets, uncorrelated assets and thematic indices are being considered for diversification. It made sense over the last 15 years to have a heavy broad equities exposure in a portfolio but with the VIX regularly above 20% in 2025, a thematic commodities stategy could help with diversification this year. Thematic equities baskets are popular but they have broad equity beta while commodities do not. The purest way to get exposure to the energy transition is to gain exposure to the raw, physical materials. Taking an equity based approach would mean other considerations like asset class vol and corporate behavior would have to be contemplated.

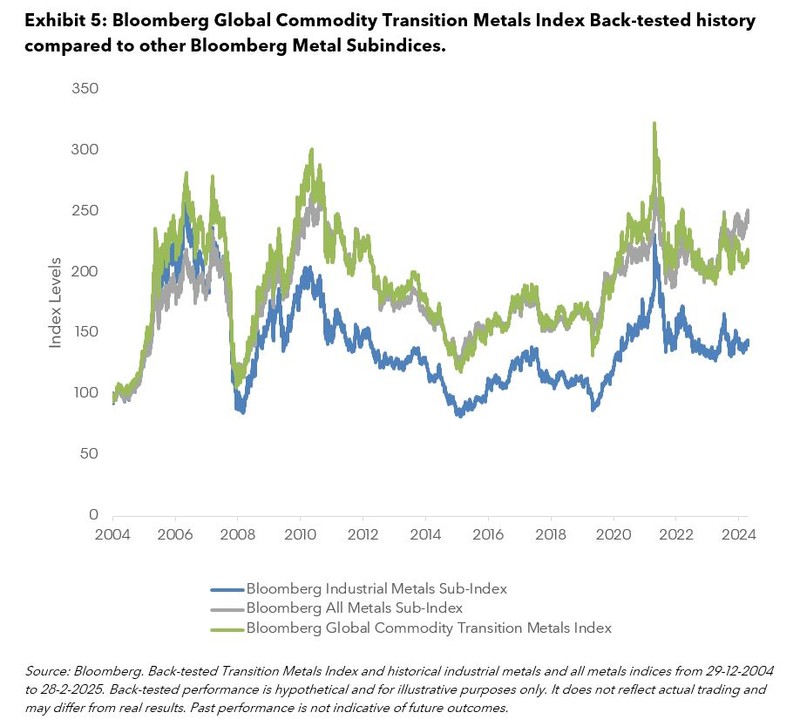

As can be seen in Exhibit 5, the back-tested history of the Bloomberg Global Commodity Transition Metals Index closely tracked the Bloomberg All Metals Index historically. It has lagged recently as battery metals prices have dropped and gold rallied.

The Bloomberg Global Commodity Transition Metals Index provides market participants with a new, replicable way to gain exposure to one of the most important themes shaping the future of the world economy. It is backed by robust research from BloombergNEF, incorporates metals markets liquidty, and diversification. The future forecasts of supply for metals may not be enough to satisfy the potential increase in demand from the energy transition leading to possible upward pressure on prices. Tariffs and geopolitical risk are top of mind for market participants in 2025 and may be further catalysts for metal prices appreciation. With the past powered by fossil fuels, the future instead will be powered by metals.

BISL Disclaimer

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.

BNEF Disclaimer

The BloombergNEF (“BNEF”), service/information is derived from selected public sources. Bloomberg Finance L.P. and its affiliates, in providing the service/information, believe that the information it uses comes from reliable sources, but do not guarantee the accuracy or completeness of this information, which is subject to change without notice, and nothing in this document shall be construed as such a guarantee. The statements in this service/document reflect the current judgement of the authors of the relevant articles or features, and do not necessarily reflect the opinion of Bloomberg Finance L.P., Bloomberg L.P. or any of their affiliates (“Bloomberg”). Bloomberg disclaims any liability arising from use of this document, its contents and/or this service. Nothing herein shall constitute or be construed as an offering of financial instruments or as investment advice or recommendations by Bloomberg of an investment or other strategy (e.g., whether or not to “buy”, “sell”, or “hold” an investment). The information available through this service is not based on consideration of a subscriber’s individual circumstances and should not be considered as information sufficient upon which to base an investment decision. You should determine on your own whether you agree with the content. This service should not be construed as tax or accounting advice or as a service designed to facilitate any subscriber’s compliance with its tax, accounting or other legal obligations. Employees involved in this service may hold positions in the companies mentioned in the services/information.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. Bloomberg makes no claims or representations, or provides any assurances, about the sustainability characteristics, profile or data points of any underlying issuers, products or services, and users should make their own determination on such issues. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.