Adrs in Focus: Breaking Down Insights and Market Trends

Discussion topics:

-How has the ability to trade ADRs changed due depth of liquidity in the market?

-Sponsored vs. unsponsored ADRs

-Direct Indexing Strategies

-Dynamics seen in Russia and China ADRs this year

Speakers

Gaurav Patankar

Alternative Investments

Bloomberg Intelligence

Gaurav Patankar is an investment and fintech executive with a track record of leading and transforming investment organizations, portfolios and products building important institutional relationships globally. Over his 22-year career, Gaurav has invested and allocated capital globally and across multiple asset classes including equities, alternatives, fixed income, infrastructure and real/operating assets. Presently, he serves as the Head of Strategy - Alternatives & OCIO Solutions at Bloomberg Intelligence with a keen focus on building and triangulating Bloomberg’s value proposition within pensions, endowments, foundations, family offices and asset managers. Gaurav previously served as the OCIO of a multi-billion family office –Atharva A&C. Prior to his OCIO journey, Gaurav was a Managing Director and Portfolio Manager at Mellon Investment Management where he managed the global emerging markets research and portfolio teams across multiple strategies. He also led key strategic dialogues with UHNW, SWF and Endowment & Foundation clients as the thought leader on emerging markets. Prior to Mellon, Gaurav was a Portfolio manager of Global absolute-return strategies at the Lockheed Martin Investment Management Co (Pension Plan) where he successfully turned around the firm’s alternative portfolio and built out the firm’s managed account platform. Before that, he served as a Vice President and Sector Head of Emerging-Markets and Global Financials at Millennium Management, LLC, as an equity research analyst at SuNova Capital and Citigroup Investment Research covering large and mid-cap banks. Prior to his investment career, Gaurav was a Corporate Strategist at M&T Bank and an entrepreneur in India where he co-founded Information Interface India Ltd (promoter of Niyogin Fintech Limited BSE: NIYOGIN_IN). In 2016, Gaurav led prominent investors to reverse merge the firm with a listed NBFC working closely with key stakeholders and regulators to create India’s first listed fintech company. Gaurav helped put together a high quality board, institutional investors and a top notch management team.

Uma Seshamani

Institutional Sales & Trading: ADRs, Equity and ETFs Specialist

Jane Street

Uma Seshamani is an ADRs, Equity and ETFs Specialist on Jane Street's Institutional Sales & Trading team. In this role, Uma helps lead initiatives and partners with institutional clients to provide trading solutions and access to Jane Street's differentiated liquidity. Prior to joining Jane Street, Uma was the Founder and Managing Director of MNAHVI Group where she advised senior executives of late-stage private and early-stage public companies on crafting and communicating their stories, developing long-standing relationships with investors, and navigating their capital raising process. Uma was previously a Managing Director in Institutional Equity Sales at BMO Capital Markets and served in multiple roles across investment banking, corporate strategy, and sales at Barclays and Lehman Brothers.

Holly Lau

Head of ADR Trading

Citadel Securities

Holly Lau is the Head of ADR Trading at Citadel Securities. She oversees the daily operations of the trading desk and lead the strategic technology and development of the business. Holly has been with Citadel for seven years, during which time she had served in various capacities to help build platforms and tools on the interest rates swaps and index options desks. Holly received her B.A. in Mathematics from the University of Chicago, M.S. in Financial Mathematics from the University of Chicago, and M.S. in Applied Economics from Johns Hopkins University.

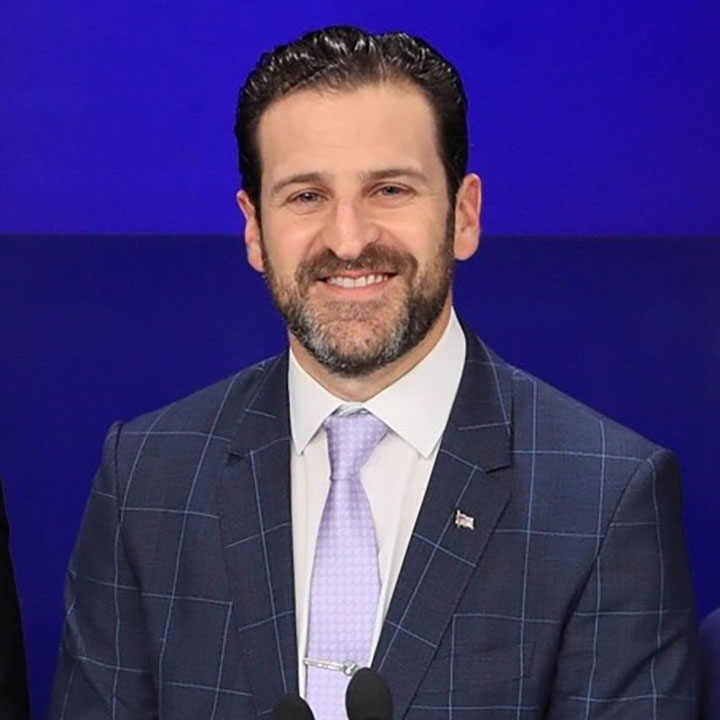

Jacob H. Rappaport

Managing Director, Head of Equities

StoneX Group Inc.

Jacob Rappaport serves as the Global Head of Equites at StoneX Group Inc. (NASDAQ: SNEX), a Fortune 100™ company and leading provider of financial-services execution, risk management, market intelligence, and post-trade services across asset classes and markets around the world. Mr. Rappaport is responsible for the company’s Equities businesses globally, which include, Wholesale Market Making, Global Institutional Sales & Trading, Outsourced, and Electronic Trading. He has held various roles at StoneX and predecessor companies since joining in 2005, including Head of Americas Trading, and Head of Market Making. Since taking the role of Head of Equities in 2013, the segment has multiplied revenue more than ten times and became the number one ranking market maker in ADRs and foreign securities traded OTC. Mr. Rappaport serves as a member of the StoneX Group Inc. Management Committee and is an Officer of the wholly owned subsidiary, StoneX Financial Inc., a FINRA registered Broker Dealer. He also served as President of the Florida affiliate of the Securities Traders Association from 2015 through 2017 and is an Advisory Board Member for the Department of Business at Rollins College, where he earned his BA in International Business.