Bloomberg Terminal / Research

Bloomberg Intelligence

Data-driven research

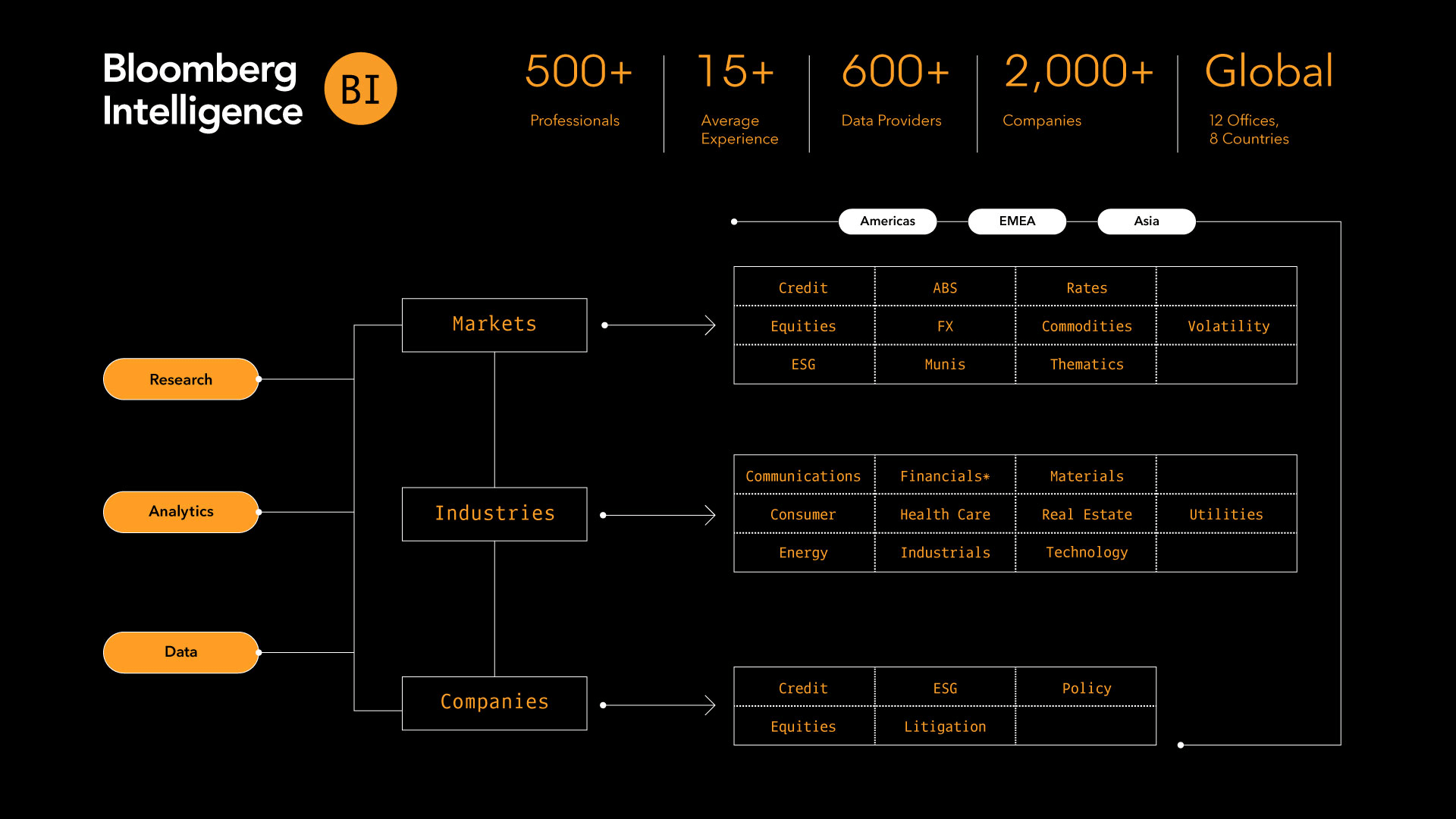

Bloomberg Intelligence (BI) delivers an independent perspective, providing interactive data, tools and research across industries and global markets, plus insights into company fundamentals, from 500+ research professionals. A trusted source of data and analysis for 15 years, Bloomberg Intelligence helps clients make more informed decisions in the rapidly moving investment landscape.

Improved time management

BI interactive charts reflect data from Bloomberg proprietary sources and 500+ third-party providers to save you time.

Scenario-specific data capabilities

Our filters and charts let you use data to study potential outcomes and scenarios with speed and efficiency.

Export data with ease

Our system allows you to export to Excel or via an API to feed your own models, workflow and analysis.

Analyst-validated data

Every piece of BI data is validated by the very analyst teams that use it daily, giving you assurance and winning edge.

In-depth data and research from experienced analysts with a wide range of coverage

Bloomberg covers both the macro picture and the specific details — down to the operating, financial and valuation information at the company level.

A wide range of coverage

Technology

Understand all key areas of Generative AI technology, including model architectures, training techniques, applications across various sectors, and ethical considerations.

Our insights delve into performance optimization, thematic advancements, profitability potential, and valuation drivers specific to the Generative AI landscape.

Industry

Industry research coverage spans all 10 major sectors and 135+ industries with powerful thinking on key performance factors, thematic issues, and profitability and valuation drivers for each industry.

Company

Over 2,000 primers deliver well-rounded insight into a company, including financial fundamentals and key macro factors that are likely to impact the company.

Credit

Gain insight into the potential direction of a company or an industry trend cycle by better understanding credit ratings and debt capacity.

Equity Strategy

A multidisciplined approach offers analysis of relevant factors for market, sector, industry and stock selection, with the aim of sifting through the noise to generate investment ideas that outperform.

Fixed Income, Currency and Commodity (FICC) Strategy

Covering rates, currencies and corporate credit across the U.S., Europe and strategic emerging markets, our strategists offer insights on potential policy, political and economic impacts on valuation.

ESG

BI is central to Bloomberg’s many Environmental, Social and Governance solutions. Understand how financially material ESG issues are and how they are redefining industries’ fundamentals and companies’ competitiveness. When combined with other Terminal features, BI delivers the most comprehensive set of ESG investment data and research anywhere.

Government

Anticipate how government action across the globe might impact companies, industries and portfolios.

Litigation

Monitor the court cases to discover the potential outcomes for a given industry or company.