Products / Indices

Bloomberg Equity Indices

Redefining benchmarking capabilities

Rules-based framework

Our rules-based approach promotes investability and consistency across market caps, sectors, currencies and styles.

Competitive methodology

Semi-annual reconstitutions maintain relevant index membership while limiting excessive turnover.

Industry-leading financial data & research

We have a dedicated cross-asset index research and development team focused on new trends and investment capabilities.

Robust distribution

Indices are broadly distributed across the financial community globally, through 350,000 Terminal users, and third-party platforms.

Deep coverage

Our capabilities include style and factor index strategies, thematics, ESG, climate and more.

Modern Infrastructure

Our differentiated development infrastructure enables us to deliver tailored solutions with speed and scale.

Transition

Our client service team assists with file delivery and history onboarding for displacement of incumbent providers.

KEY STATS

developed and emerging countries

sectors and 7 levels of industry granularity

indices calculated daily

Performance

Scroll within the table below for the full list of Bloomberg equity indices.

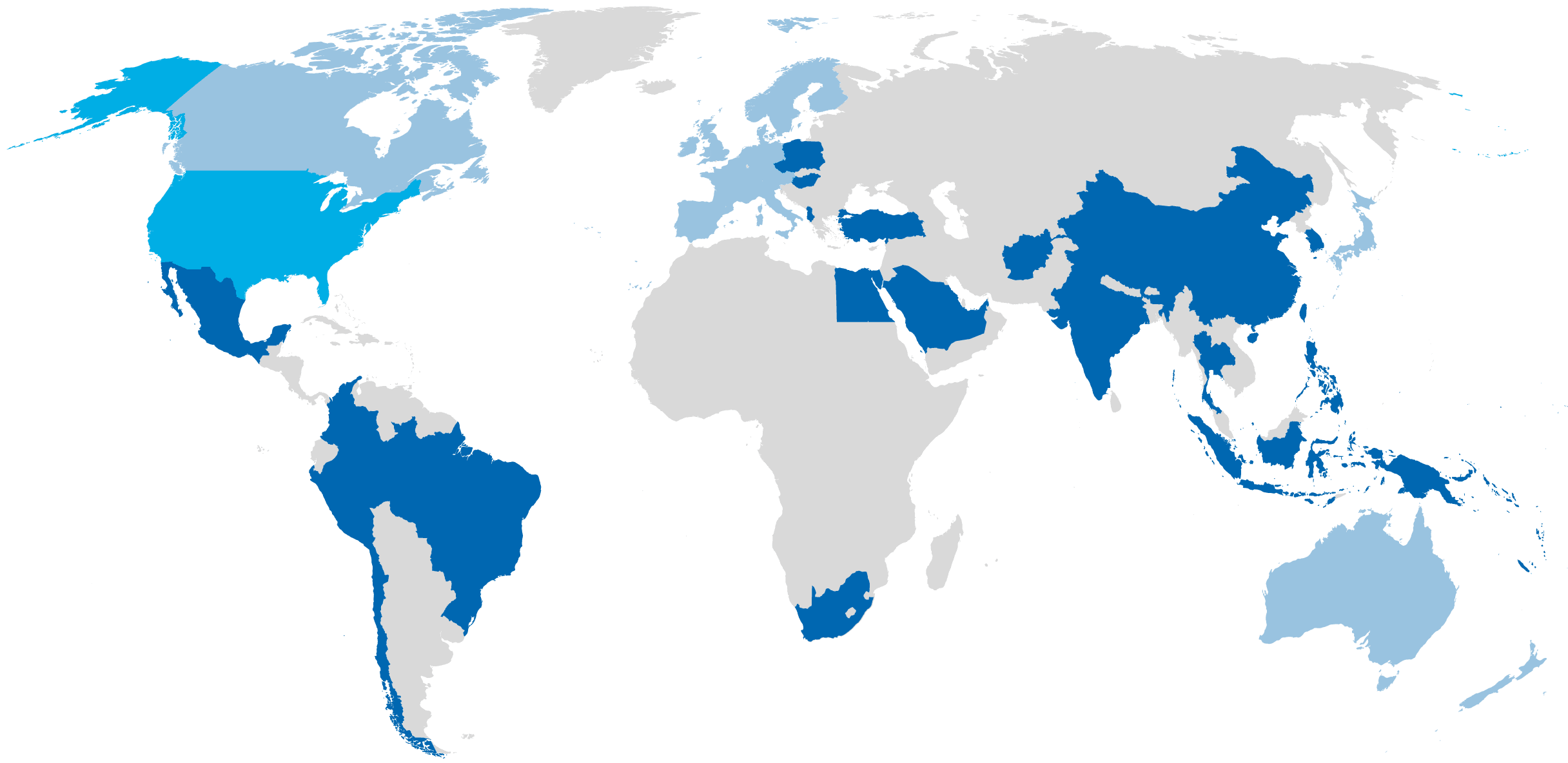

Deep global coverage for benchmarking and index-linked products

Bloomberg Equity Indices are available in global, regional, country and sector exposures and include traditional growth and value styles, factor index strategies, thematics, ESG, climate and more.

Covering over 99% of the available free float market cap in 47 developed & emerging countries

US Domestic Indices

Developed Market Indices

Emerging Market Indices

Index innovation in action

In addition to creating bespoke versions of our flagship indices, we continuously work with clients to develop ideas for new products. With industry-leading data, differentiated datasets unique to Bloomberg and access to Bloomberg Intelligence and BloombergNEF research capabilities, we collaborate to address the changing needs of market participants.

Indexing the latest trends

We help clients find opportunities based on the latest secular trends as illustrated by two recent examples.

Capturing AI opportunities

Bloomberg Artificial Intelligence Index (BAIT) is constructed to track the performance of companies that develop, facilitate or utilize artificial intelligence (AI) solutions, such as deep learning, machine learning, natural language processing, image and speech recognition.

Targeted exposure on competitive advantage

The Bloomberg Pricing Power Index (BPPUS) is constructed to track the performance of companies that have historically maintained stable profit margins.

Additional use cases

We support multiple use cases such as financial product innovation, risk management, currency hedging, target exposure, exclusion needs, and capping securities to meet regulatory requirements.

Differentiated datasets, unique to Bloomberg

We have constructed specialty indices based on the robust datasets on the Bloomberg Terminal.

Analyst recommendations

The Bloomberg US Analyst Recommendations Index (USANRN) tracks the performance of the 50 U.S. large and mid-cap companies with the best analyst recommendations scores based on ANR data on the Bloomberg Terminal.

Apple’s supply chain

The Bloomberg AAPL Supply Chain Select Index (BASPLCSN) is constructed to track the performance of Apple’s top 30 suppliers from selected industries based on supply chain data maintained by Bloomberg.

Billionaires

The Bloomberg Billionaires Index (BBIST) is constructed to track the performance of the top 50 U.S. listed companies held by U.S. billionaires based on data maintained by Bloomberg. The index uses net worth analysis and net worth confidence scores published by Bloomberg News.

Sign up for indices insights

Select your areas of interest to receive the latest news, research and event invitations.

Cross-asset coverage

Bloomberg’s index team delivers high-quality benchmarks across asset classes.