Risk Solutions

Multi-Asset Risk System (MARS)

Bloomberg’s Multi-Asset Risk System (MARS) is a comprehensive suite of risk management tools that deliver consistent, consolidated results across your firm.

Powered by Bloomberg’s world-class pricing library, market data and mortgage cash flow engine, MARS enables front office, risk and collateral professionals to analyze their portfolios, manage their exposures and ready themselves for any turn of events.

Multi-asset coverage

MARS provides broad asset coverage, including equities, FX, fixed income, inflation, credit, and mortgages, as well as listed and OTC derivatives.

Powerful analytics

MARS features cross-product support with integrated calculations, allowing for best-in-class data and pricing models.

Flexible and integrated system

MARS can be accessed via the Bloomberg Terminal, alongside our other products and solutions, or through the MARS API.

Around-the-clock support

MARS clients receive 24/7 risk support, a specialist account management team, and assistance from other in-house experts.

Manage risk your way

MARS

Manage risk in a flexible and transparent way to ensure resilience in various market conditions.

MARS Valuations

A solution that provides credible and complete market data, pricing models and Greeks calculations.

MARS Front Office

A suite of analytics that deliver consistency between risk teams and front office.

MARS Market Risk

A complete risk analytics and reporting solution designed to monitor, assess and manage intraday and end-of-day risk.

MARS Credit Risk

A solution providing consistent portfolio analytics to evaluate, monitor and assist in managing counterparty credit risk.

MARS X-Value Adjustment (XVA)

An enterprise-scale tool designed to measure and manage the counterparty risk arising from OTC derivative portfolios.

MARS Collateral Management

An end-to-end collateral management hub that provides an automated solution for monitoring exposures.

MARS Hedge Accounting

A comprehensive solution to meet the requirements of hedge accounting and related financial instrument standards.

MARS Climate

A solution that aims to help firms assess, quantify and manage climate risk and opportunities across portfolios.

What MARS offers

Explore some key features of the MARS suite of solutions.

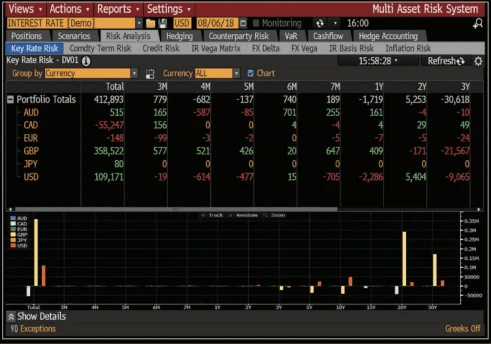

Analyze your risk

Assess your exposure using term-structure Greeks, including Key Rate Risk, Commodity Term Risk, Credit Risk, IR Vega Matrix, FX Delta, FX Vega, IR Basis Risk and Inflation Risk.

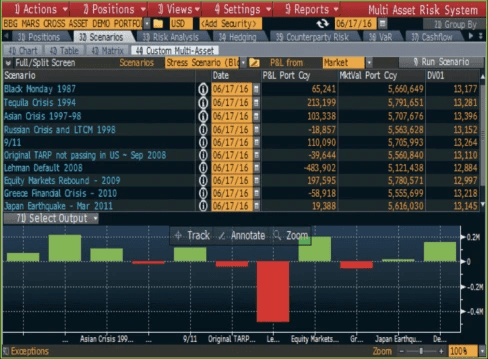

Conduct analysis across portfolios

Perform powerful pre- and post-trade analysis across portfolios, including scenario analysis and stress testing to assess your risk and impact on profit and loss.

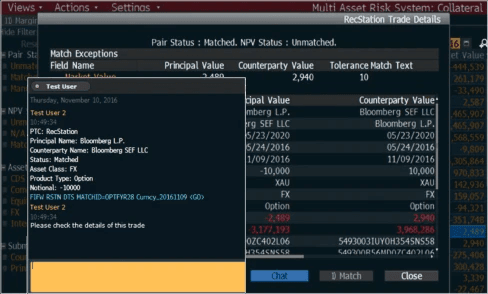

Identify and communicate mismatches

Use the built-in Instant Bloomberg (IB) messaging tool to quickly and easily communicate reconciliation results with counterparties and colleagues.

MARS API

The MARS API is designed to enable programmatic access to all MARS risk solutions, for seamless integration with financial institutions’ technology suites.

Single-market data snapshot

Each portfolio-level calculation is processed to ensure all your subscribers have a unified view of their portfolios and seamless integration between positions, market data and pricing models.

State-of-the-art models

Bloomberg delivers high-quality data and models across asset classes — enabling you to improve operational efficiency and potentially reduce costs by eliminating redundant feeds.

Secure and reliable technology

MARS API is built on top of Bloomberg’s Server API (SAPI) and B-PIPE datafeed, but can also be accessed through BQL & BQNT, or delivered to your virtual private cloud (VPC).

Client use cases

See how Bloomberg clients are using MARS solutions.

Bank SinoPac

Bank SinoPac, a leading financial institution in Taiwan, adopted Bloomberg’s MARS Market Risk module to support its implementation of the latest Basel III banking regulation.

HDFC

Housing Development Finance Corporation (HDFC), India’s leading housing loans provider, adopted Bloomberg’s MARS Valuations solution to augment its treasury digitization journey.

Putnam Investments

Putnam Investments has selected Bloomberg’s Core Mortgage Premium (CMP) solution — accessed via MARS — to support portfolio modeling and strategy for the firm’s mortgage funds.

Explore Bloomberg products

Bloomberg Professional Services are built on cutting-edge technology with best-in-class data and analytics.