Trading / Post-Trade Services

FailStation

The standard in settlement management

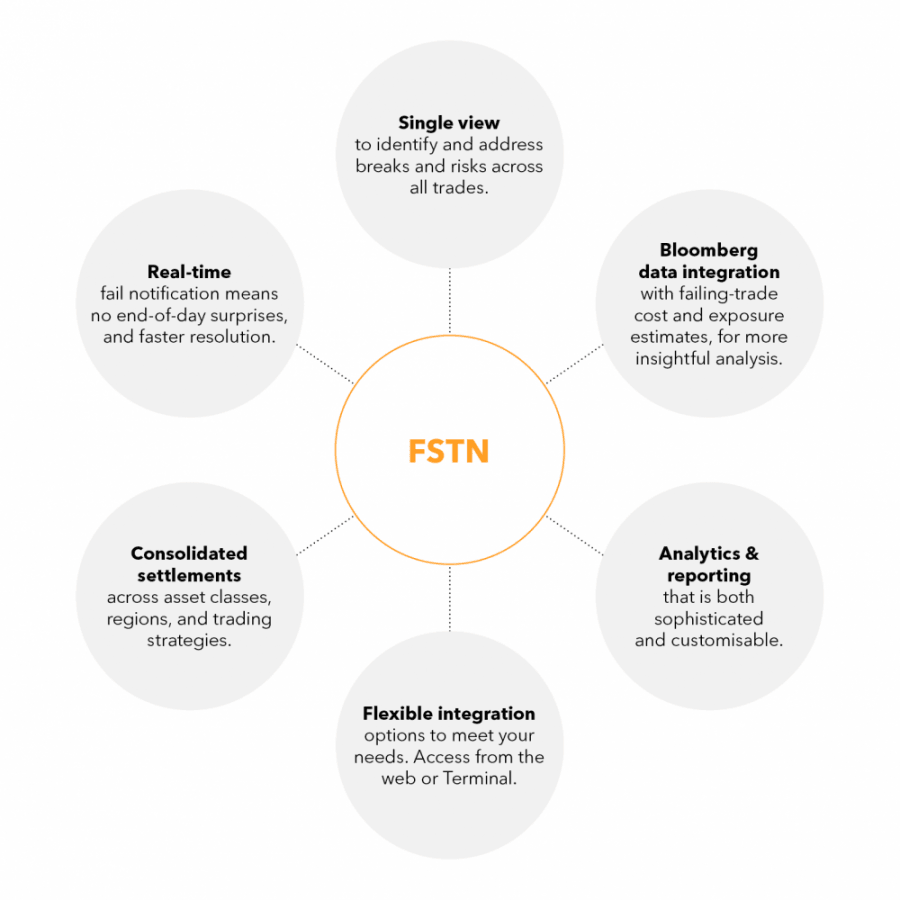

Bloomberg’s FailStation (FSTN) is a settlement-exception management tool that aggregates, in real-time, pre- and post-settlement exceptions into a single view and normalized format.

FSTN enhances operational workflows and facilitates regulatory compliance by providing the instant transparency required for efficient post-trade processes.

Connecting the industry

FSTN connects 150+ custodian banks, prime and executing brokers, creating a comprehensive post-trade network.

As firms face increased regulatory demand for exceptions to be resolved at speed, FSTN’s communication system automates manual processes to save time and reduce effort. Automated emails to all stakeholders of a fail mean resolution begins faster, and is further accelerated by Bloomberg’s post-trade network.

Solving CSDR’s post-trade puzzle

Sell-side and buy-side firms across the globe should prepare to comply with – and manage the impact of – the settlement discipline being introduced by the Central Securities Depositories Regulation (CSDR) in 2022.

FSTN helps solve the CSDR post-trade puzzle so firms can fulfil their new regulatory requirements with tools that evolve and automate operations, and achieve high settlement rates. These include:

- Complete CSDR data schema including security classifications and penalty rates

- Integration with buy-in-agents and proprietary financial systems

- CSDR penalty and buy-in cost estimate calculations

How we help our clients