Asset Management

Scalable investment management solutions to drive your firm’s growth

Whether you need an end-to-end solution or modular integration, our technology scales to your evolving needs.

Increase efficiency with the right technology

Automate processes, integrate data across your firm and systematically manage risk to help increase efficiency, streamline operations and lower costs.

We help firms generate alpha with best-in-class data

Gain an edge with access to unique datasets, portfolio management tools and industry-leading technology.

Service clients & remain compliant as markets change

Bloomberg can help prepare your firm for growth and the inevitable macro forces, such as regulation, by providing scalable solutions.

INVESTMENT MANAGEMENT SOLUTIONS

Portfolio tools and market intelligence for every stage of the investment process

Create, analyze and generate new investment ideas

Access native, real-time market data and analyze industry research. BQuant is fully integrated with the Bloomberg Terminal and provides direct access to real-time market data and Bloomberg Intelligence for building and deploying quantitative models with Python.

Bloomberg Research Management Solutions (RMS) centralizes your research workflow, from creation to insight discovery using AI, to streamline the entire investment research process within a single environment.

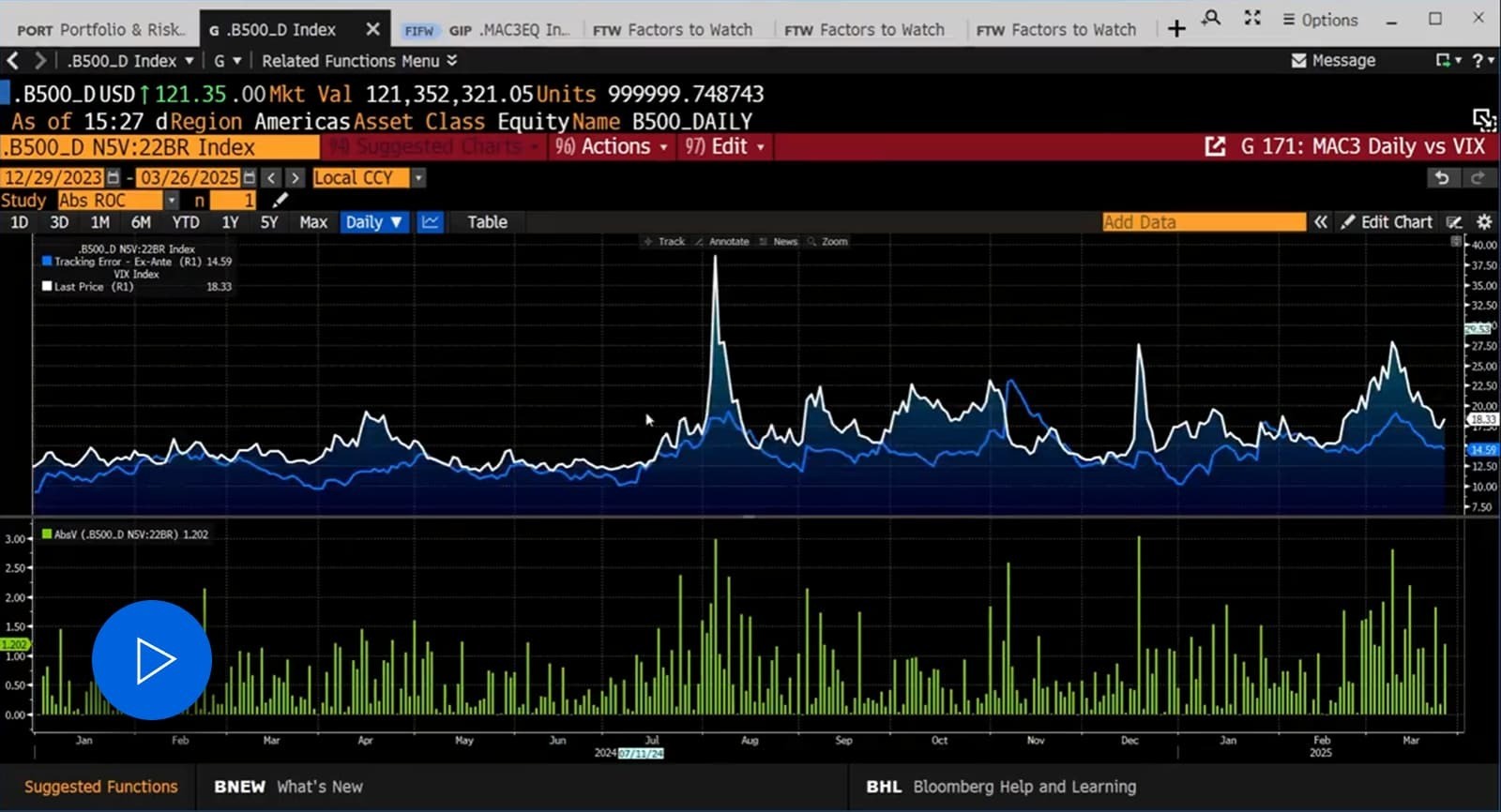

Portfolio tools that support investment decision making, performance attribution and reporting

Make quicker, more informed decisions with Bloomberg Portfolio Analytics (PORT), MAC3 models and the Bloomberg Multi-Asset Risk System (MARS). Our integrated portfolio and risk analytics solutions allow you to incorporate your best ideas into risk-managed portfolios.

Get the most out of your data and infrastructure

Stay competitive with seamless access to both traditional and innovative datasets — like ESG, Liquidity and Alternatives — and data management tools, such as Data License Plus, that promote data quality, consistency and distribution across your entire enterprise.

Customize and license benchmarks

Build and license benchmark products – across equity, fixed income, commodities, multi-asset and more – informed by Bloomberg data and research. Integrate Bloomberg Indices into our portfolio and risk analytics solution (PORT) to track portfolio performance and risk.

Maximize your operational and trade efficiencies

Turn your trade and order data into a competitive advantage with Bloomberg Asset and Investment Manager (AIM). Our order management and trade execution solutions provide multi-asset capabilities for portfolio management, electronic trading, trade automation, operations and compliance.

Systems that give you a holistic view to manage your positions and exposures

Streamline your post-trade workflows with Bloomberg’s real-time multi-asset class and multi-jurisdictional solutions with Bloomberg Transaction Cost Analysis (BTCA) and Electronic Trading Solutions.

Mitigate exposure while gauging risk levels

Bloomberg’s comprehensive suite of risk and compliance solutions, such as Bloomberg Vault and Bloomberg Regulatory Reporting Services (BRRS), span across investment, enterprise and regulatory risk management, and provide broad asset class coverage.

Featured insights

Bloomberg Series for Investment Managers

A webinar series designed for asset managers and asset owners.

Navigate the storm of global volatility with the Bloomberg Series for Investment Managers. Dive deep into cutting-edge automation, transformative technologies, streamlined workflows, and robust risk management strategies to gain a competitive edge.

Driving inclusive leadership in the Buy-Side community

The Bloomberg Buy-Side Network (BWBN) is dedicated to cultivating inclusivity, education, and meaningful connections among all industry professionals.

This comes to life through networking, professional advancement workshops, and thought leadership across chapters globally.

Awards

Winner of 5 Waters Rankings 2024

2024 RegTech Insight US Awards

Chartis RiskTech100, 2025® Rankings

Bloomberg Earns Top 10 Chartis RiskTech100 Ranking For Third Consecutive Year

Contact us

Let us show you how to:

- Increase efficiency with the right technology

- Access best-in-class data to help generate alpha

- Service clients & remain compliant as markets change