Asset Owners

Applying next-gen technology to streamline investment decisions

Bloomberg offers comprehensive scalable technology that supports the entire investment workflow, to help asset owners, from pension funds to insurance companies, seize opportunities.

Diversify investment strategies

Shifts in client needs and preferences have pushed asset allocation beyond traditional asset classes. Bloomberg provides a suite of solutions for public and private markets alongside OTC management.

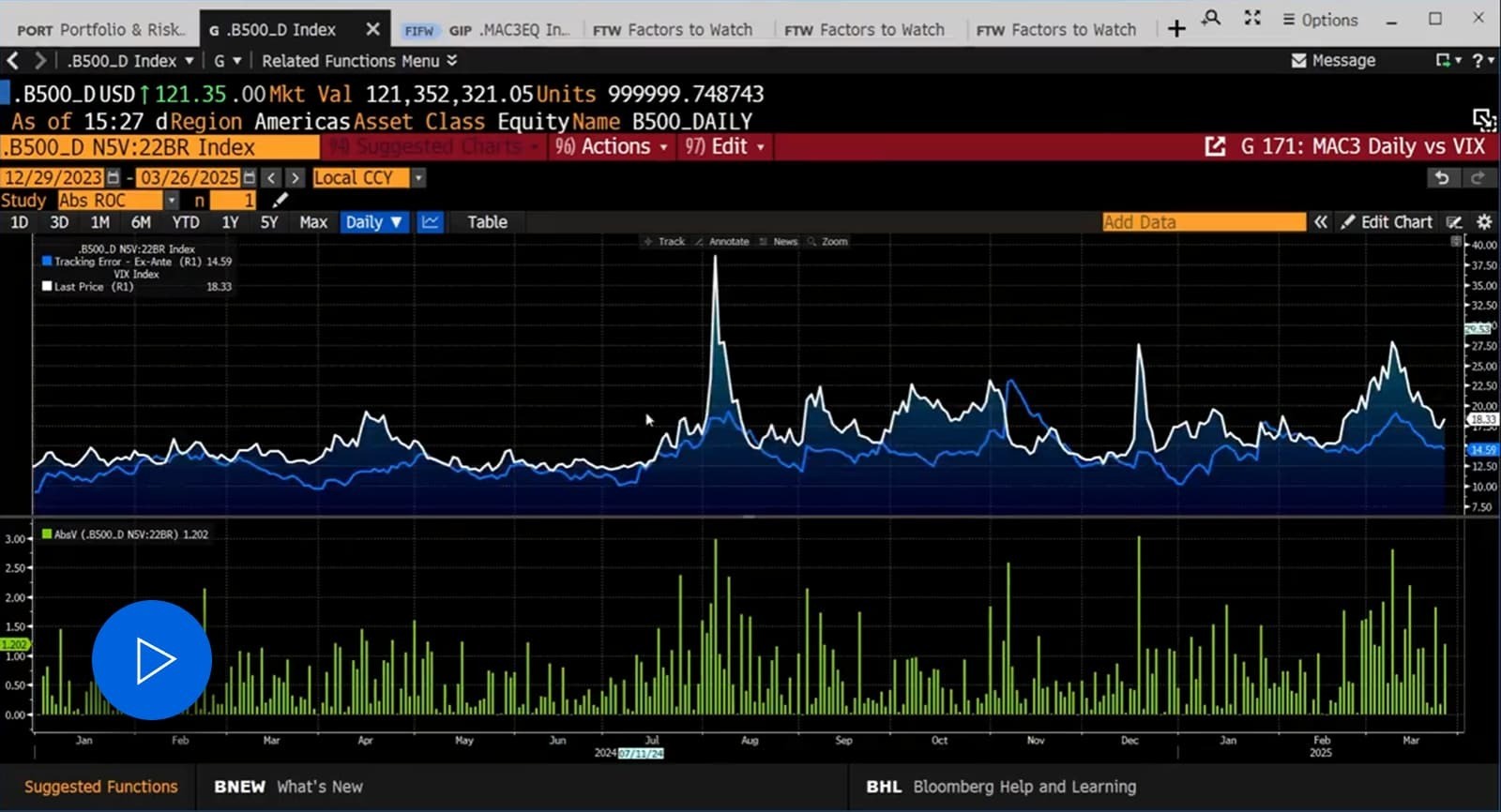

Manage evolving compliance and risk requirements

Oversee mandates by understanding and implementing regulatory controls, pre-trade checks and risk assessment across asset classes.

Scale your operating model

Optimize workflows across investment teams built on reliable data, advanced workflow technology and AI-powered solutions to help achieve return objectives, while managing costs and risk.

INVESTMENT MANAGEMENT SOLUTIONS

Put the power of Bloomberg to work for your firm

Strengthen your firm’s ability to manage risk, comply with regulations and innovate with our solutions and data models.

Make smarter investment decisions, manage long-term liabilities and drive better outcomes across the full investment workflow.

Featured insights

Bloomberg Insider

A webinar series designed for asset managers and asset owners.

Navigate the storm of global volatility with the Bloomberg Insider webinar series. Dive deep into cutting-edge automation, transformative technologies, streamlined workflows, and robust risk management strategies to gain a competitive edge.

Driving inclusive leadership in the Buy-Side community

The Bloomberg Buy-Side Network (BWBN) is dedicated to cultivating inclusivity, education, and meaningful connections among all industry professionals.

This comes to life through networking, professional advancement workshops, and thought leadership across chapters globally.

Awards

Winner of 5 Waters Rankings 2024

2024 RegTech Insight US Awards

Chartis RiskTech100, 2025® Rankings

Bloomberg Earns Top 10 Chartis RiskTech100 Ranking For Third Consecutive Year

Contact us

Let us show you how to:

- Diversify investment strategies

- Manage evolving compliance and risk requirements

- Scale your operating model